Big tech meltdown

This is a quick note to answer some questions this morning related to the continued meltdown in Big Tech. As this is published, the Nasdaq 100 index is indicated down more than 2% from Friday's close.

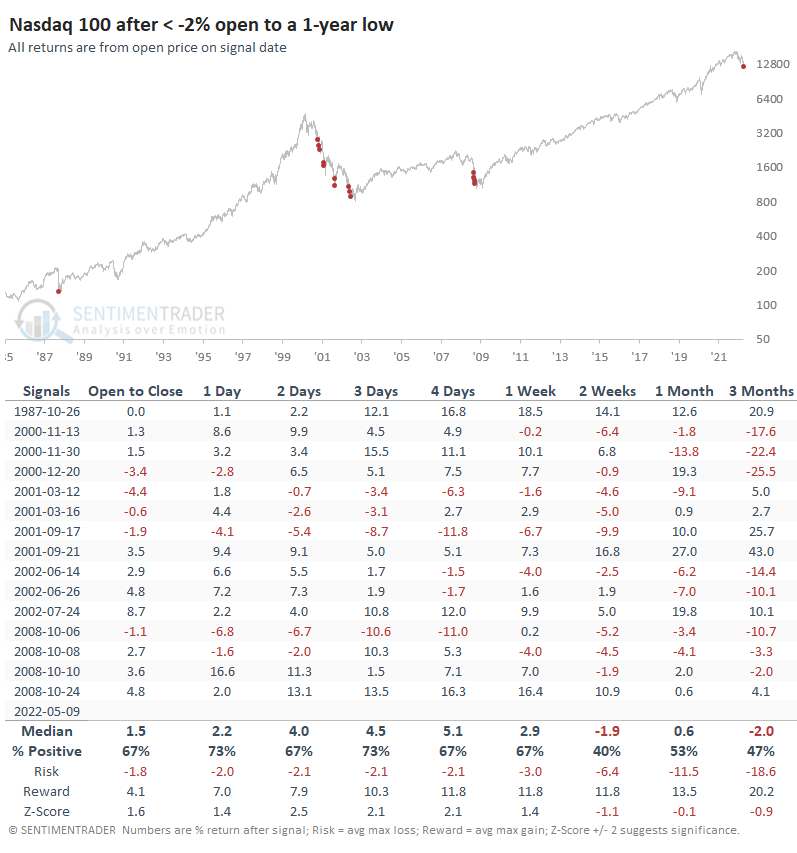

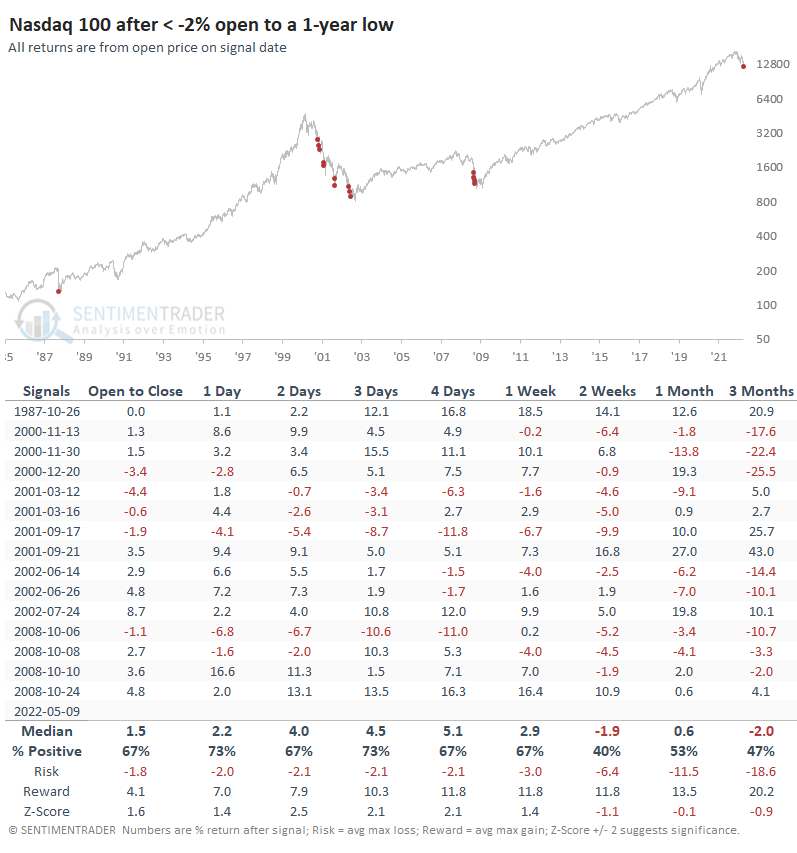

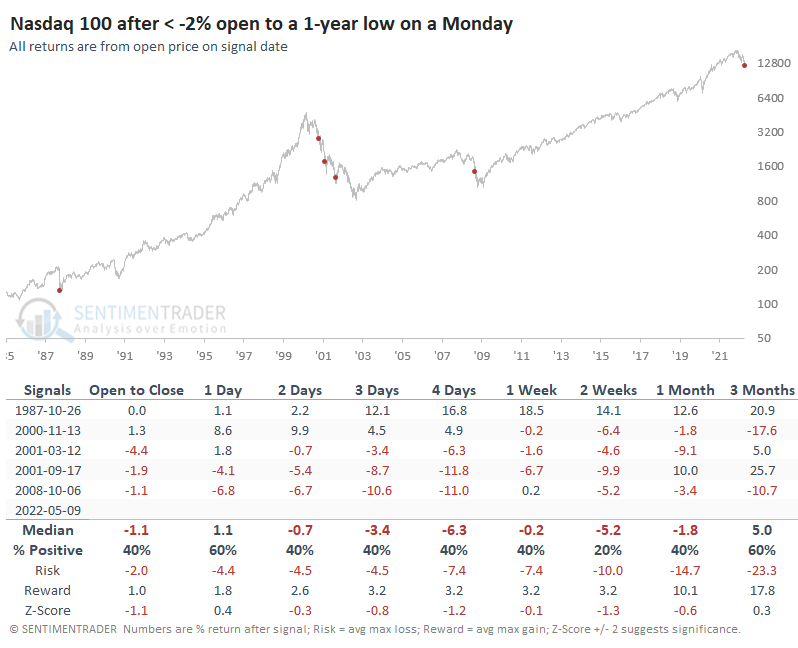

In case there is any doubt about what kind of market environment we're in, this type of behavior has only been seen during the "crash-y" parts of bear markets. Those are the only times we've had to endure such large opening losses in the Nasdaq 100 when the index is already hitting at least a one-year low.

For anyone who was watching markets during the financial crisis, this was a regular feature as traders digested all the woeful headlines over the weekend and started the week with even more dread. But because that was a relatively quick crash, there was only once in October of that year when we saw behavior like we're facing today.

The sample size is tiny, but the only time it paid for traders to buy the dip in these cases was the initial tremor following the '87 crash. The others saw more weakness in the days/weeks ahead.

Even if futures recover a bit before the open, the implications don't change much as long as the negative gap is 1% or more. This is an atrocious market environment across virtually all financial assets, unlike anything the current generation (or the two generations before) has witnessed. It remains a time to be very judicious about having a buy-the-dip mentality.