Bad news and sentiment

Media headlines continue to shower readers with more bad news while governments around the world aim for multiple rounds of stimulus to save their economies. One of the latest pieces of bad news relates to dividends.

Dividend investing was all the rage during the 2010s bull market since it was often referred to as "investing for income" and could buffer investors against capital losses during a bear market. I considered this concept to be misguided at the time since many dividends are slashed or suspended during recessions, and a paltry 3% dividend doesn't do much for investors when they're down -30% or -40%. The dash for cash among corporates has many of them considering dividend suspensions:

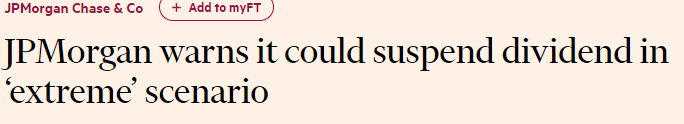

Bloomberg demonstrates that the number of media stories with "dividend suspension" has soared. The previous high was in late-February 2009, just 2 weeks before stocks bottomed and began a decade long bull market.

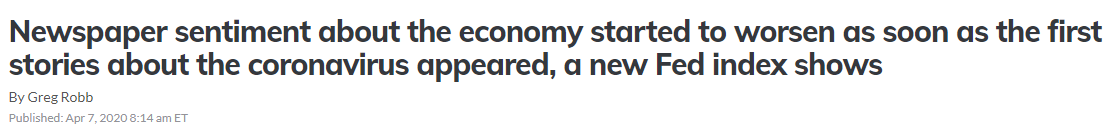

Similarly, the number of media stories with "recession" spiked as stocks bottomed 2 weeks ago, and is now retreating.

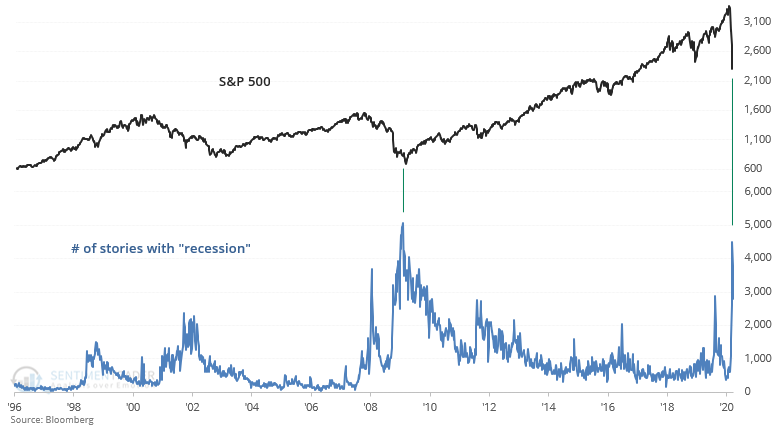

Oil's crash a few weeks ago caused a spike in the number of media stories with "oil contango". This was matched only by oil's crash in 2008 and 2015. 2008 was the bottom for oil, whereas the 2015 case saw oil bounce before making fresh lows.

Sentiment elsewhere is also extreme. Consider this headline from Kiplinger:

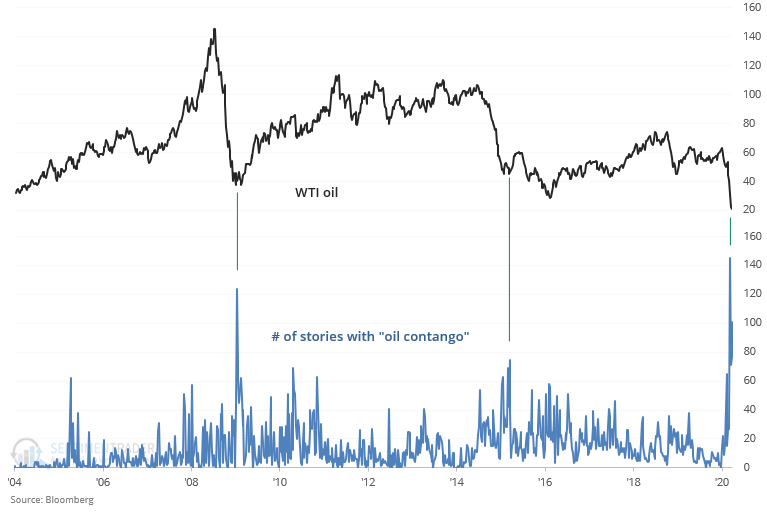

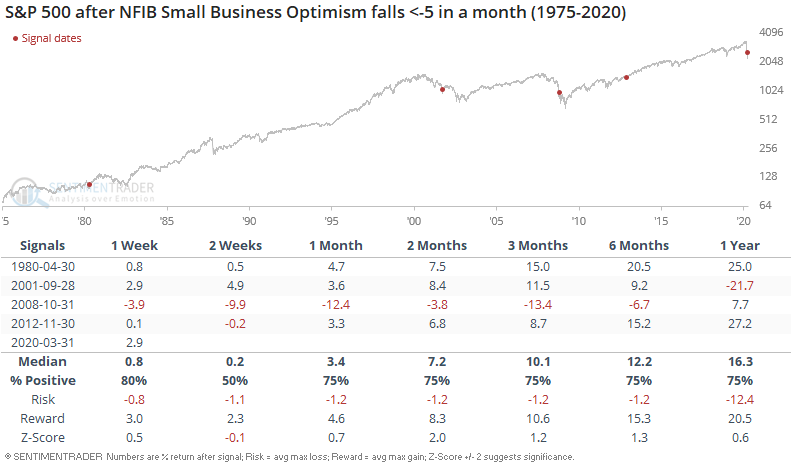

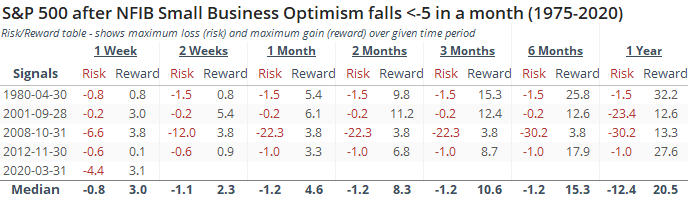

The coronavirus-driven recession has many small business owners scrambling for survival, and one can only hope that the government's efforts are enough. This is one of the largest 1 month drops in NFIB Small Business Optimism ever:

The historical cases usually occurred near periods of market turmoil:

- March 1980 recession

- 9/11

- October 2008 market crash

- Fiscal cliff

The 1980, 2001, and 2012 historical cases were followed by at least a medium term bounce. And while October 2008 wasn't followed by a powerful medium term bounce, the S&P did come closer to putting in a long term bottom:

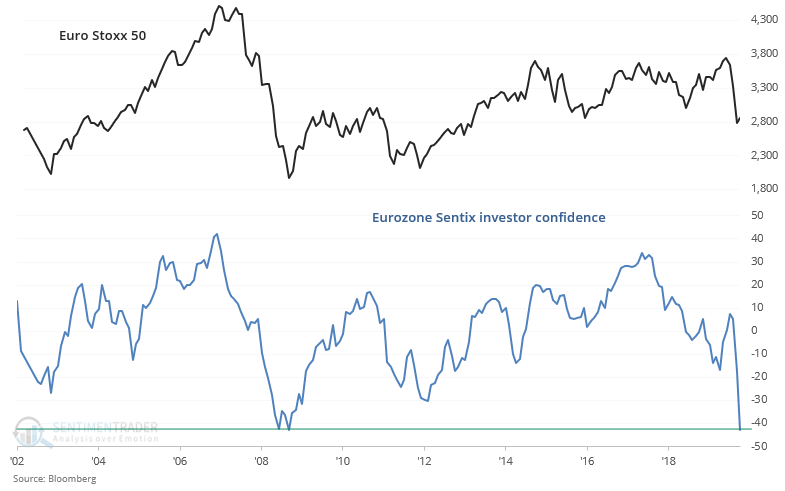

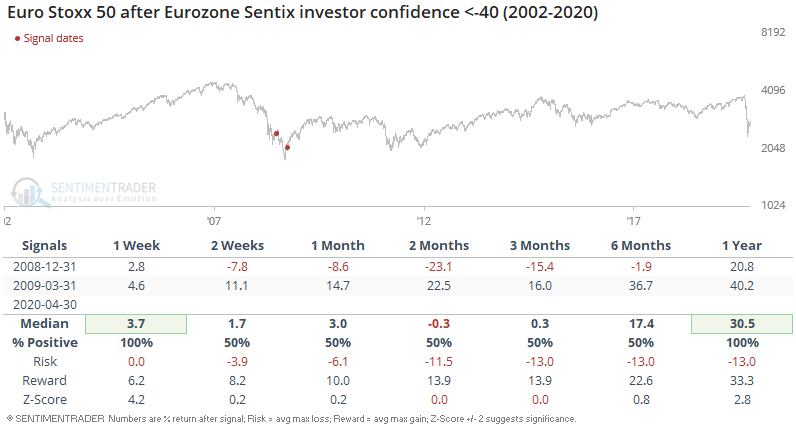

Lastly, Eurozone investor confidence has sunk to one of the lowest levels in almost 2 decades:

This was matched only by 2008/2009:

Overall, many sentiment extremes we have witnessed over the past few weeks yield very small sample sizes. Although it's hard to draw a very strong conclusion from such small sample sizes, overall I would consider such extremes to be a bullish factor for stocks going forward.