Big-Picture Energy Sector Observations

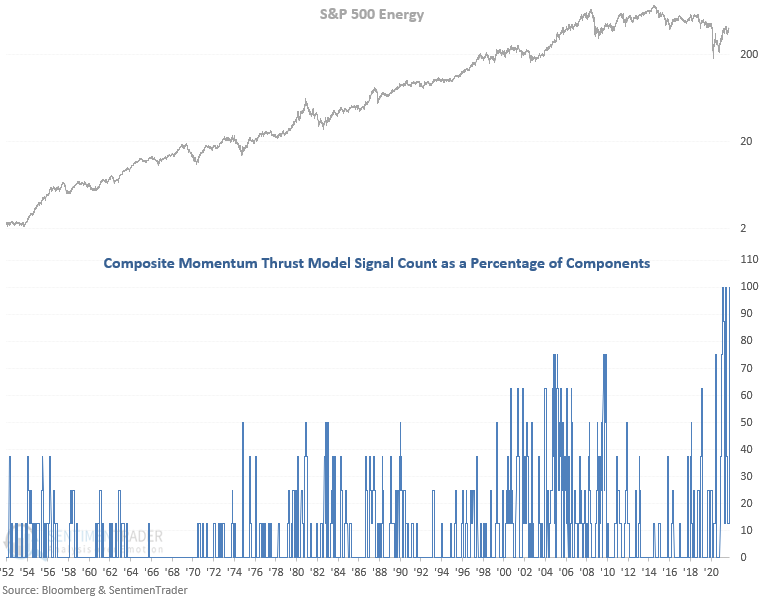

A composite momentum thrust model for the energy sector surged to a signal count of 100% at the close of trading on 10/4/21. If you recall, I last shared the details of the model in a note on 1/15/21.

CURRENT DAY CHART

HISTORICAL CHART

In my note on 1/15/21, the Composite Momentum Thrust Model signal count as a percentage of components crossed above 75%. The count subsequently continued to move higher and finally hit a reading of 100% on 2/16/21. Since the original note, the model has now reached a level of 100% a total of three times. As the chart shows, that's never happened in history.

When I dropped the signal count to 50% in the original note, forward returns for energy stocks looked below average except for the 2003-08 instances.

HISTORICAL CHART

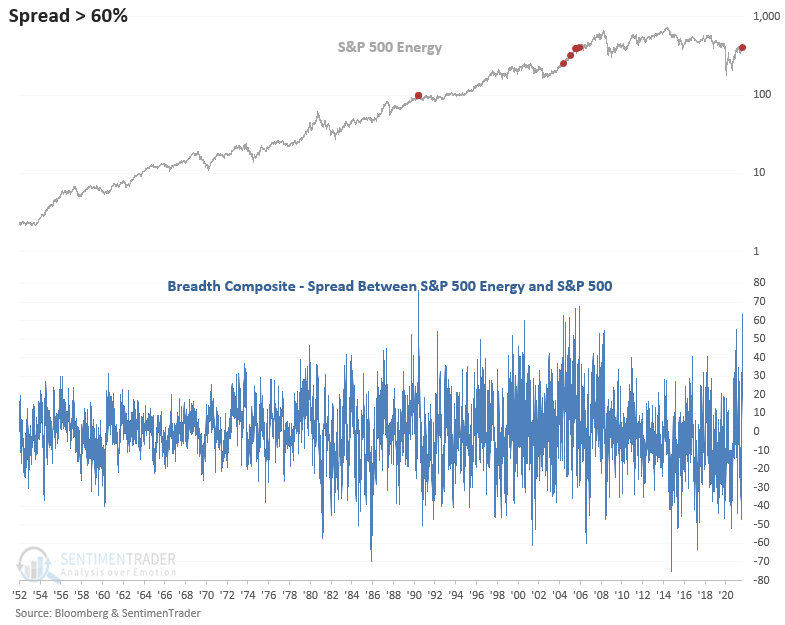

The following chart compares a breadth composite for the energy sector to a breadth composite for the broad market as measured by the S&P 500. The breadth composite contains the following indicators.

- Percentage of issues above the 10-day moving average

- Percentage of issues above the 50-day moving average

- Percentage of issues above the 200-day moving average

- Percentage Spread Between 21-Day Highs and Lows

- Percentage Spread Between 63-Day Highs and Lows

- Percentage Spread Between 252-Day Highs and Lows

The spread between the two breadth composites surged to the highest level since September 2005 on 10/4/21.

HISTORICAL CHART

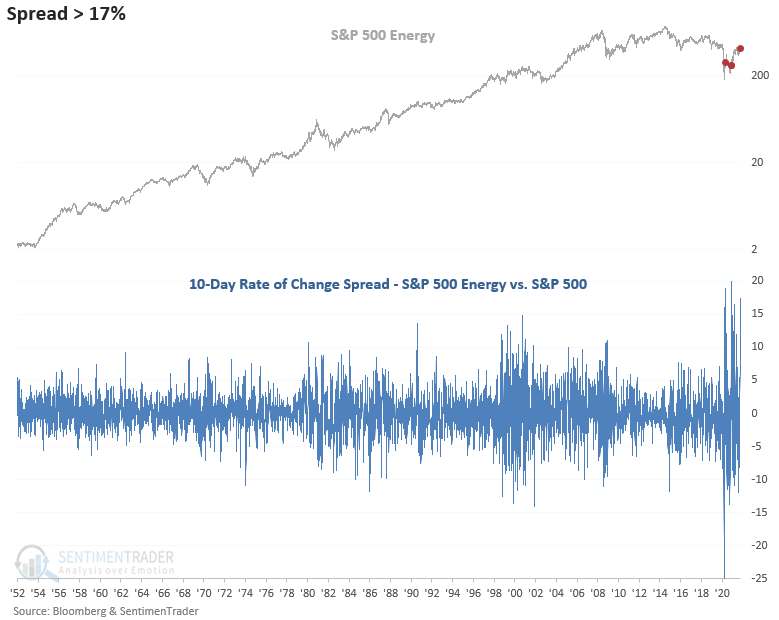

Let's compare a 10-day rate of change for the energy sector to a 10-day rate of change for the S&P 500. We see that over the most recent trailing ten-day period ending on 10/4/21, the spread crossed above the third-highest level since 1952.

HISTORICAL CHART

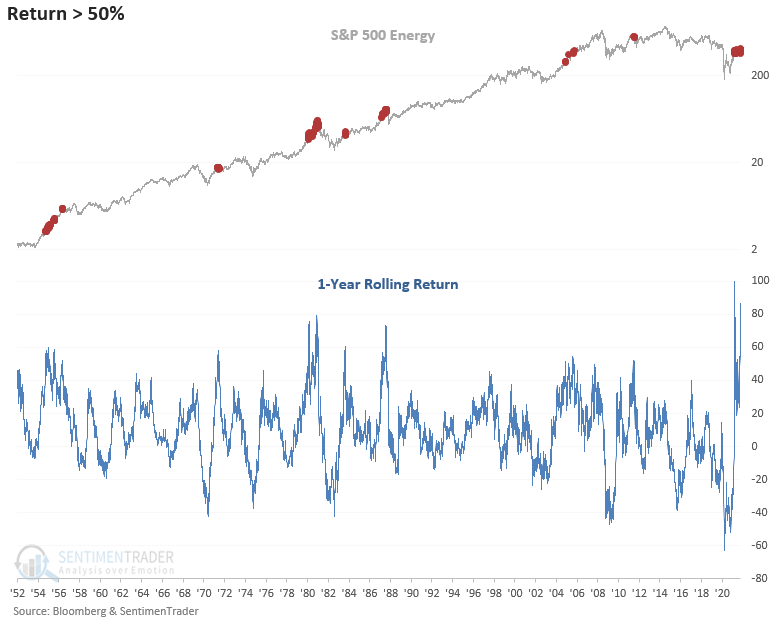

The 1-year rolling return for the energy sector shows the largest increase in history since the pandemic low.

HISTORICAL CHART

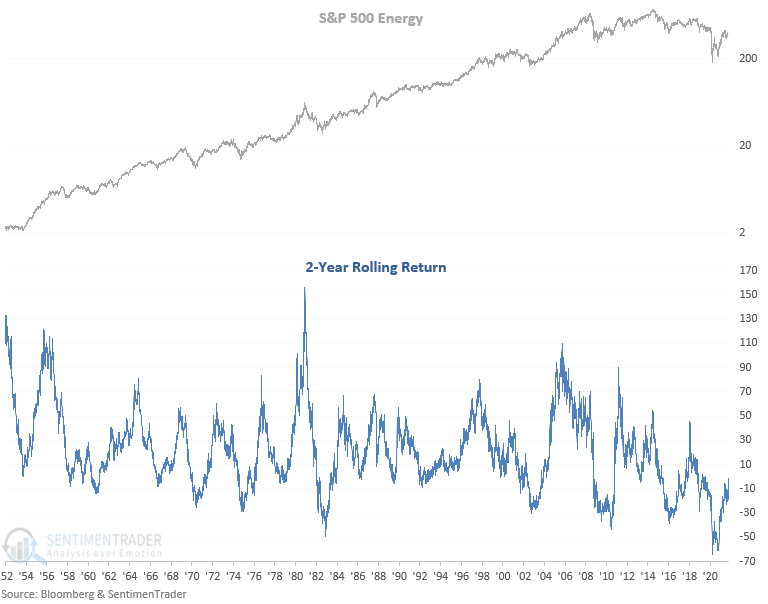

However, the 2-year rolling return for the energy sector is still negative. And, it remains well below other historical instances that preceded a market peak.