Black swan risks are rising

The CBOE SKEW Index, which looks at the probability of a Black Swan event at some point over the next 30 days, has surged to the highest level in over half a year. This means that there's a 15-16% probability that stocks will undergo a 2 standard deviation event. In the meantime, VIX and the Creidt Suisse Fear Barometer are trending downwards.

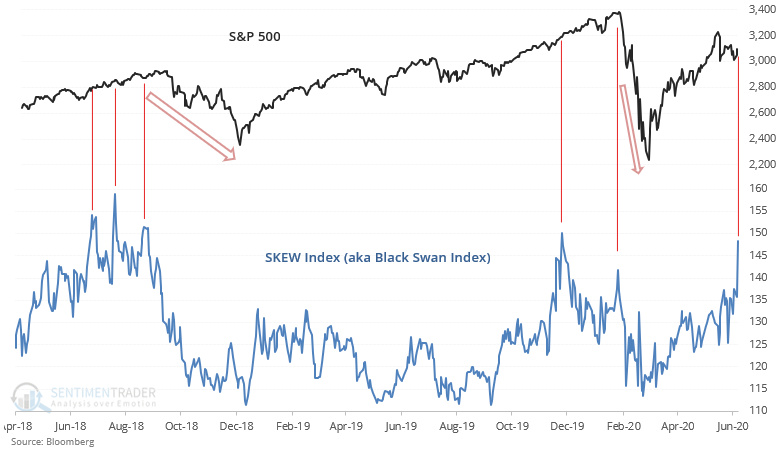

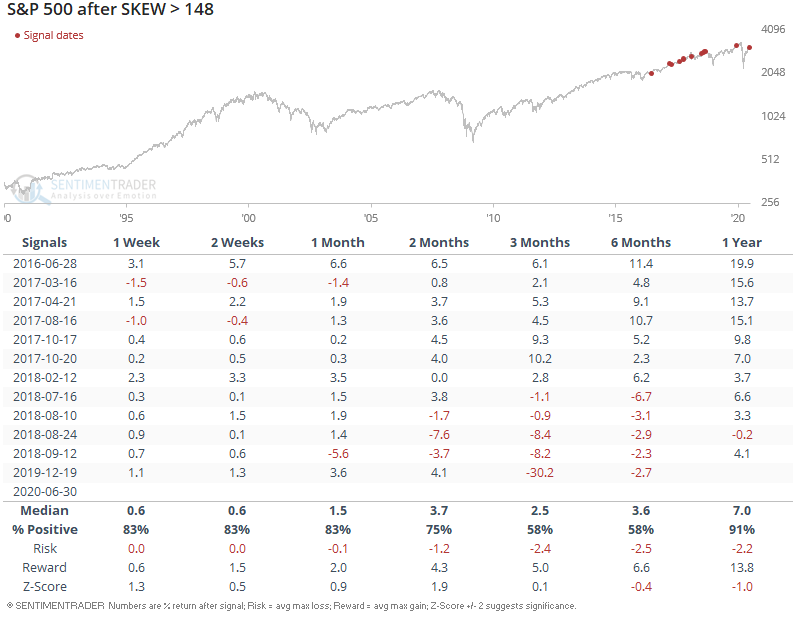

Such high SKEW readings have been a warning sign for stocks in recent years. This occurred in the runup to the March 2020 market crash and the Q4 2018 market crash. So while the initial signal may not have been a timely bearish signal, it successfully warned investors to be careful in the months ahead.

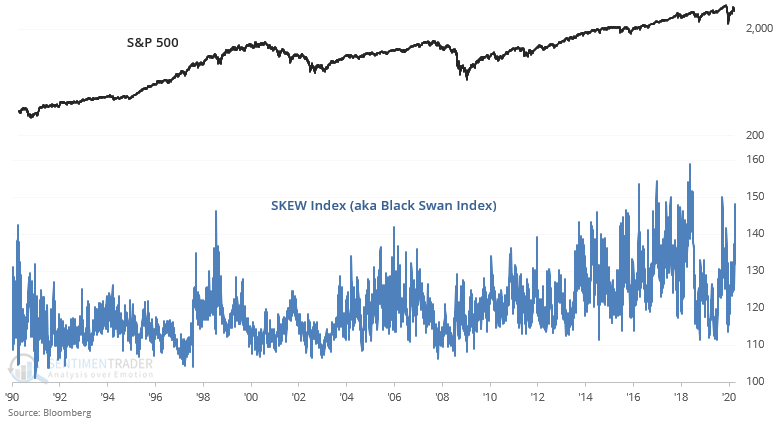

Here's a longer term look at SKEW. As you can see, SKEW's long term average has trended higher post-2014 vs. pre-2014:

While this was a successful bearish sign for stocks over the past 2 years, it failed as a bearish signal pre-2018.

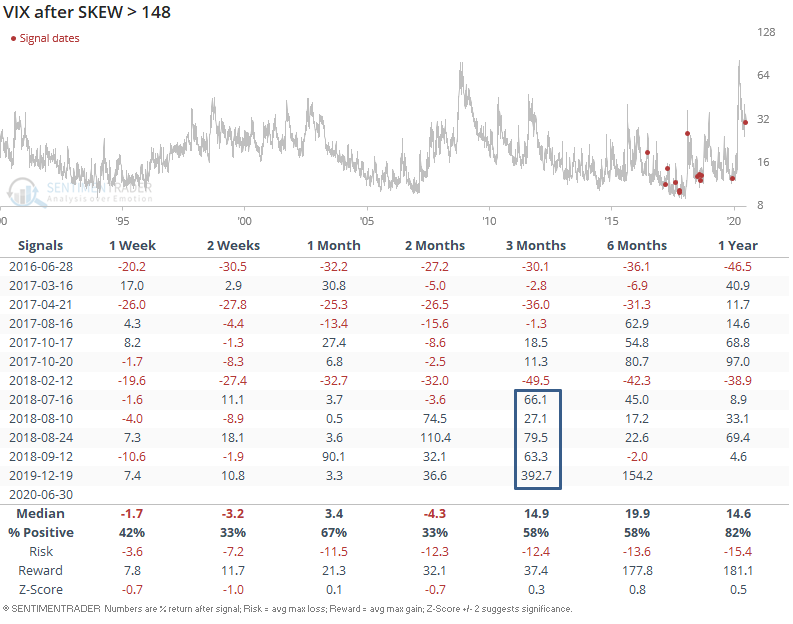

As for VIX, this has been a successful bullish signal post-2018, but did not portend VIX spikes pre-2018.