Backtesting Individual Stock Sentiment with the sentimenTrader Backtesting engine

One of the offerings that we have within the sentimenTrader service is the ability to backtest sentiment indicators against indexes and ETF's. This feature has proven to be fairly popular among our users since we implemented it. One of the features requested by users is the ability to backtest individual stocks using the sentimenTrader backtest engine and over the weekend, we rolled this new functionality out to users.

To provide an overview of this new functionality, we've put together a quick video tutorial (you can find it on our YouTube Channel as well as embedded below.

A few key features of this new functionality:

1.) All the functionality of the backtest engine is available although you can currently only test a single stock's Optimism Index (sentiment reading) with that stock. There are plans to expand that to allow users to test single stock sentiment against Indexes, ETF's and other stocks.

2.) When viewing a stock's Optimism Index (Optix), you can select 'Backtest this Indicator' to be taken directly to the backtest engine.

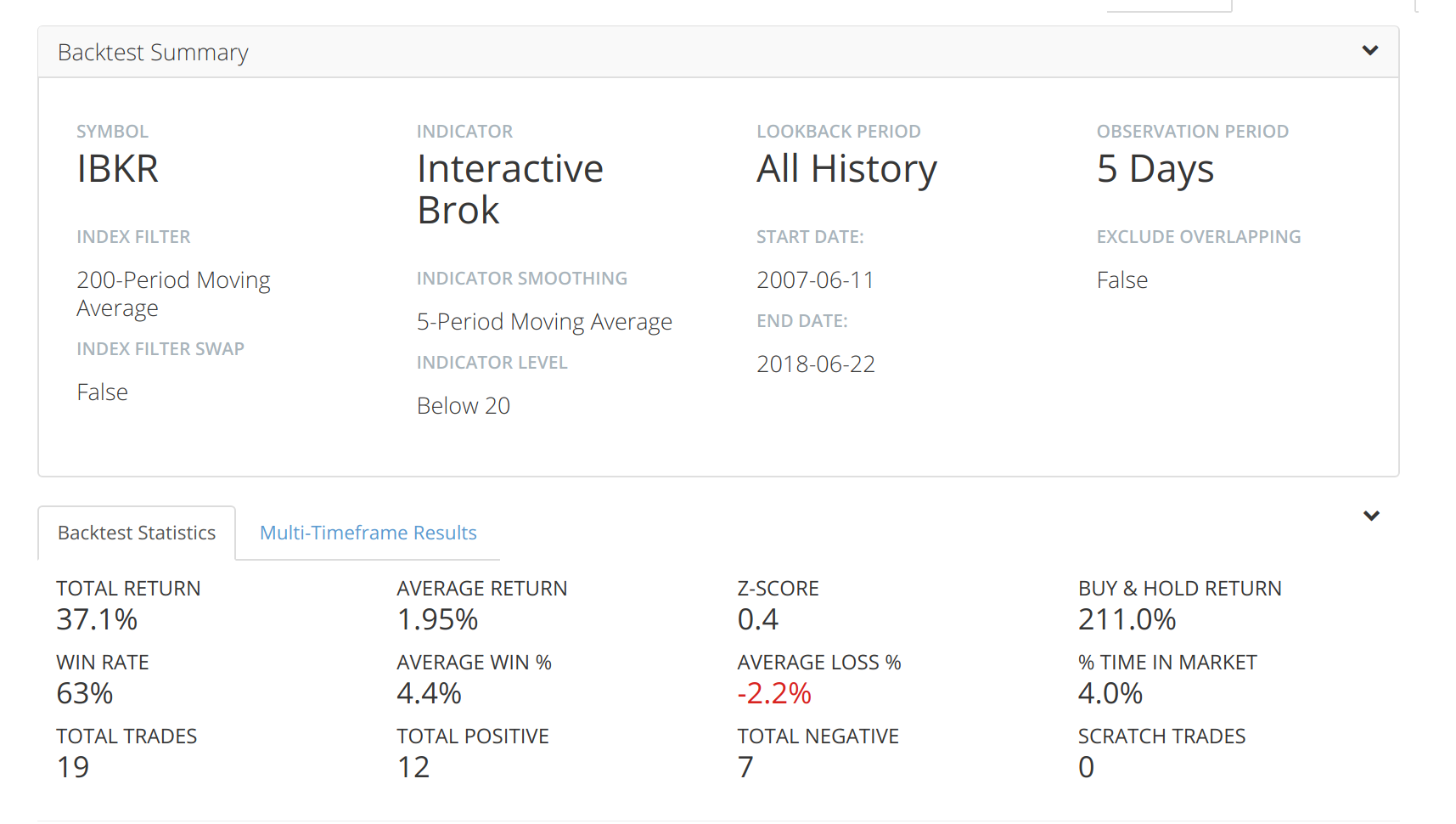

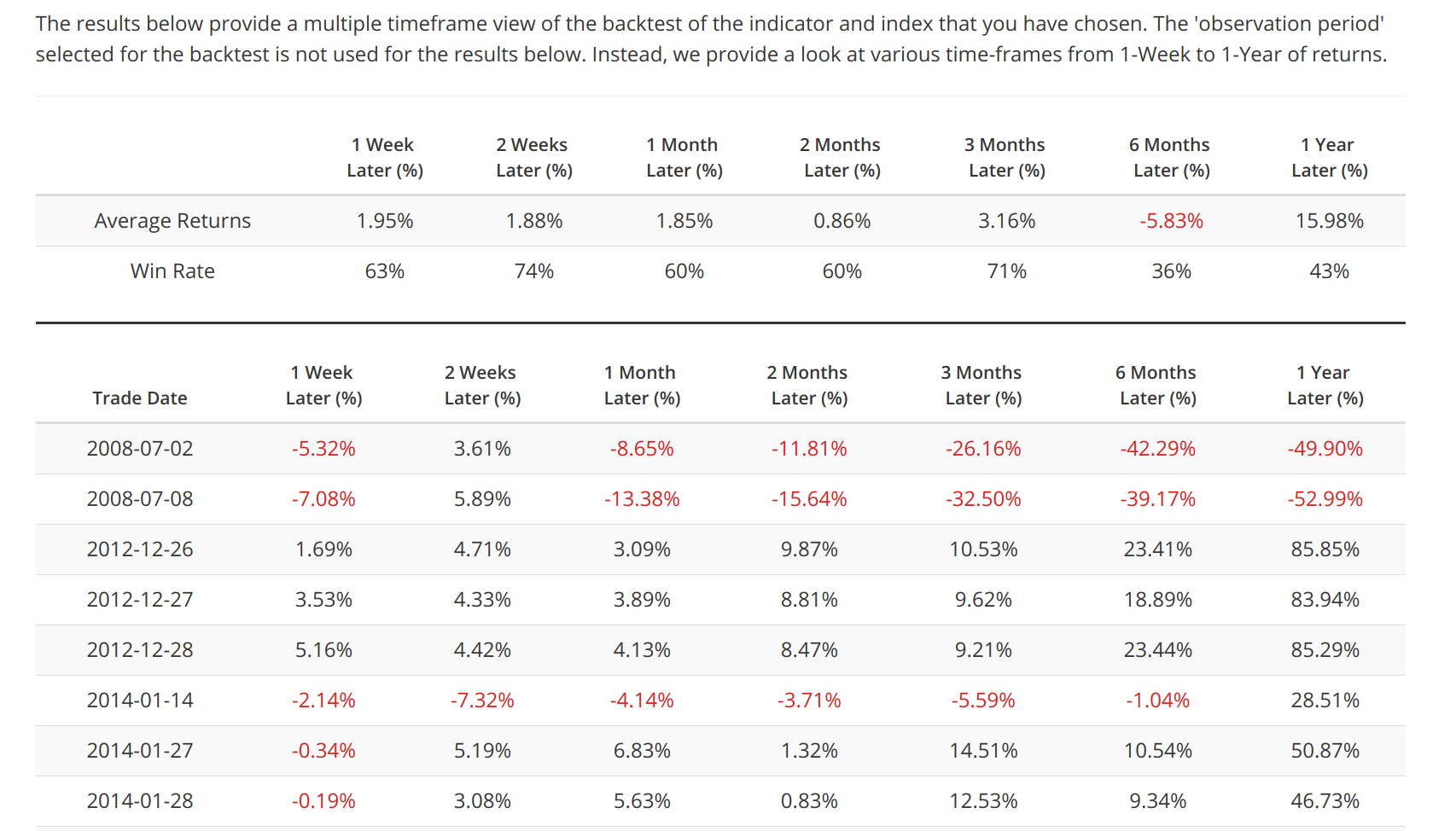

3.) Backtest results are formatted and presented in the same manner as for other backtests. A few samples are provided below.

sentimenTrader Stock Sentiment Backtest Results Summary

sentimenTrader Stock Sentiment Backtest Results Multitimeframe Results Summary

If you don't have an account, you can sign up for a free 30-day trial today. if you are a sentimenTrader subscriber, log in and start using our Backtest Engine to backtest Individual Stock Sentiment.