Backtest Engine Scans I Have Known and Loved - The Microcap/SPX Relative Ratio Rank Edition (Part II)

This is Part II of a 2-part series highlighting potentially useful Backtest Engine Scans. Please note that these scans are not necessarily presented on a "timely" basis. The goal is two-fold:

- To help you learn more about the Backtest Engine and its potentially powerful uses

- To help you build an arsenal of scans that may ultimately prove to be very useful at just the right time

Sometimes traders can use the same indicator in different ways. This is often due to the non-intuitive quirk of the stock markets that:

- Deeply oversold can at times be bullish for stocks

- Strongly overbought can ALSO at times be bullish for stocks

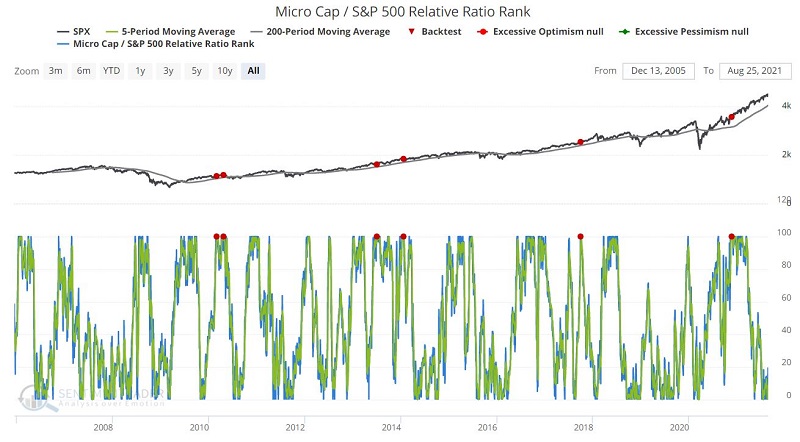

In this piece, we will use the Micro Cap/SPX Relative Ratio Rank indicator to identify a buying opportunity within an existing uptrend. As the name implies, this indicator measures the ratio relative to its range over the past four months. When the relative ratio is high, investors are showing risk-on behavior. When the ratio drops to a low level, they are exhibiting risk-off behavior.

Micro-Cap/SPX Relative Ratio Rank

In Part I, we used this measure as an oversold indicator to help us buy on weakness. For Part II, we will attempt to use this measure to signal a "continuation" rally.

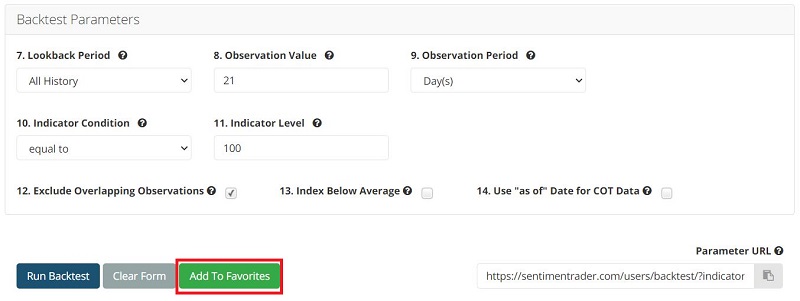

By clicking this link and then clicking "Run Backtest" you can run the following test, where we look for:

- The 5-day moving average of the MicroCap/SPX Relative Ratio Rank indicator to be equal to 100

- While the S&P 500 Index is above its 200-day moving average

- For the first time in 21 days

The chart below displays the signals.

The table below displays SPX performance following previous signals.

Note that:

- There are only 6 signals, so small sample size is a concern

- The 6-month and 12-month Win Rate is 83%

- The 1-year Median return was a significant +15.42%

The bottom line is this: This particular signal can at times give investors some confirmation that an ongoing bull market is still intact - and likely to reassert itself in the year ahead. This can be important "weight of the evidence" information for helping an investor to "sit tight" when the news and current events cause doubt to creep in.

Now let's look at how you can save this scan (or any scan) so that you will automatically be alerted when it gives a signal.

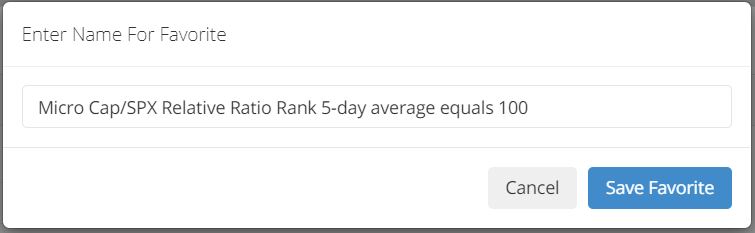

You can do this by:

- Clicking "Add to Favorites"

- Typing "Micro-Cap/SPX Relative Ratio Rank 5-day average equals 100" (or whatever label you would prefer)

- Then click "Save Favorite"

These steps will add this particular scan to your list of Favorites. Anytime you enter Backtest Engine, your Favorites will be listed at the bottom as per below.

More importantly, any Saved scan that is active is listed at the bottom of your Evening Digest email. You can go to My Website Preferences under My Account to ensure you get those (they are on by default).