Attention Shoppers!

Since roughly the mid-1970's, certain months of the year have typically been much more favorable for Consumer Discretionary stocks than others. Let's take a closer look.

For testing purposes, we will use the S&P 500 Consumer Discretionary Index (heretofore referred to as SCDI). We will look at the month total return performance for SCDI during:

- March, April, May, November and December

- versus all other months

- From January 1977 through December 2020

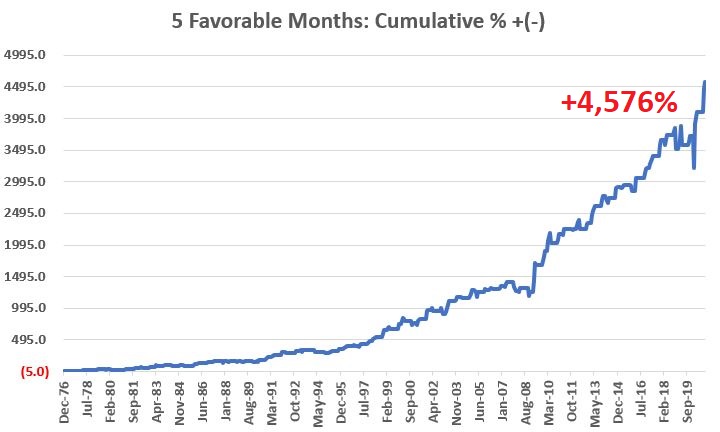

The chart below displays the cumulative total return for SCDI ONLY during the 5 "favorable" months

The chart below displays the cumulative total return for SCDI ONLY during "all other months"

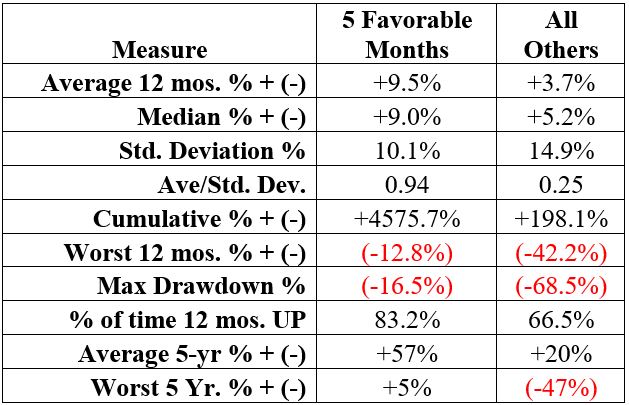

The relevant comparative numbers appear below.

It would be incorrect to refer to "All Other Months" as "bearish". As you can see in the second chart above SCDI performed very well during these months during stretches of the 80's, 90's and since the low in 2009. But what we are really comparing here is:

- Cumulative results

- Relative consistency

The question we are looking to answer is "when is the best time to allocate capital to the consumer discretionary sector. The data appears to answer that question. To wit:

- The 5 Favorable Months showed a gain 23 times that of All Other Months (+4,576% vs. +198%)

- The 5 Favorable Months had a significantly lower standard deviation of returns (10.1% vs. 14.9%)

- The worst drawdown during the 5 Favorable months was a manageable -16.5% (versus -68.5%)

- The 5 Favorable Months showed a 12-month gain 83% of the time

- The worst 5-year performance for the 5 Favorable Months was a gain of +5% (versus -47%)

Can we say with certainty that these 5 months will continue to see better performance ad infinitum into the future? Not necessarily. Still, investing is a lot about finding an "edge" and exploiting it as often as possible and for as long as possible.

For investors, ticker XLY (Consumer Discretionary Select Sector SPDR Fund) tracks the index used in the test with a correlation of roughly 0.998. Another alternative is ticker FSRPX (Fidelity Select Retailing Portfolio) which tracks the index with a correlation of roughly 0.94.