Bad Breadth On A Good Day

Breadth is not good today, despite most of the major indexes pushing to new 90-day highs.

On the NYSE, the Up Issues Ratio is at 43%, one of the worst figures in 50 years on a day the S&P 500 closed at a 90-day high. There is still some time in the session, but even if the S&P closes modestly negative, this is a bad breadth reading.

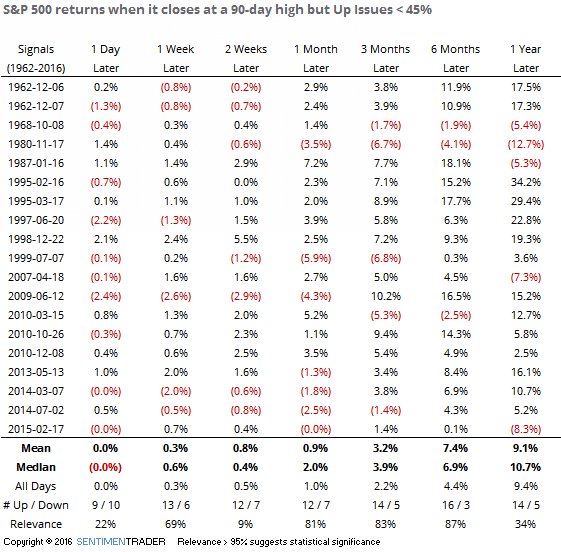

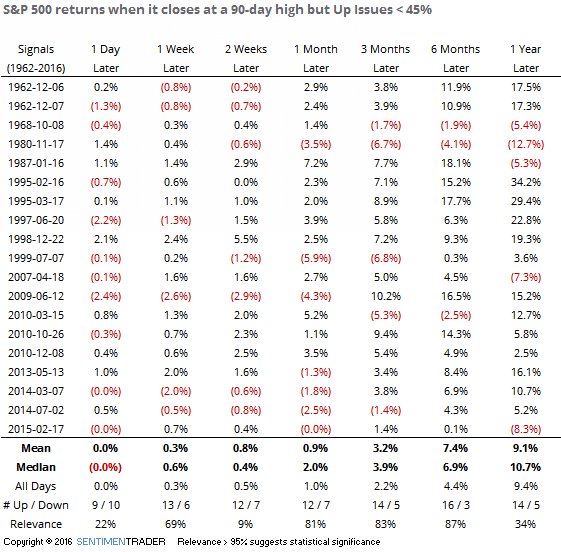

The table below shows every time the S&P closed at a 90-day high with an Up Issues Ratio below 45%. As we've discussed before, these kinds of situations tend to be a short-term negative but not so much longer-term. We wouldn't read much into the longer-term returns simply due to one minor day of activity, but if this holds on into the close, it would be a negative for the shorter-term.