Attention Shoppers - Beware a Potential Markdown

Attention Shoppers. History suggests a 50/50 chance that the prices of your favorite retail and/or consumer discretionary stocks could be marked down soon.

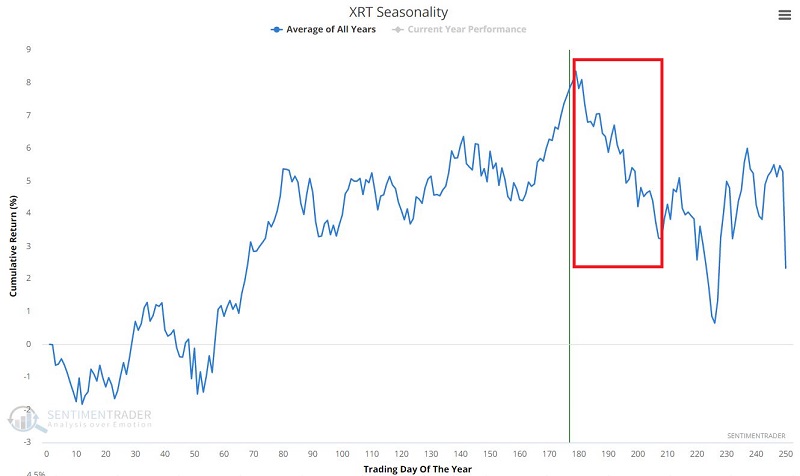

To wit, the chart below displays the Annual Seasonal Trend for ticker XRT (SPDR S&P Retail ETF). As you can see, we are entering a seasonally weak period.

RETAIL/CONSUMER DISCRETION SEASONAL WEAKNESS

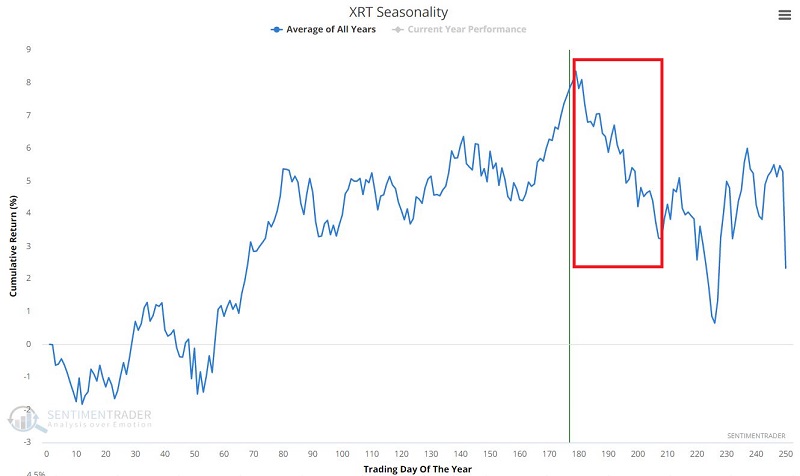

For testing, we will use the S&P 500 Discretionary Index (which contains many retailing-related stocks and has a high correlation to ticker XRT), going back to 1953.

Let's focus on the period extending from:

- The close on Trading Day of the Year #179

- Through the close of Trading Day of the Year #208

The chart below displays the year-by-year % return for the index during this period

Things to note:

- # of Times UP = 34

- # of Times Down = 34

- Average UP % = +4.9%

- Average DOWN % = (-6.3%)

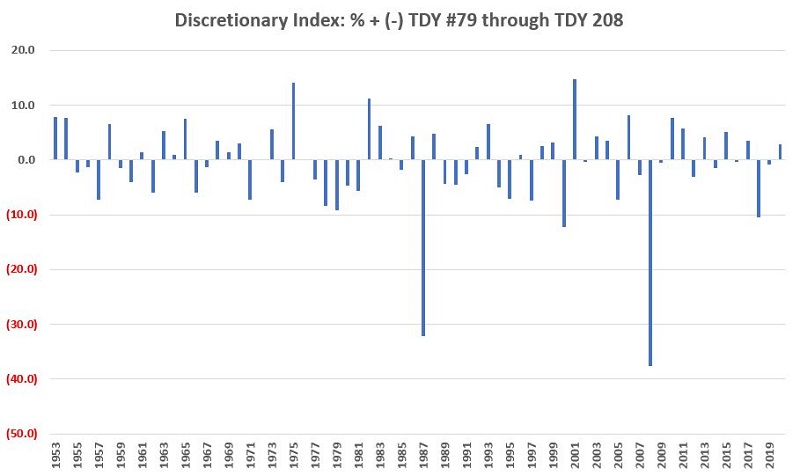

The bottom line is that whether this period shows a gain or loss is essentially a coin-flip (50% up, 50% down) on a year-to-year basis. However, the average losing period is worse than the average winning period. This explains the results in the chart below, which displays the cumulative % + (-) for the discretionary index during this "unfavorable" period.

The cumulative return for the discretionary index held ONLY from TDY 179 through TDY #208 every year since 1953 is -52%.

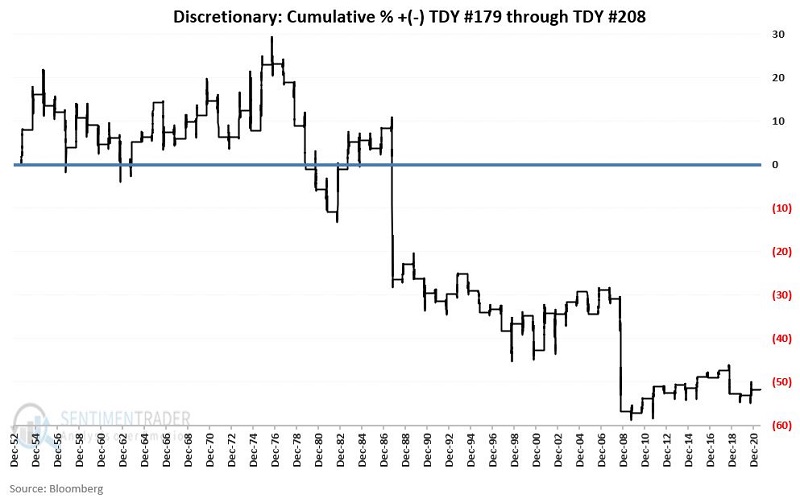

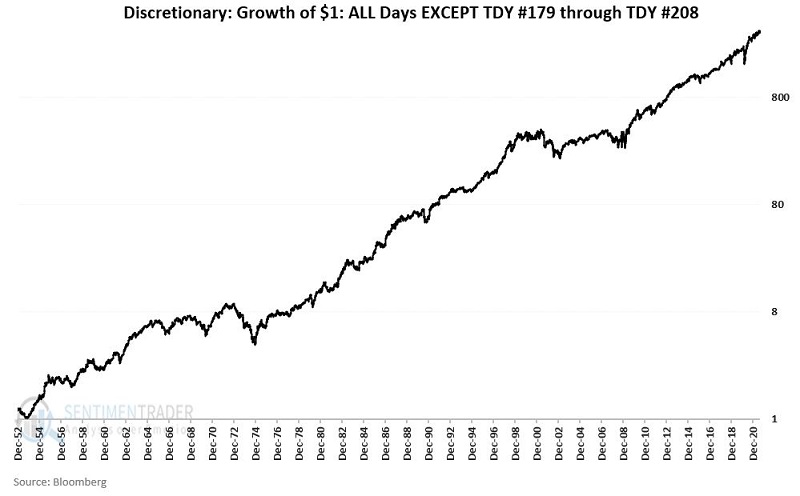

To put this into context, the chart below displays:

- A logarithmic chart

- The growth of $1 invested in the discretionary index if held during ALL OTHER DAYS of the year (i.e., excluding TDY 179 through TDY #208).

From January 1, 1953, through August 31st, 2021, the cumulative total return during these days was +160,300%.

SUMMARY

So far in 2021, the stock market has shrugged off all suggestions of anything that might be unfavorable for stocks. Will this run continue, or will the market's luck run out. As far as the retailing/consumer discretionary sectors go, history suggests the odds are 50/50 and that investors should be prepared for anything in the weeks directly ahead.