Big fund managers bet on stocks, yield curve

Each month, Bank of America releases a widely-followed survey of professional fund managers. The latest results, released earlier this week, showed that 216 managers with $573 under management are the most optimistic on stocks in more than 2 years.

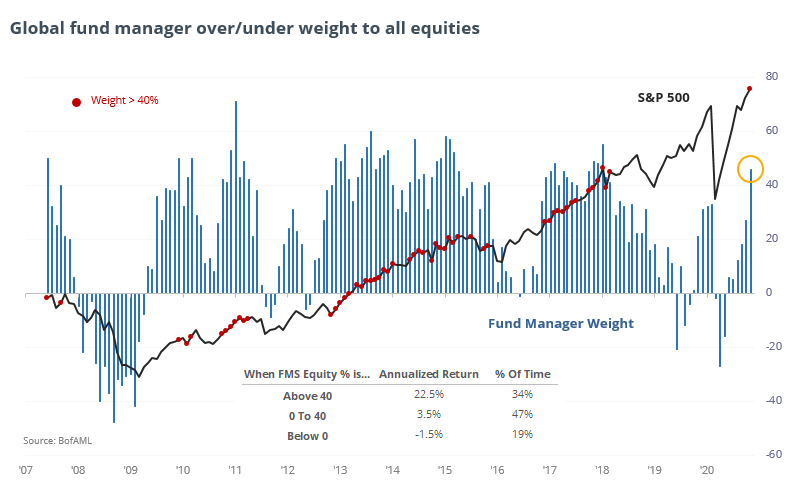

The percentage of managers who are overweight equities jumped again in the past month, with more than 45% of them positioned to benefit on a rising market.

As we can see from the chart, however, this was not a good reason to bet against them. Most "smart money" surveys show at least a modest contrary bias when there is clear evidence of group-think, but that hasn't been the case so much with this particular one. The S&P 500's annualized return when the overweight percentage was 40% or higher was an impressive +22.5%, versus -1.5% when managers were underweight stocks.

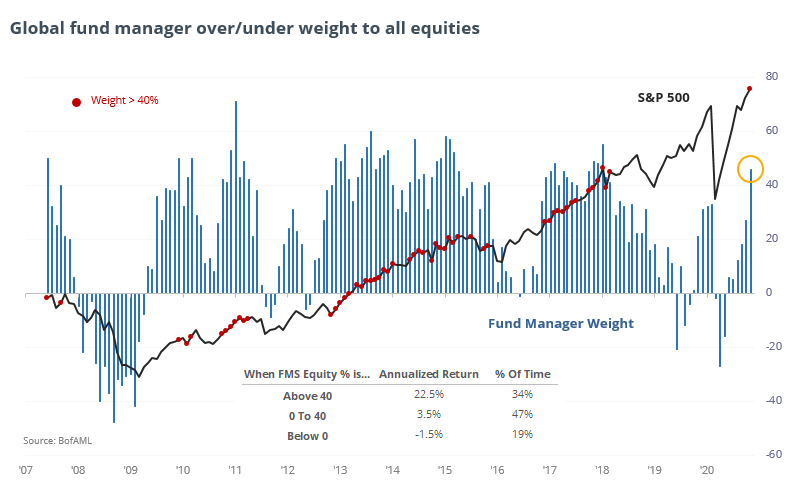

The same goes for potential concern that managers have bought too much into the nascent outperformance from emerging market stocks. Managers now have more than 10% overweight toward those stocks than either the U.S. or eurozone. But other times they were relatively overweight those stocks, it didn't lead to a consistent change in the ratio of emerging markets to the S&P.

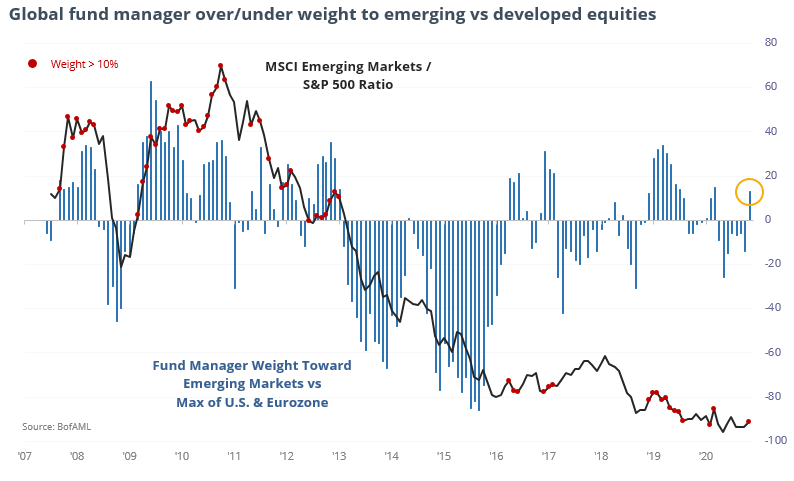

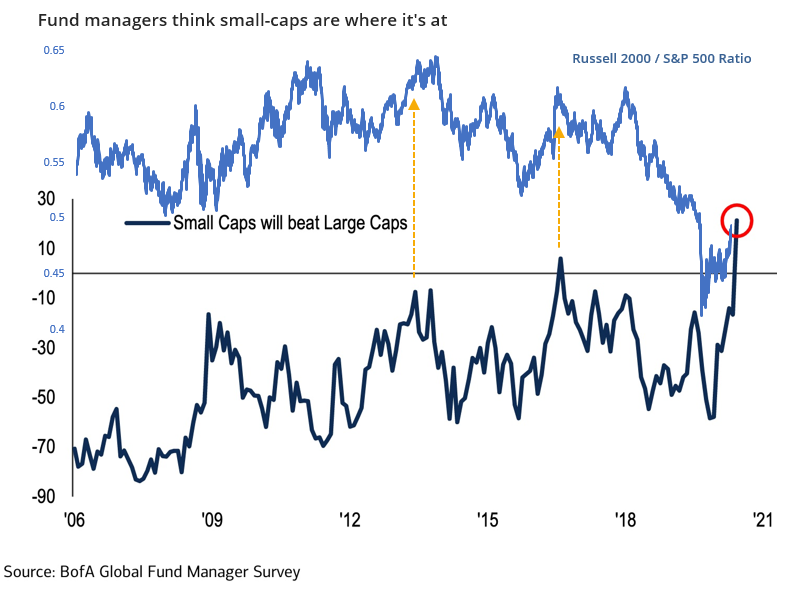

The survey is more of a contrary indicator in other aspects. For example, they're currently enamored with small-cap's prospects relative to large-caps, which has not been a great sign for the lil' guys over the past 14 years. Other times these managers decided to bet on small stocks versus large ones, the ratio of the Russell 2000 to S&P 500 turned south.

The same goes for the yield curve. These managers are currently very confident that the curve will steepen in the months ahead, but the few other times they were similarly confident, the curve promptly flattened.

Like everything, it pays to watch how these factors play out in the coming month(s). If small-caps continue to outperform (and there are signs that they should) and the yield curve continues to steepen (and there are signs it should) then we'll have some good evidence that this time is indeed different than the multiple false starts over the past decade.