Back-To-Back-To-Back Reversal

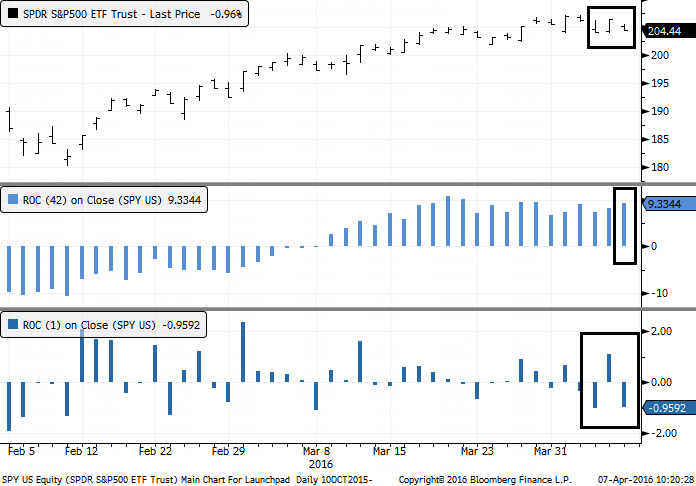

It's still early in the trading session but with a bit more weakness into the close, the S&P 500 would be on track to have back-to-back-to-back 1% reversals.

This kind of volatility after a large rally is widely considered to be a negative, as it indicates increasing uncertainty among traders and rising volatility is often a negative sign in general. In the chart, ROC stands for Rate Of Change, the percentage change over the past 42 days and 1 day, respectively.

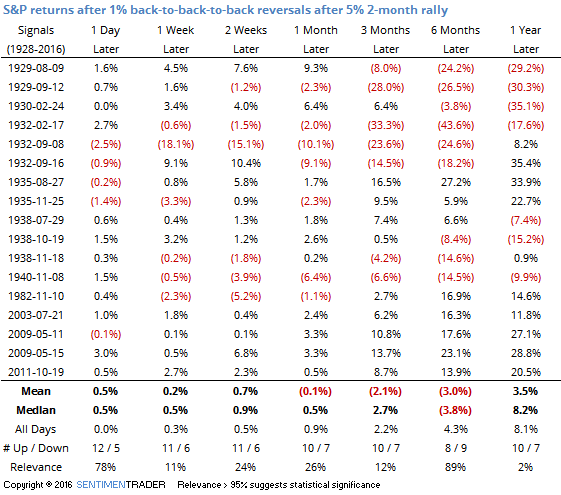

Let's go back to 1928 and look for any time the S&P had rallied at least 5% over the prior two months, and then had a 1% loss followed by 1% gain followed by 1% loss. Here are the returns going forward:

Overall returns were mixed with a negative tone. There were some large losses in the medium- to long-term but that was dominated by the 1930s. In modern markets, it wasn't so bad but the sample size is so small as to give little context. In the five times it happened since 1950, the S&P was higher six months later by at least 13% each time.

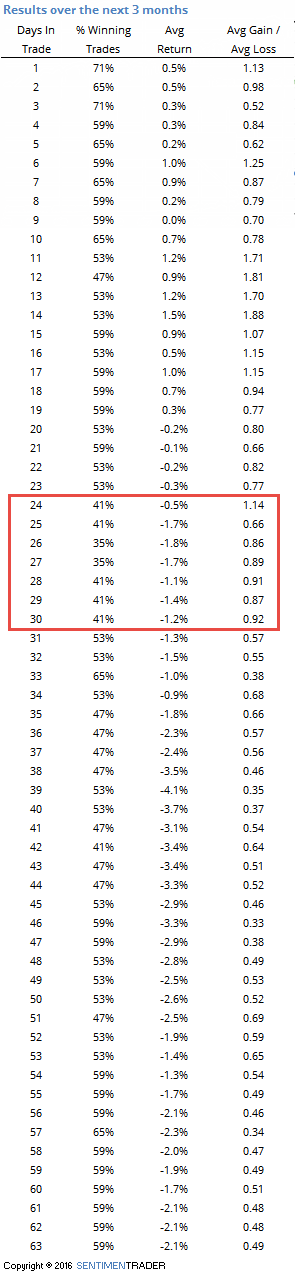

Looking at individual trading days, we can see that if there was consistent weakness, it tended to be between 24-30 days after the reversals occurred. Again, in modern markets these reversals have had less meaning, but we'd consider it a (very) minor negative when looking at the next 4-6 weeks or so.