Backtest Engine Scans I Have Known and Loved - The Bear Market Probability Edition

Generally speaking, the mandate is to be "topical", i.e., to write about things that are relevant to investors and traders in the here and now.

However, as I see it, another objective is to help investors and traders to build an arsenal of useful tools that can be employed when the time is right. So, in this periodic series on Backtest Engine scans the material that I present will often NOT be relevant in the here and now.

Take this one for instance.

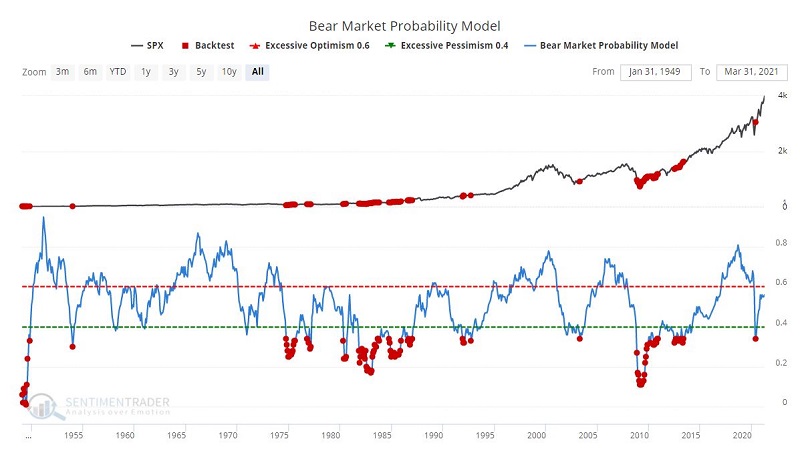

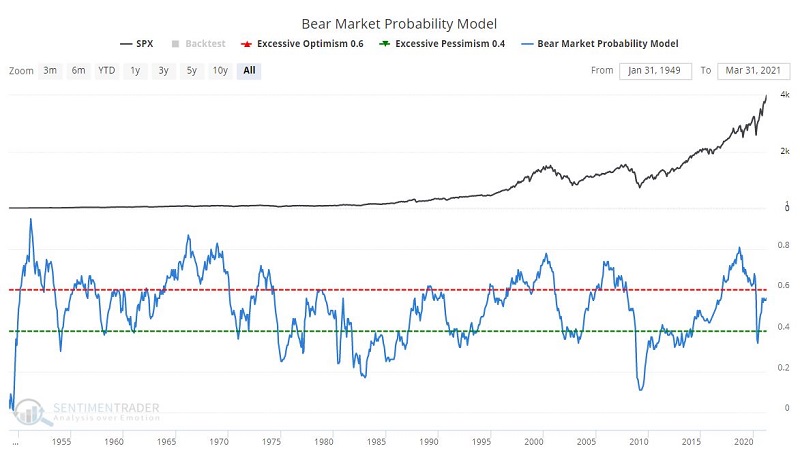

The Bear Market Probability Model is a model outlined by Goldman Sachs using five inputs covering fundamental, valuation, and price-based metrics. In theory, its readings can range from 0 to 1, but since a few early extreme readings in the early 1950s, the extremes have been 0.11 in March 2009 and 0.81 in August of 2018.

The chart below displays the S&P 500 Index on top and the Bear Market Probability Model at the bottom.

While there are many ways to analyze and utilize this model, for the purposes of this piece we will focus on just one. Clicking on this link and then clicking "Run Backtest" will generate the results shown below. In this test, we are simply highlighting:

- Every month for which the Bear Market Probability Model reads 0.35 or less

You can save this test as a Favorite Backtest and in the Evening Digest email, you would see if any of your favorite tests have triggered.

The screenshot below displays some of the relevant performance figures.

Some key things to note are that each time frame showed a:

- Median profit

- Larger median profit than the previous time frame

- Higher Win Rate than the previous time frame.

In addition, the median gain for 1 year was a solid +18.9% and median gains continued to grow significantly in years 2 and 3 after the signal.

There are two pieces of bad news:

- The stock market typically experiences some "pain" leading up to a favorable reading of 0.35% or less. In other words, signals tend to occur only after a significant bear market decline has unfolded over a number of months or even years. So, this is not something we necessarily "wish for" - just something we should be prepared to take advantage of when the opportunity does present itself

- There is absolutely no guarantee that the market will NOT continue to fall for some period of time and distance after a Bear Market Probability Model reading below 0.35. Following the October 2008 signal, the S&P 500 Index fell almost 25% more before finally bottoming out

The Bottom Line

The Bear Market Probability Model is a tool and NOT a "sure-fire, you can't lose, the market is sure to rally" indication.

The proper use of this tool goes something like this:

- The next time you find yourself feeling fearful in the market, go ahead and run this scan

- If you find a reading of 0.35 or less that is your cue to hold your emotions in check and to start making plans to participate in a robust bull market in the years ahead