Big Stretch Of Calm Even As Investors Leave SPY

No sudden movement

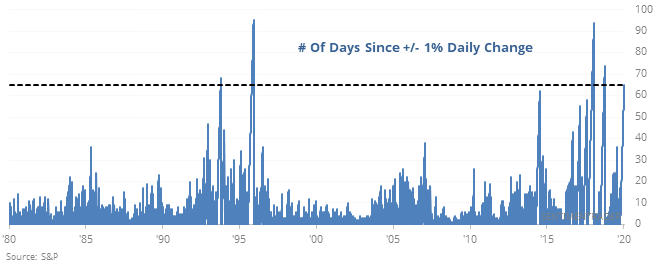

Stocks are enjoying a preternaturally long stretch of calm, with no big moves for more than 3 months. Troy has been noting this trend for a while, and it keeps going. This is now the 17th-longest streak since 1928.

Periods of extreme calm tend to precede at least some future volatility, and we can see that in the risk/reward skew in the table. Risk was as high or higher than reward up to three months later.

The S&P’s median return was below average across all time frames longer than the next week. Even a year later, the median return was only 1.0%, more than two standard deviations below average. It’s rare to see reward below 9% over that long of a time frame, too.

This kind of creeper uptrend can last even longer, but the risk/reward tilts more and more to the risk side (see inside).

Large and leaking

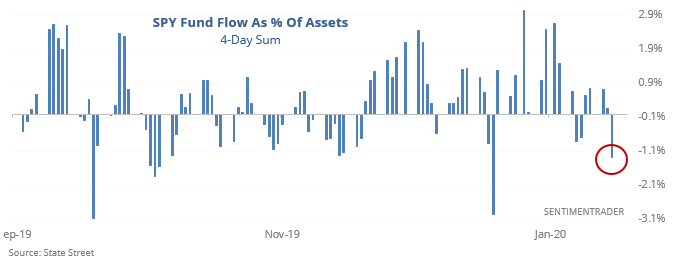

Over the past four sessions, while stocks were driving to all-time highs, investors were pulling money from SPY, which lost more than $4 billion in assets even as the fund itself tacked on nearly 0.5% in price gains. That $4 billion is over 1.3% of its total asset base.

While there is a temptation to assume this outflow is a good sign, evidence doesn’t support it. After similar instances, SPY's return up to three months later was well below average, with risk as high or higher than reward.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- The flow of funds out and stocks and into bonds is nearing a 24-year record

- The spread between our Smart and Dumb Money Confidence is nearing a record

- There has been a big jump in utility stocks popping outside their Bollinger Bands