Big Payroll Miss

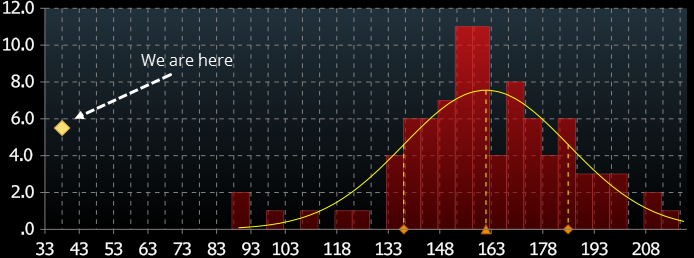

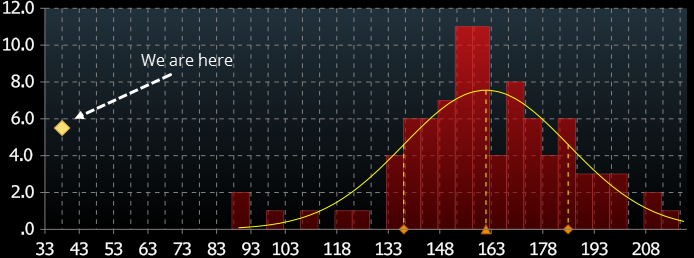

The Nonfarm Payroll report was released this morning with a shocking miss. Out of 91 economists surveyed by Bloomberg, the number of workers added was more than 50k below the lowest estimate. So, yeah, shocking.

Source: Bloomberg

Source: Bloomberg

In response, stocks opened modestly lower. It was enough to stoke concern that buyers have been relying on overly optimistic economic projections, potentially leading to a correction.

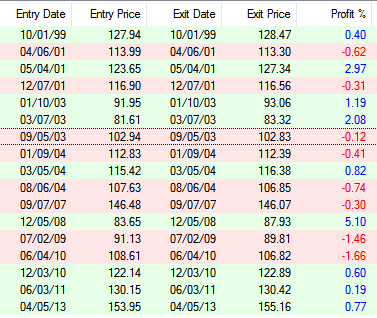

As for the day, here is how the S&P performed when gapping down by 0.25% or more on a morning when the Payroll report misses by more than 100k jobs:

The returns were mixed, so no real edge there. There were two instances when the S&P had closed at a six-month high the day before, on 2003-09-05 and 2004-01-09. Both led to further weakness during the day, but nothing major, and both led to rallies in the ensuing days.

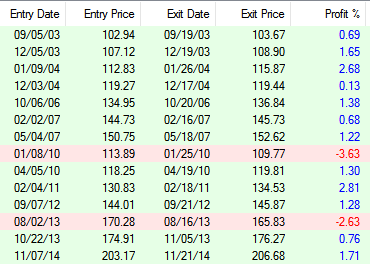

If we just look at times when the S&P had closed at a six-month high before the report and then Nonfarm Payrolls missed estimates (by any amount), stocks actually did quite well going forward across almost every time frame. Here are the returns two weeks later:

As noted in last night's Report, the Payroll report has often led to a plateau in prices over the next 2-3 weeks, but we're not seeing anything with the miss, or traders' reaction to the miss, that either furthers or diminishes that tendency.