Big Stock Swings As Consumers Retrench

This is an abridged version of our Daily Report.

Big swinging ticks

The past four days have seen stocks swing with heavy positive and negative ticks, gyrating near a multi-month low. We haven’t seen that since 2011, and normally only in bear markets. Since 1950, such persistent wild swings have led to mostly positive returns but they were volatile.

Consumers rethink the market

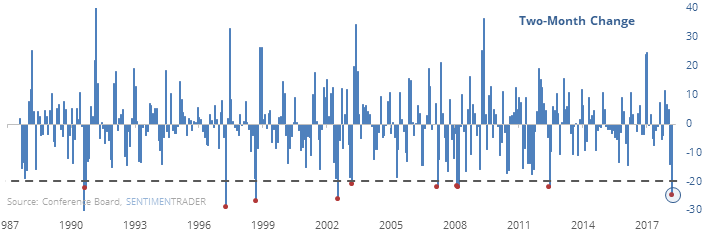

In January, a near-record percentage of consumers were looking for stocks to keep rallying. The past two months have forced a drastic change, with their expectations suffering a near-record decline.

Stocks have done well after consumers retrenched so much.

Don’t mind the gap

Monday’s upside reversal was preceded by a large gap up opening, suggesting emotional buying. That is considered a negative, as reversals that include a gap up are suggested to be less reliable. Looking at all reversals since 1982, there was little difference in future returns depending on how the reversal began.

Inverse turnover

Since the implosion of some of the large volatility ETFs, tradrs seem to be favoring the older funds that more simply bet against the indexes, and the volatility of the past few days has spurred that move.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.