Backtest Engine Scans I Have Known and Loved - The SPY % > 50-day MA Edition (Part I)

Sometimes the same indicator can be used in different ways. This is often due to the non-intuitive quirk of the stock markets that:

- Deeply oversold can at times be bullish for stocks

- Strongly overbought can ALSO at times be bullish for stocks

So, in this article and Part III, we will focus on two different ways to use the SPY % > 50-day MA indicator. As the name implies, this indicator measures the percentage of stocks held by SPY that are currently above their respective 50-day moving average.

SPY % > 50-DAY MA

For our first test, we will attempt to use this measure as a momentum indicator. In this approach, we are NOT attempting to buy on weakness but rather buy into the type of strength that tends to follow through to the upside. In essence, we are looking for a continuation of a recent strong trend. While this type of momentum trading makes some traders nervous, applying an objective indicator to generate the signals can help to remove the emotion and increase one's confidence.

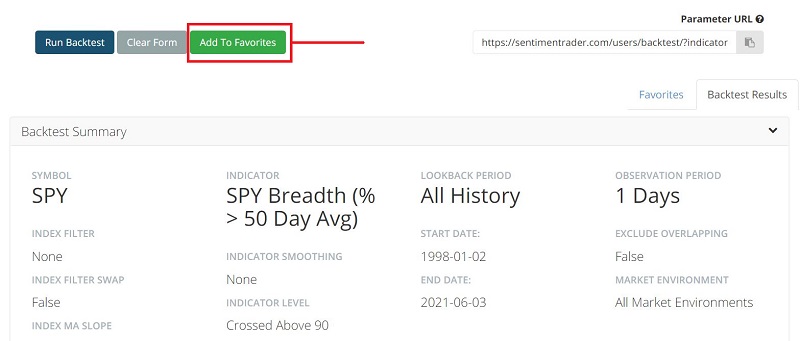

By clicking this link and then clicking "Run Backtest" you can run the following test:

- We look at the SPY % > 50-day MA indicator

- We look for the indicator value to cross above 90 (i.e., 90%)

In plain English, we are looking for a day when at least 90% of the stocks held by ticker SPY are above their respective 50-day moving averages after NOT being above 90% the day before.

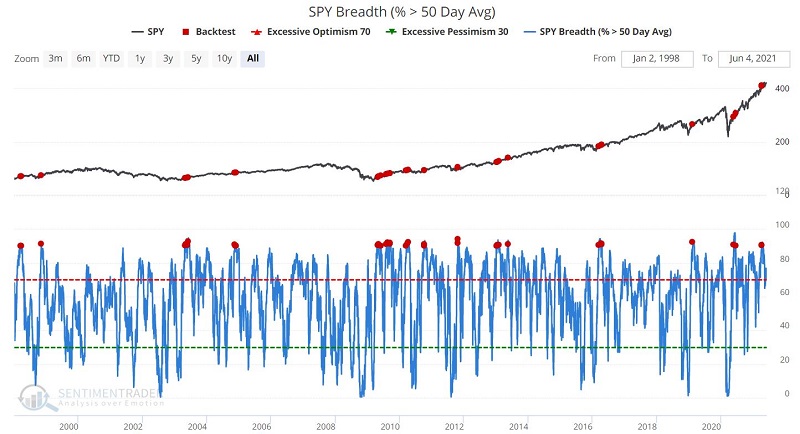

The chart below displays the signals.

The figure below displays a summary of results 1 week to 1 year after each signal. The results are consistently favorable, though not perfect.

Note that:

- Each time frame showed strong upward bias, with Win Rates ranging from 74% to 97%

- 3 months had a Win Rate of 92% (good for traders)

- 1-Year had a Win Rate of 97% (good for investors)

- The 3-month Median return was 5.18%

- The 1-year Median return was a robust +16.55%

Investors and traders are often hesitant to "chase the market" when it makes a strong up move. However, these signals offer a strong clue that it is time to "go with the flow."

Now let's look at how you can save this scan (or any scan) so that you will automatically be alerted when it gives a signal.

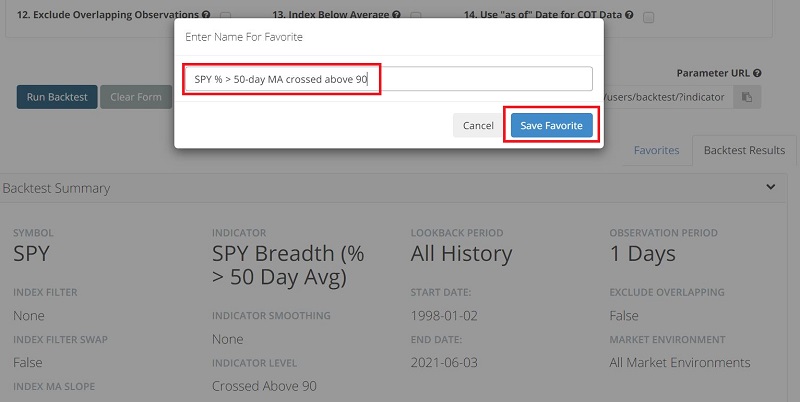

You can do this by:

- Clicking "Add to Favorites"

- Typing "SPY % > 50-day MA crossed above 90"

- Then click "Save Favorite"

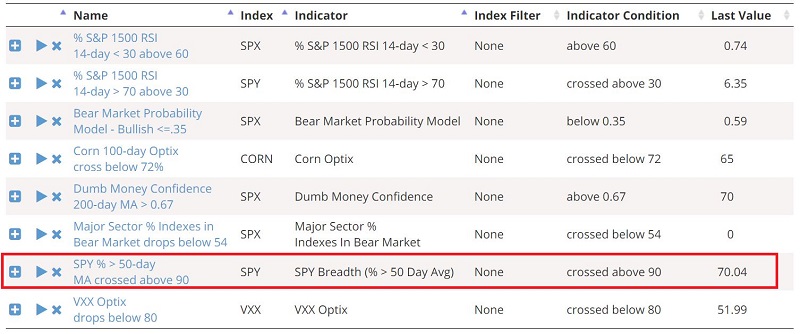

These steps will add this particular scan to your list of Favorites. Anytime you enter Backtest Engine, your Favorites will be listed at the bottom as per below.

More importantly, any active Saved scan is listed at the bottom of your Evening Digest email. You can go to My Website Preferences under My Account to make sure you get those (they are on by default).