Before You Take a Flyer on Gold Stocks...

There is always someone willing to make the case that "gold is about to soar." Always. Regardless of how gold is performing. Likewise, there is always someone else willing to proclaim that "gold miner stocks will vastly outperform gold itself."

Let's be candid. If we had a dollar for every time we've heard someone make these arguments, we likely wouldn't need to worry about our investments anymore.

The funny thing is, every once in a while, the people making these arguments are correct. Will they be right again in the near term? Anything is possible. But history - and the calendar - argue otherwise.

GOLD STOCKS AND SEASONALITY

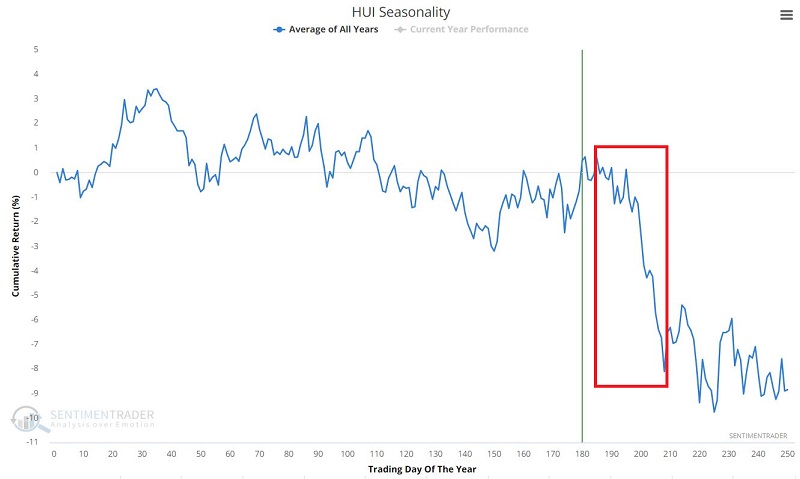

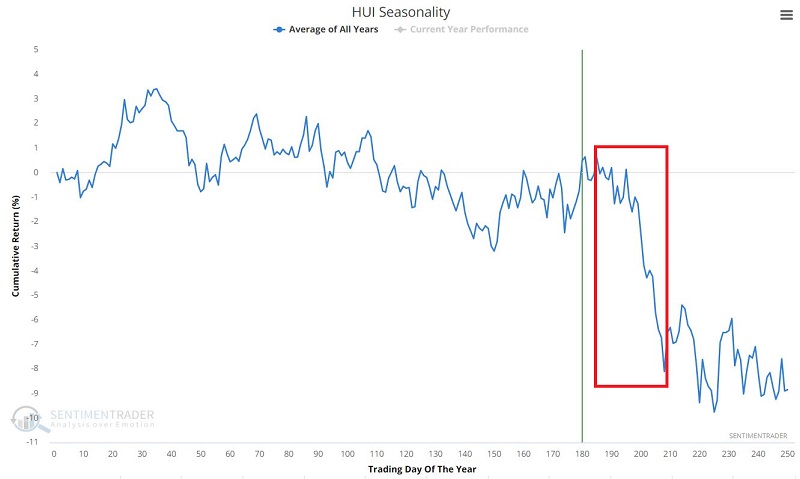

For backtesting gold-stock performance, we will use ticker HUI (Gold Bugs Index), for which we have data going back to 1958. Because HUI is strictly an index and cannot be traded, the most common choice is ticker GDX (VanEck Vectors Gold Miners ETF) for actual trading purposes.

The chart below displays the Annual Seasonal Trend for ticker HUI.

We want to focus on the period extending from:

- The end of Trading Day of the Year (TDY) #185

- Through the end of Trading Day of the Year # 208

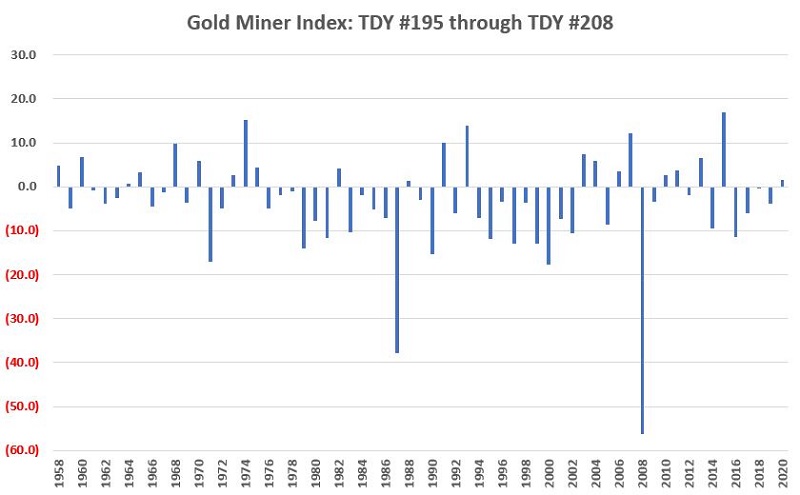

The chart below displays the results on a year-by-year basis.

Things to Note:

- # of Times UP = 22

- # of Times DOWN = 41

- Average UP % = +6.5%

- Average DOWN % = (-8.8%)

The bottom line: Gold miners have advanced only 35% of the time during this period, and the average losing trade has been 1.35 times the size of the average winning trade.

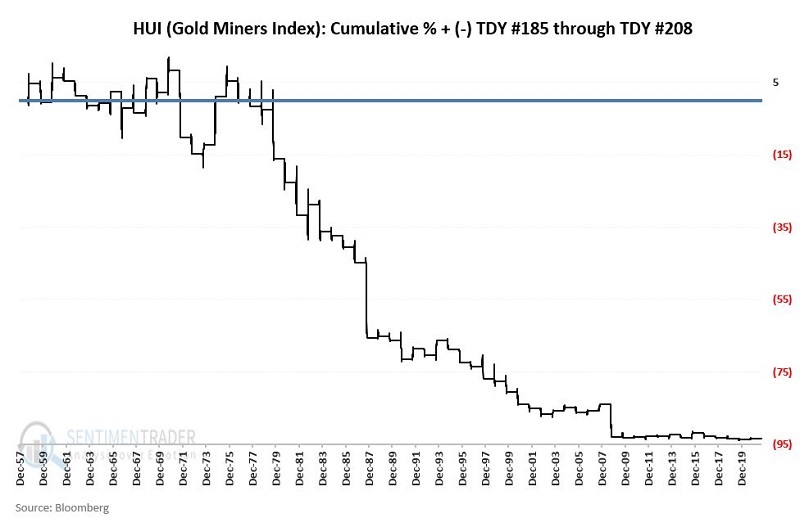

To drive home the point, the chart below displays the cumulative % performance for ticker HUI during TDY #185 through TDY #208 every year since 1958.

The bottom line: The HUI Gold Miners Index has lost a cumulative -93.5% during this unfavorable seasonal period since 1958.

TICKER GDX

The ETF ticker GDX started trading in 2006. Mathematically, the price movements of ticker GDX track those of the HUI Index with a correlation of 0.9865 (1.00 means they trade exactly the same).

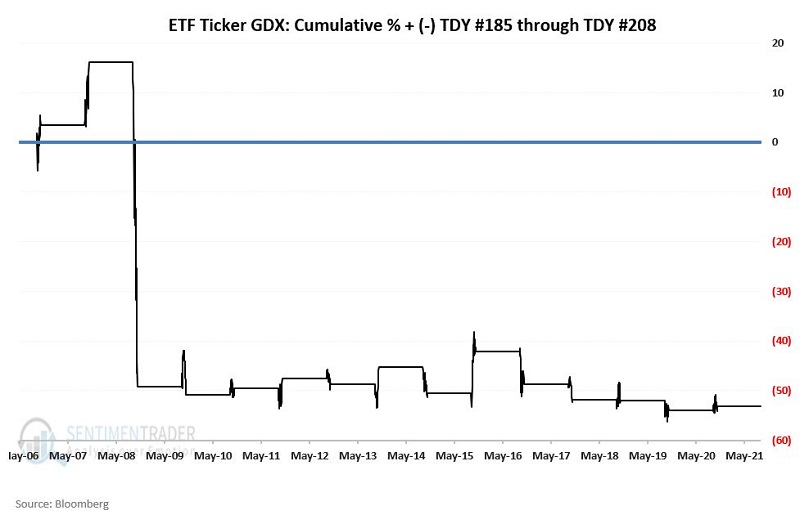

Since inception, the cumulative performance for a long position held in GDX from TDY #185 through TDY #208 appears in the chart below.

Things to Note:

- The cumulative performance during the period in question is a decline of -53.2%

- Obviously, the bulk of that decline occurred in 2008

- Still, performance is lackluster on the whole in all other years

SUMMARY

For whatever reason, late September through late October has historically been an abysmal time to hold gold miner stocks. There is no way to know if 2021 will fall in line with this tendency or be an exception to the rule.

Nevertheless, when we move past "theory" and enter the realm of "real-world trading," the real question to consider is, "Does allocating capital to gold miner stocks seem like a good idea to you right now."