Big Thrust In Up Volume As Junk Bond Metrics Diverge

This is an abridged version of our Daily Report.

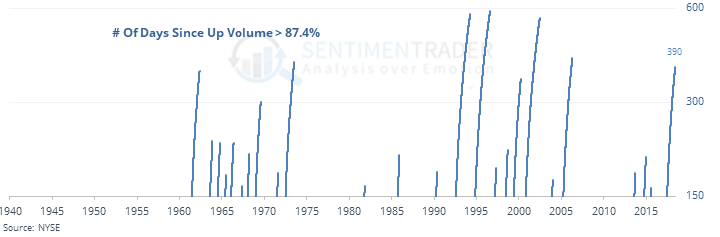

Kind of a thrust

We still haven’t had a “breadth thrust” with more than 90% of NYSE volume flowing into advancing stocks. But Wednesday’s session had the best ratio since November 2016, nearly 400 sessions ago.

A big Up Volume figure for the first time in a while, especially during an uptrend, led to good returns.

Are junk bond funds hiding a nasty surprise?

Popular high-yield (junk) bond funds like HYG and JNK are holding well above their spring lows. At the same time, indices that track option-adjusted high-yield spread are moving to their most extreme in 6 months. That’s happened before, and it wasn’t an indication that the funds were hiding a nasty surprise.

A healthy flow

The popular health-care ETF, XLV, enjoyed an inflow of more than $350 million on Tuesday. That ranks among its largest ever.

Submerging markets

Unlike health care, traders have had no interest in emerging markets. The EEM fund has seen a steady outflow, capped by more than $700 on Tuesday, its largest in more than a year.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |