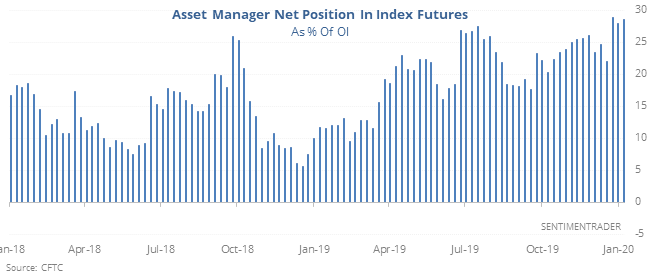

Asset Managers Have Record Exposure As Wall Street Favors Technicals

Asset managers at record exposure

Asset managers are now holding a net long position of nearly 30% of the open interest in major equity index futures, the most ever. While history is limited, other times they held a large amount of the open interest didn’t pan out so well for their bets.

The only dates that show a positive return over the next 1-2 months were the ones from last November. And to be fair, the jury is still out on those.

Overall, the sample size is relatively limited in terms of unique occurrences, but it’s another sign that there were a whole lot of folks who are a whole lot of leveraged.

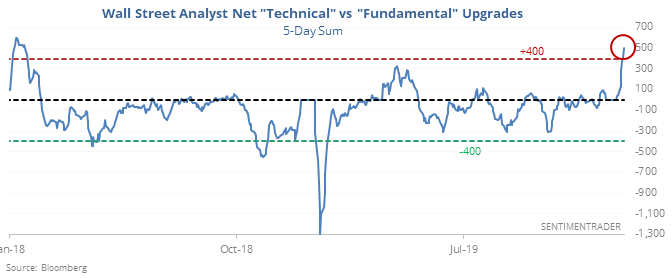

Analysts upgrade technicals, not fundamentals

Last April, we saw that Wall Street analysts were bullish on companies’ technicals but much less so on their fundamentals. Bottom-up sentiment like that was rare and had a tendency to lead to poor returns over the next 1-2 months, much worse than when analysts were fundamentally bullish and technical bearish.

They’re at it again.

The only time in nearly 10 years it’s been more egregious than now was as Q4 2017 earnings reporting season was beginning in early January 2018. That did not work out well for all those price target upgrades.

The only time in nearly 10 years it’s been more egregious than now was as Q4 2017 earnings reporting season was beginning in early January 2018. That did not work out well for all those price target upgrades.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Long-term momentum on high-yield bonds is nearing a record

- There has been a surge in new highs among junk bonds, too