Back to back buying thrust

Barring a collapse into the close, we were on track for back-to-back 90% up volume days on the NYSE. An hour before the close, 93% of NYSE volume was concentrated on issues with a higher price than yesterday's close.

With stocks backing off in the final half-hour due to political posturing, up volume made up "only" a little more than 80% of total volume.

A single 90% up day when coming off of a low has preceded gains as we saw yesterday. Troy noted in a premium note earlier today that even an 85% up day led to longer-term gains every time when the S&P had been at least 20% below its high at the time.

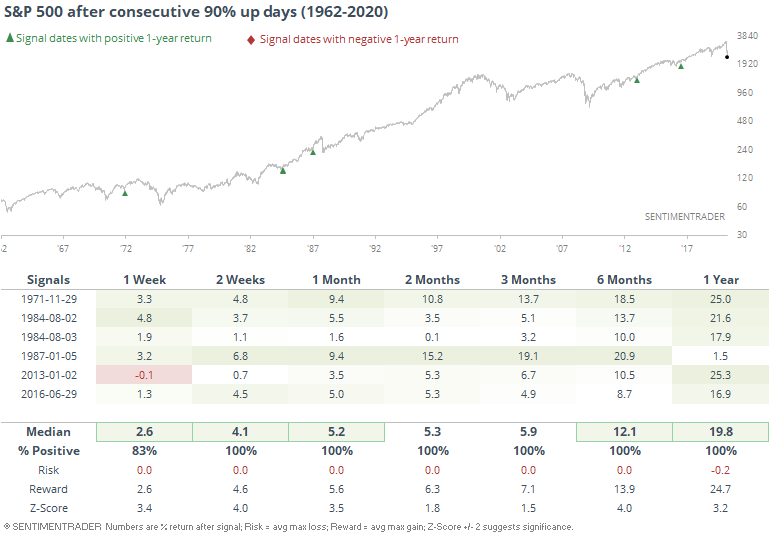

And when we get consecutive 90% up days - with that being the only condition - gains were remarkable. This did not trigger due to the late selloff, but it's at least worth noting given how trading had developed until the last half hour.

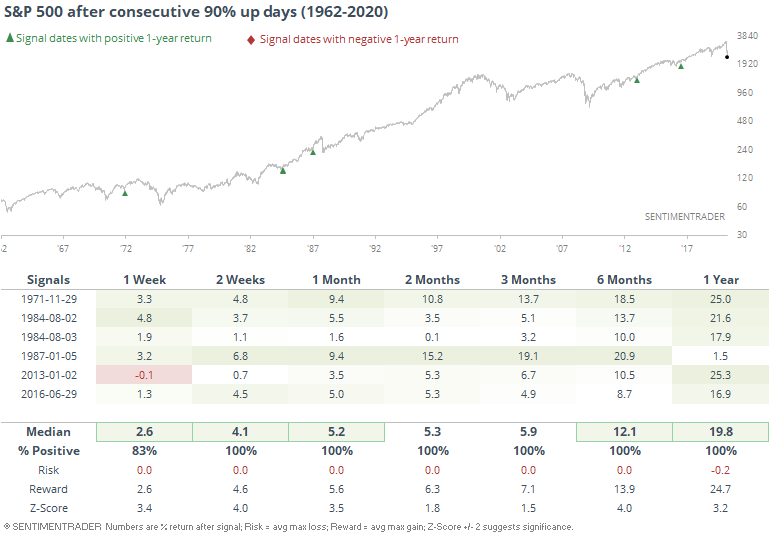

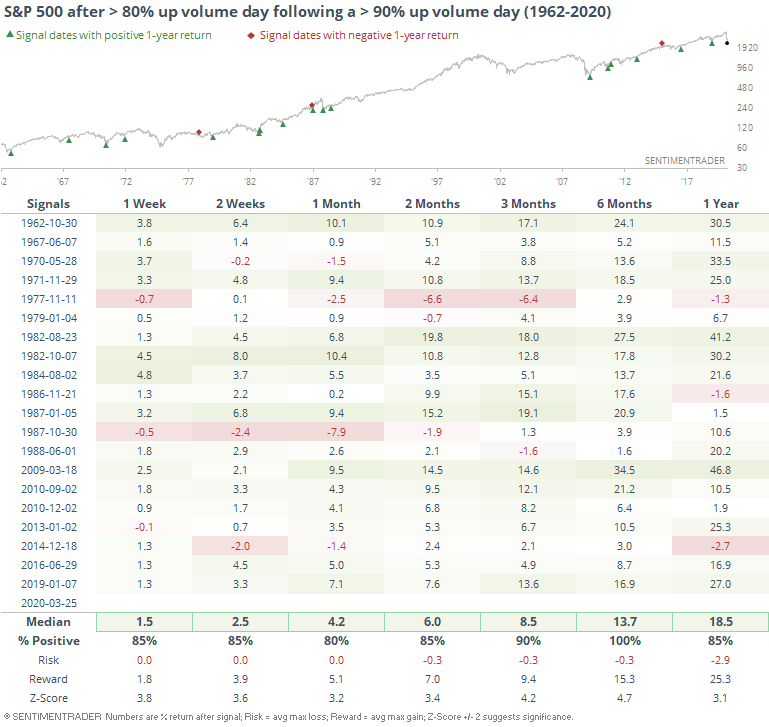

Even though selling pressure picked up, we still saw more than 80% up volume, on the heels of the 90% up volume day from Monday.

Even though many of these triggered in the midst of bear markets, future returns were excellent. Over the next six months, there wasn't a single loss, and the risk/reward was heavily skewed to the upside.

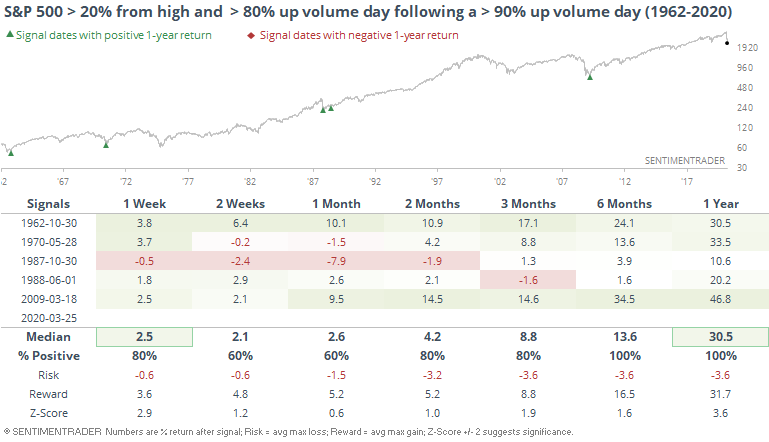

When these triggered while the S&P was more than 20% off of its 52-week high, it returned a median 30.5% over the next year (tiny sample size, though).

So far, buyers are doing what they need to in order to preserve the idea that we've seen an important inflection point.