Back To Greed; Low Exposure; Oscillator Streak

This is an abridged version of our Daily Report.

Back to greed

The CNN Fear & Greed model has gone from extreme Fear in December to Greed now.

It’s not unusual to see it swing this much, this quickly, but it is unusual when the S&P 500 still hasn’t made it above its 200-day averages. And those instances consistently led to weak returns in the medium-term. Over the next two months, there was only a single positive return

Low exposure

Equity hedge funds were at a record level of exposure to stocks as they peaked and have since pulled back. Their exposure never reached an extremely low level and they haven’t seemed overly eager to add back as stocks have rallied. Across strategies, their exposure is at a low level.

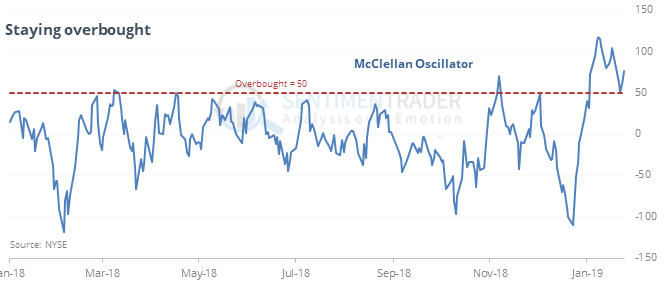

Staying stretched

The McClellan Oscillator has held above 50 for 15 consecutive days, its longest streak in 27 years.

This kind of persistent, meaningful, and widespread buying pressure has preceded gains in the S&P 500 every time. Yes, that directly conflicts the note above about sentiment returning to normal in a downtrend, and there is no good way to reconcile that at the moment. There is a battle between stretched shorter-term conditions during an unhealthy market and the remarkable momentum and breadth of the rally.

Optimistic options

The CBOE Equity Put/Call Ratio dropped to a low level on Friday, showing almost twice as many calls traded as puts. According to the Backtest Engine, this has been rare to see when the S&P 500 was below its 200-day average. In 2008 it marked short-term peaks, also in 2011.