Big Gains Ahead Of Elections

Markets are reacting strongly to the latest twist in the presidential election, and thankfully (hopefully) we will be less subject to headline risk like this after Tuesday's session.

Trying to derive any historical precedent from gaps like Monday's is fruitless. It is purely headline-driven and there is no sense in trying to compare this to "natural" market movements. Doing so would just be fooling ourselves.

About the only historical comparison we'd feel comfortable in making is looking at other times in modern markets when stocks surged the day before an election, possibly as investors see the latest poll numbers or mood of the country and make bets it's going to be good for the country.

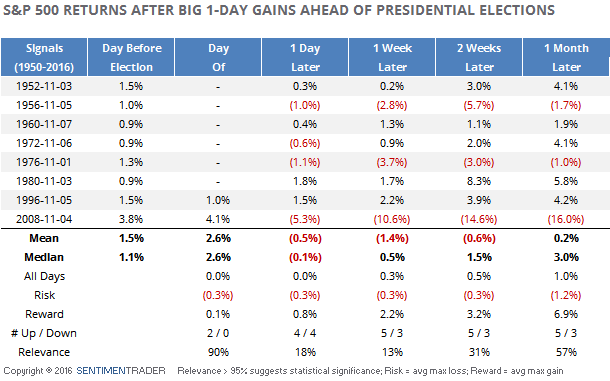

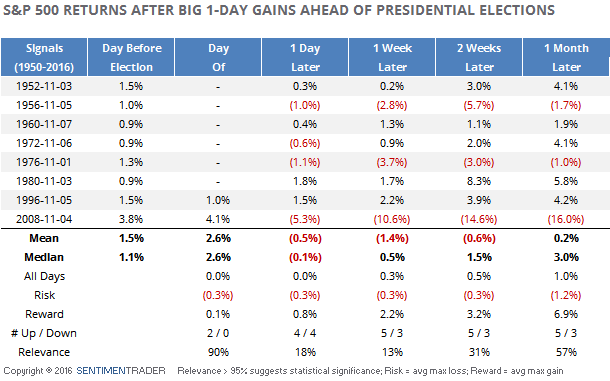

Going back to 1950, there were 8 times when the S&P 500 rose more than 0.5% the day before an election. Assuming Monday's early indications hold, 2016 would mark the 2nd-largest.

The following table shows how the index performed in the days and weeks ahead (markets were closed for election day prior to 1988).

There was a negative hangover the day after the results were in 4 out of the 8 times, though two of the exceptions were large gains or more than 1.5%. Over the next week, there were 3 large gains and 3 large losses. There was no discernable pattern relating to whether stocks were in an uptrend or downtrend in the month before the election. There is no discernable pattern at all among the dates and future performance.

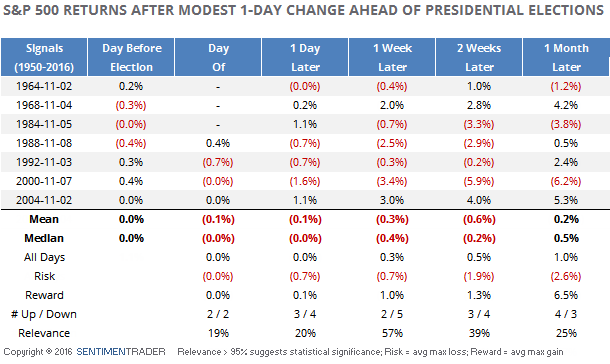

For the record, here is the S&P's performance record after it fell or showed only modest gains on the day before the election. In these cases, there was a tendency to see more losses in the week after the results, in as much as we can determine anything from such a small sample.

Overall, this market has been and continues to be subject to whipsaws based on the latest headline, so trying to apply historical context ahead of time is mostly just entertainment. We much prefer to wait until the dust settles and watch how traders and investors react, to see how that fits in with how they've behaved in the past and how it impacts our risk going forward. From recent reports, we know that volatility has a strong likelihood to decline in the coming weeks, but the next two sessions probably won't add a lot of meaning to the broader markets.