Bio-tech has turned into a bio-wreck

Bio-tech has become bio-wreck

Heading into February's speculative peak, almost everything was in gear. That euphoric sentiment eased as some of the riskiest parts of the markets took a dive or treaded water at best.

Since then, there have been entire sectors that have lagged the broader market. Some equity indexes, especially those weighted by market capitalization, are at or near record highs. But not everyone is enjoying the gains.

Getting reliable information on the losses in the sector is difficult. It's a notoriously volatile group, with share prices skyrocketing based on rumors or collapsing and de-listing based on the same. That can trigger heavy turnover in Biotechnology indexes, with historical studies often suffering from survivorship bias.

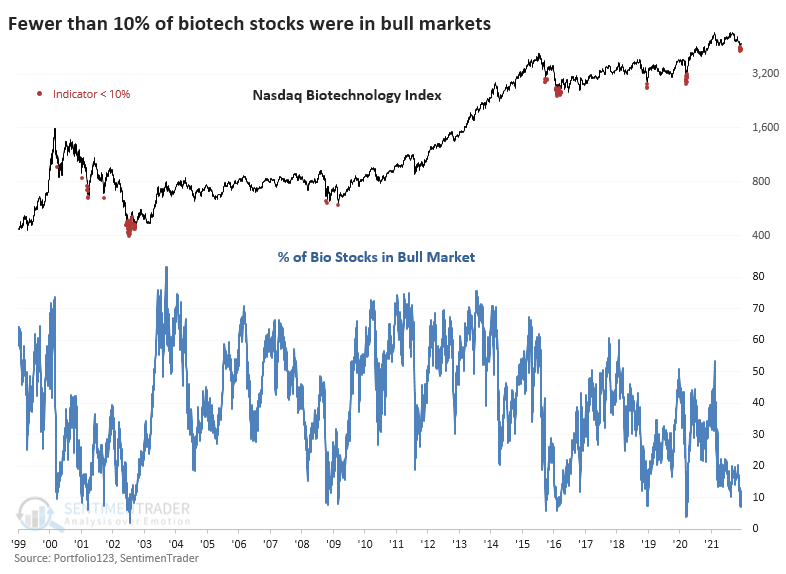

We can create metrics that look at the breadth of the performance among many of these stocks to gauge whether recent declines are enough to suggest the worst is likely over. We've done our best to recreate the stocks included in the ICE Biotechnology Index, the index underlying the largest Biotech fund, IBB. There are a little over 300 stocks in the custom index, but it is not perfect.

All of the metrics we studied showed readings that were in the bottom 5% of days since 1999. For example, fewer than 10% of Biotech stocks were able to hold within 20% of their 52-week highs, ranking in the bottom 1% of all days in the past 22 years.

Combining all these metrics into a composite, it recently dipped below 20%, recording a level of oversold behavior in the bottom 1% of all days.

| Stat box Over the past 10 days, an average of 17 more Consumer Staples stocks rose versus declined. That's in the top 15 reading among all days in the past 22 years. After the others, the Staples sector rose over the next 2 months every time but once. |

Combining trend-following methods for interest rates

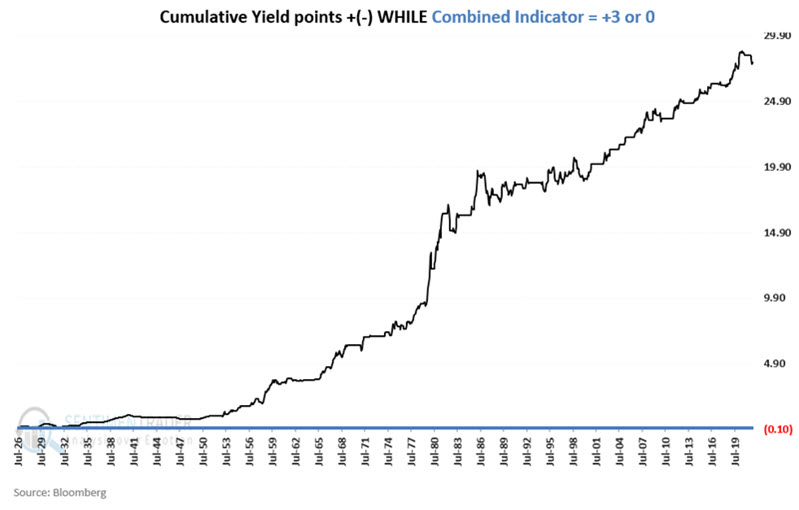

Jay continued his look at using some simple trend-following methods applied to interest rates. This time, he combined his previous methods into one.

To measure the efficiency of the Combined Indicator, let's use the following methodology:

- Add changes in yield points if the Combined Indicator reading is +3

- Subtract changes in yield points if the Combined Indicator reading is 0

The chart below displays the cumulative gain/loss in yield points ONLY when the Combined Indicator reading is +3 or 0.

Interest rates tend to rise when the combined indicator = +3 and tend to decline when the combined indicator = 0. The first takeaway is that investors should avoid long-term bonds and stick to shorter-term securities (or floating rate debt, or avoid bonds altogether) when the combined indicator = +3. The second takeaway is that investors seeking maximum gains can extend maturities when the combined indicator = 0, which is where it was at the end of November.