Basic Materials stocks have stormed back

Key points:

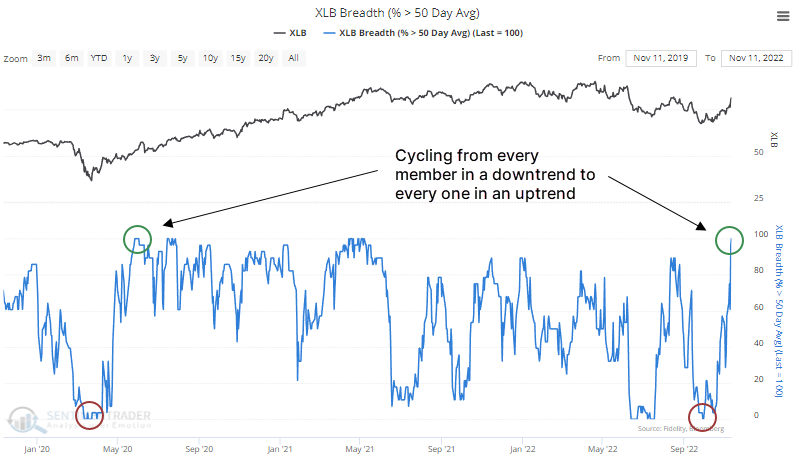

- Less than two months ago, every Material stock was in a medium-term downtrend

- By Friday, every one of them was back above its 50-day moving average

- Similar cycles over the past 70 years preceded tremendous gains for the sector

From 0 to 100

It's been a heck of a couple of weeks, including a sector most investors ignore. Out of all the sectors and indexes we track, none have more members in medium-term uptrends than Basic Materials.

Populated by companies like Linde, Sherwin-Williams, and Ecolab, they are exposed to the pedestrian workings of an economy.

It would be impossible for more of these stocks to be trading above their 50-day moving averages because every one of them is. It's a dramatic turnaround from less than two months ago when every one of the stocks was below its 50-day average.

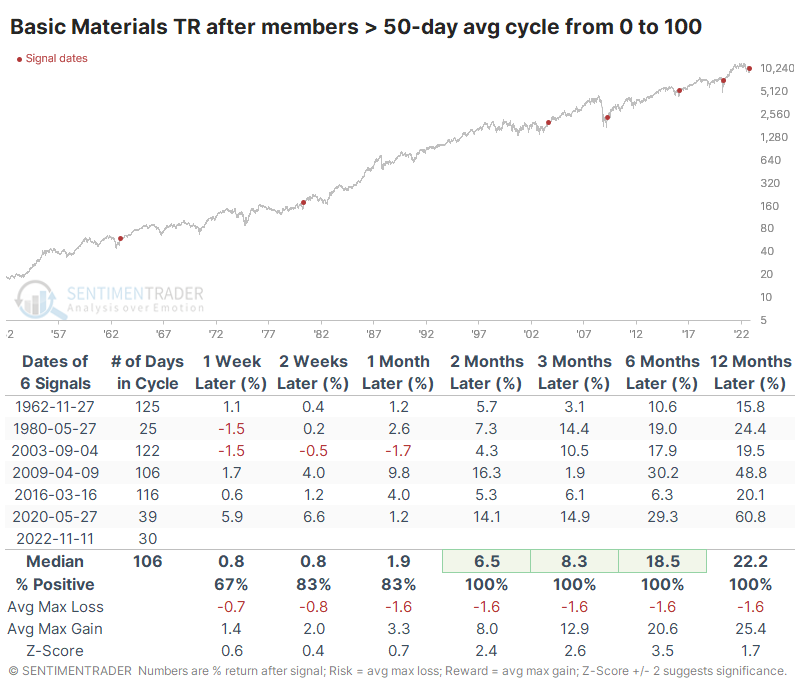

Over the past 70 years, only a handful of times has the sector undergone such a dramatic shift in fortunes within six months. The table below shows every time since 1952 when, within six months, every stock was below its average, then every one was above.

The current shift is the 2nd-fastest in history, next to May 1980. It even beat out the pandemic recovery. It was a good sign for future returns, as all of the dates showed a positive total return over the next 2-12 months.

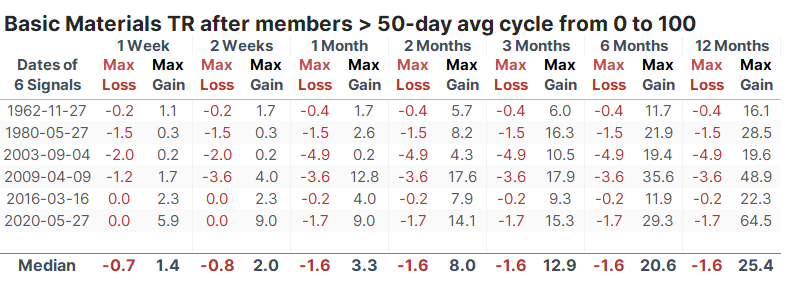

The returns in the table are impressive, though with a tiny sample size. What makes the signals more compelling is consistency. At no point within the following year did any of them suffer more than a -5% drawdown, while all enjoyed gains of at least +15%.

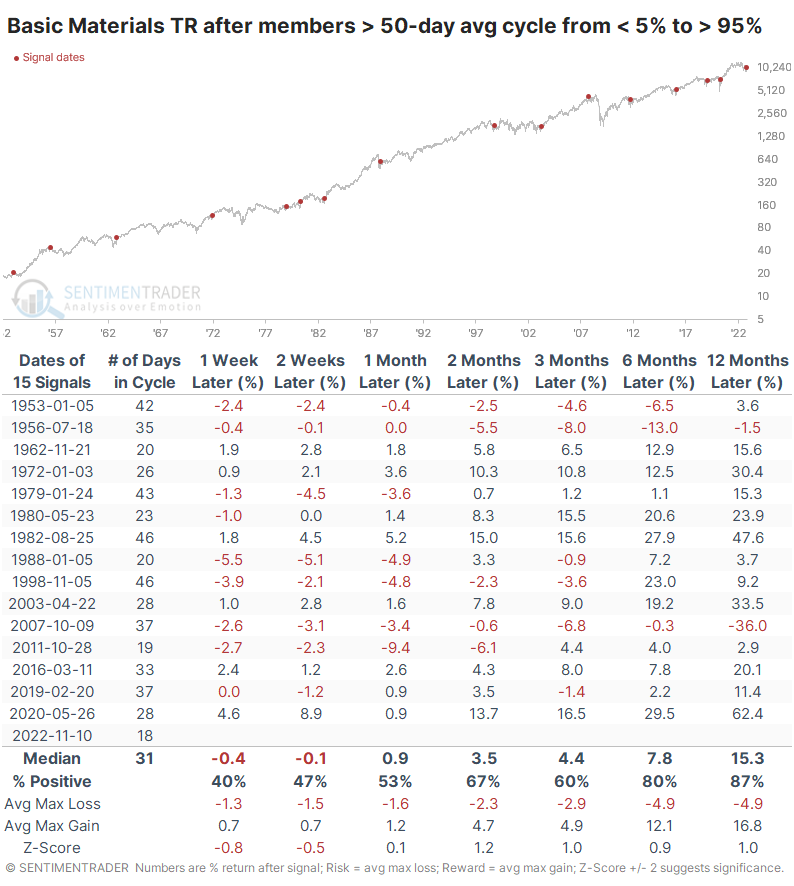

If we lessen the parameters but tighten the cycle length, we can generate a larger sample size. The table below shows times when the members above their 50-day moving average cycled from fewer than 5% to more than 95% within three months.

There were two outright failures, in 1956 and 2007, but those were also among the few that triggered when the sector was trading at or near a new high, which is not the case now.

What the research tells us...

As we saw with Industrial stocks, some of the more staid sectors are enjoying tremendous interest among investors. While that may not be the best sign for the broader market, it has tended to be a good sign of long-term momentum for the sectors themselves. They have rarely, if ever, declined in the 6-12 months following a resurgence of interest like they've enjoyed over the past couple of months.