Bond Aren't Buffering Stocks As Earnings Surprises Near Record

This is an abridged version of our Daily Report.

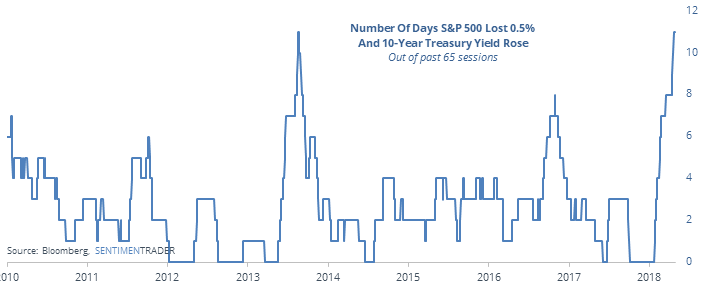

Balanced portfolios see unusual losses

Over the past few months, there was a 5-year high in days where stocks sold off and bonds did too.

That raises worries that the typical 60/40 stock/bond portfolio allocation will suffer as bonds don’t lift when stocks dip. Other times when bonds failed to provide a cushion for stocks did not consistently lead to losses.

Analysts can’t keep up with earnings

Companies in the S&P 500 are beating Wall Street analysts’ earnings estimates at a near-record clip. Through April, the beat rate exceeded 80%, only seen once before in 25 years. A high percentage of positive surprises was not an automatic buy signal for stocks.

Corn keeps growing

Most commodity contracts have a negative correlation to the U.S. dollar. That makes it unusual to see new multi-month highs in both the dollar and a commodity like corn, which triggered on Tuesday. Going back to 1980, both the dollar and corn hit a three-month high on the same day 47 times.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |