Backtest Engine Scans I Have Known and Loved - The Major Sector % Indexes in Bear Market Edition

This first iteration involves a signal that happens very rarely. That's the bad news. The good news is that when it does give a signal, it sends an important message to investors, typically alerting them that the time has come to become aggressively bullish in the stock market - typically occurring after a significant bear market has completed running its course.

MAJOR SECTOR % INDEXES IN BEAR MARKET

True bear markets tend to be drawn-out affairs that inflict a great deal of damage on:

- Investor's psyche

- Investor's pocketbook

- Wide swaths of various stock market sectors

The goal in using this indicator is NOT to try to pinpoint the exact bottom of a bear market - since that is roughly equivalent to attempting to catch a falling safe. Instead, we will use this indicator in a way that will hopefully give us as close to an "All Clear" signal as we can hope for.

To put it another way, our objective is to buy when the likelihood is great that the market is ready to begin a new bull market. So let's look at a simple way to use the Major Sector % Indexes in Bear Market indicator to identify these rare opportunities.

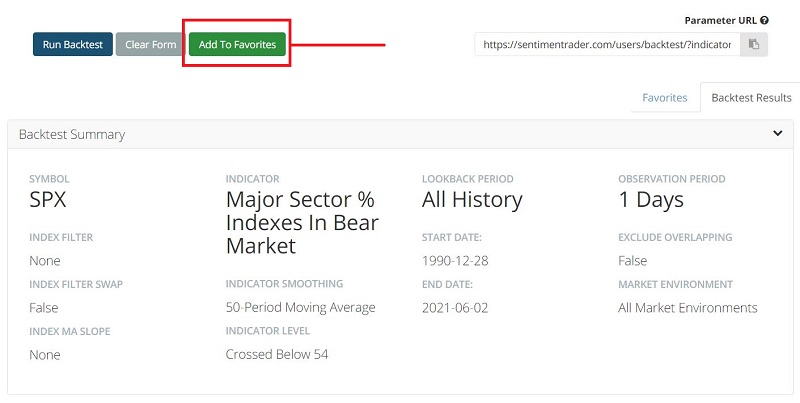

By clicking this link and then clicking "Run Backtest" you can run the following test:

- We look at the 50-day moving average of the Major Sector % Indexes in Bear Market indicator

- We look for the 50-day moving average to drop from above to below 54

In plain English, in a major stock bear market, most major market sectors will also experience a bear market of their own. With this scan, we are looking for a point when the percentage of these sectors in a bear market declines from a high level as a sign that the worst is over.

THE SIGNALS AND RESULTS

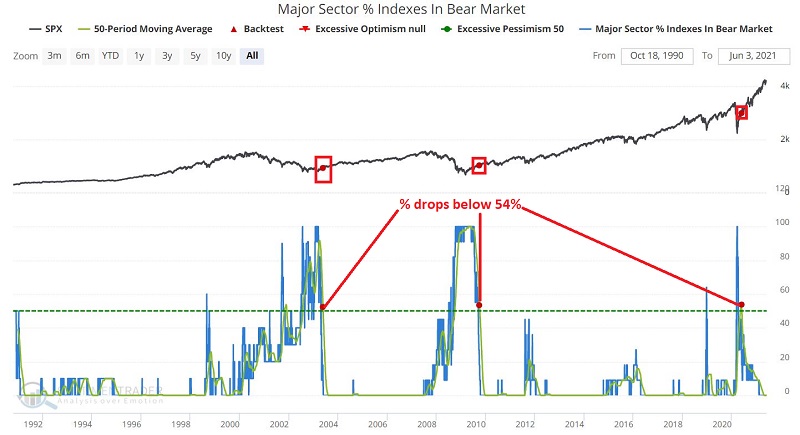

The chart below displays the signals.

When I stated that this indicator generates signals very rarely, I clearly was not kidding. In fact, there have been only 3 signals in the past 29 years. Given the infrequency, it is fair to ask, "Is this even worth knowing about?"

To answer that question, the figure below displays a summary of results 1 week to 1 year after each signal. The results are exceptionally bullish.

Note that:

- Each signal produced gains during all time frames displays

- The Win Rate is 100% across the board

- Beyond 1 month, the Average and Median returns trend higher the more time that goes by

- The 6-month Median return is +15.3%

- The 1-year Median return is a robust +17.35%

The signals are infrequent, but they constitute the type of timely alert that most investors seek.

Now let's look at how you can save this scan (or any scan) so that you will automatically be alerted when it gives a signal.

SAVING THE SCAN FOR AUTOMATED USE

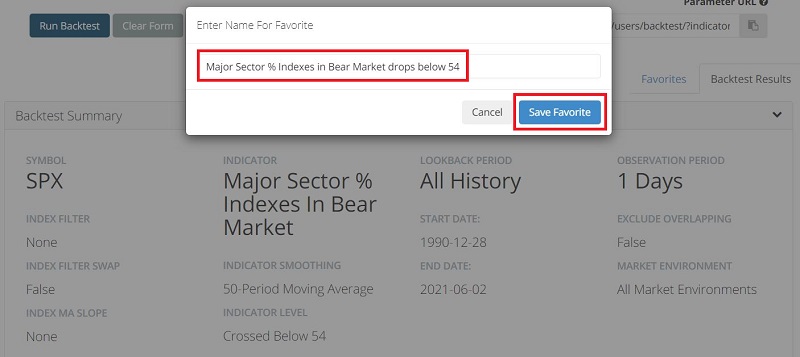

You can do this by:

- Clicking "Add to Favorites"

- Typing "Major Sector % Indexes in Bear Market drops below 54"

- Then click "Save Favorite"

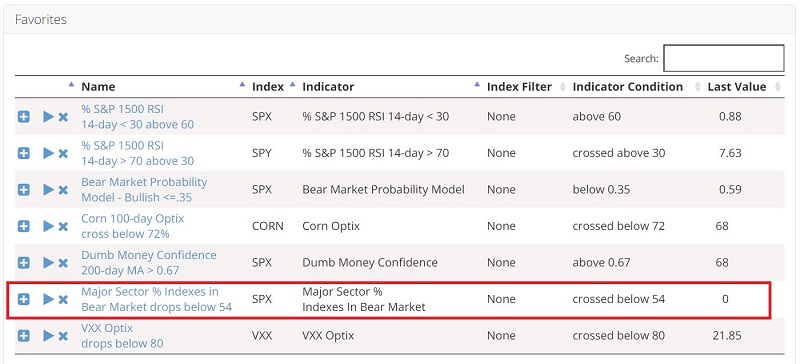

These steps will add this particular scan to your list of Favorites. Anytime you enter Backtest Engine, your Favorites will be listed at the bottom as per below.

More importantly, any active Saved scan is listed at the bottom of your Evening Digest email. You can go to My Website Preferences under My Account to make sure you get those (they are on by default).