As tech indexes rally, participation starts to wane

Finding fault with the rally in tech has been difficult, as it has powered higher with decent participation (shorter-term, anyway). About the only warning signs have come from "too far, too fast" types of measures, and even those haven't been consistent warning signs.

As pointed out on Twitter, though, there are some emerging signs that participation among these stocks is lagging. We saw on Wednesday that when looking at an equal-weight index of the largest tech stocks, their relative performance just hit a new low.

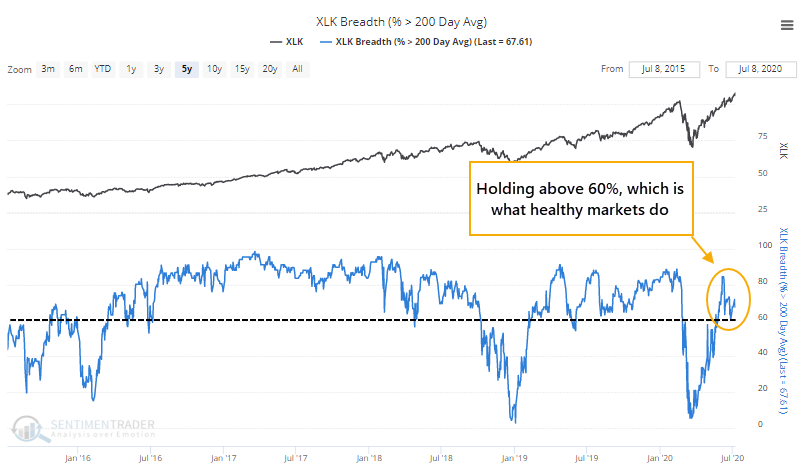

On the plus side, while the broader market continues to show signs of being unhealthy longer-term, that's not evident in tech. More than 60% of these stocks are holding above their long-term 200-day moving averages, which is what we see during healthy market environments.

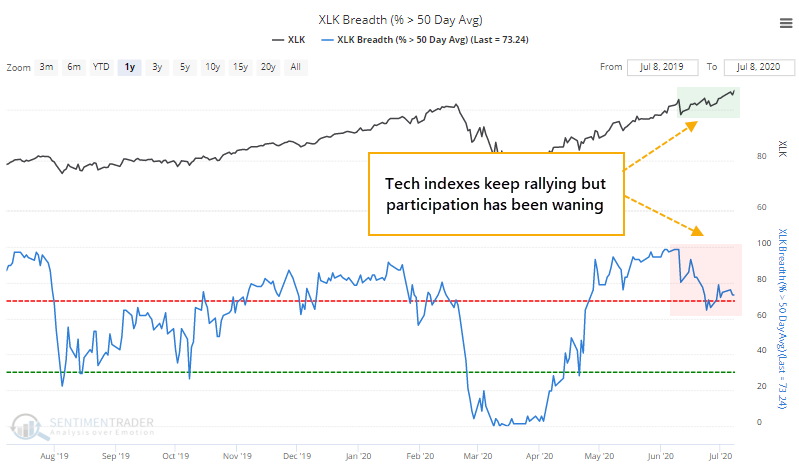

The potential trouble is over the medium-term. Despite new highs virtually every day in funds like XLK, the percentage of members in the tech sector that are holding above their 50-day averages is dropping and is well of the highs.

More than 95% of tech stocks were above their 50-day averages a month ago, and now fewer than 75% of them are.

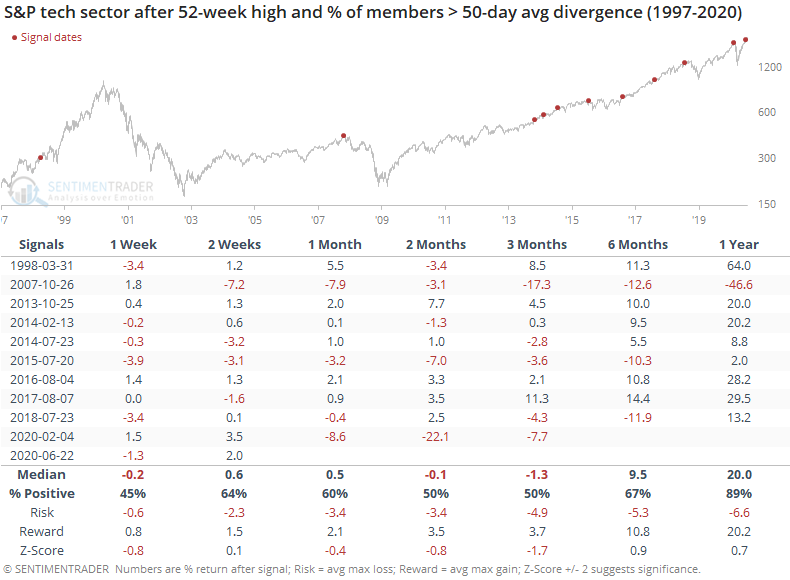

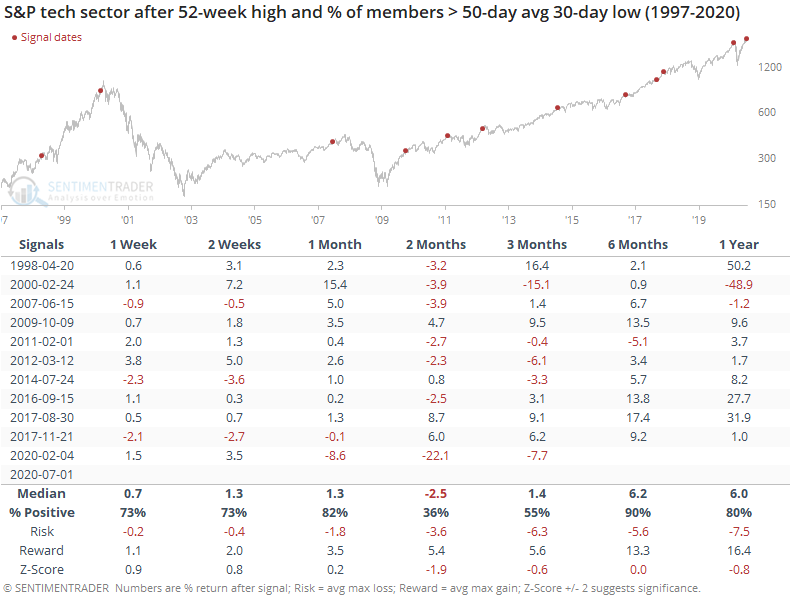

When the tech sector hit a 52-week high and the percentage of its members above their 50-day average was more than 20% below the peak, we can see what happened going forward in the table below.

This was an effective warning sign at a few peaks (2007, 2015, 2018, 2020), which would have saved us from pretty drastic declines in the months ahead. Unfortunately, it also failed as a warning multiple times. About the worst we can say is that 7 out of the 10 signals showed a negative return in tech stocks somewhere between 1 - 3 months later.

The percentage of members above their 50-day average has been dropping for a while, and the 10-day average of this indicator has hit a 30-day low. Again, this kind of divergence has preceded some troubles over the next couple of months.

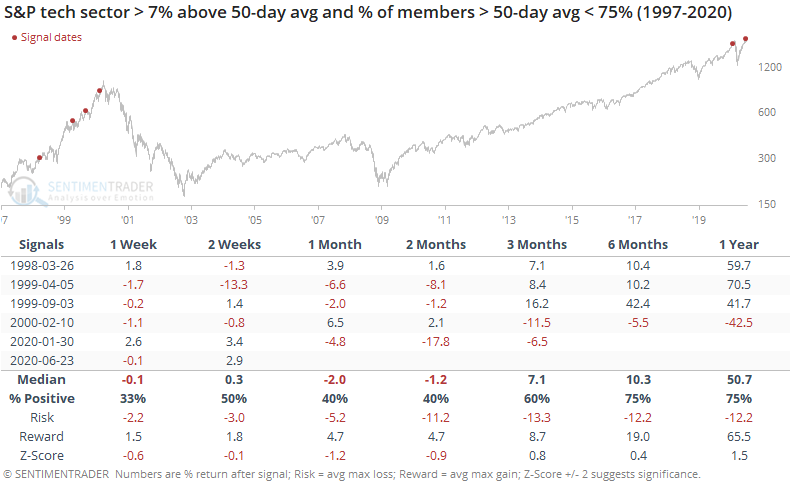

It's also notable that tech stock indexes are nearly 10% above their 50-day averages, and yet fewer than 75% of members are above their own averages by any amount. This kind of stark difference was rare, only triggering during the lead-up to the bubble peak, and again in January of this year.

There is certainly a chance that tech can shrug off this potential warning in the weeks ahead. Maybe participation will turn around and further fuel the rally. Historically, that has not happened, and the major tech indexes have dropped in order to catch up with the declining participation of the stocks. We'd consider this a minor warning here.