As Small Traders Gamble, Hedge Funds Buy Protection

Speculative options activity is near records, but somebody, somewhere, is hedging against a big fall.

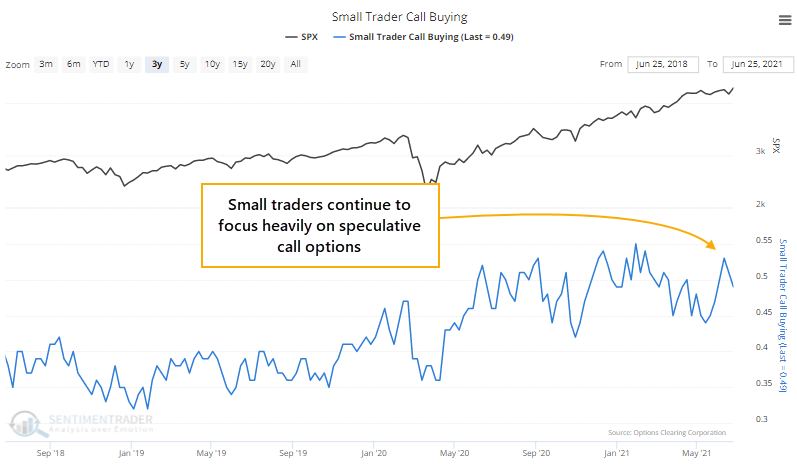

A couple of weeks ago, we saw that options volume was exploding to the speculative side again, with few indications of hedging activity anywhere. That hasn't changed much, with small traders still focusing nearly 50% of their total volume on buying call options to open.

That's down a bit from the recent peak but still among the highest readings in over 20 years.

SOMEBODY IS HEDGING...MAYBE

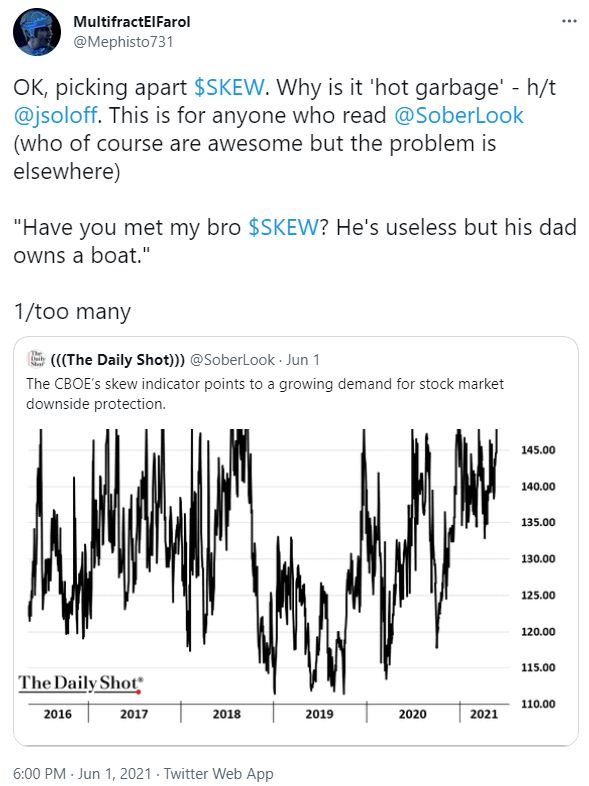

At the same time, there is a big spike in the SKEW Index. According to Cboe, "SKEW is a global, strike independent measure of the slope of the implied volatility curve that increases as this curve tends to steepen."

Yeesh. Their whitepaper goes even further into the weeds on its construction, but it has been dumbed down since its introduction in an attempt to rival the VIX as the "fear index." At its core, it tries to measure the price of far out-of-the-money puts versus calls, with high readings suggesting a higher probability of a crash-type event within the next 30 days.

Now, there's a lot wrong with this index and this approach. Some awfully smart folks have torn it apart, and this Twitter thread is as good of a schooling as any, so if you care about why you might NOT want to put a lot of weight on SKEW, check it out.

Let's ignore the issues and take it for what it's supposed to be. We'll assume that a high SKEW reading suggests that somebody, somewhere, is willing to pay a pretty penny for some protection against a larger-than-average and imminent decline.

So, what we have right now is a bunch of the smallest options traders in the market betting heavily that stocks are going to keep soaring, at the same time that (probably) sophisticated (probably) hedge funds are (probably) betting on a quick, big drop.

RETURNS WHEN SMALL TRADERS BULLISH, HEDGE FUNDS BEARISH

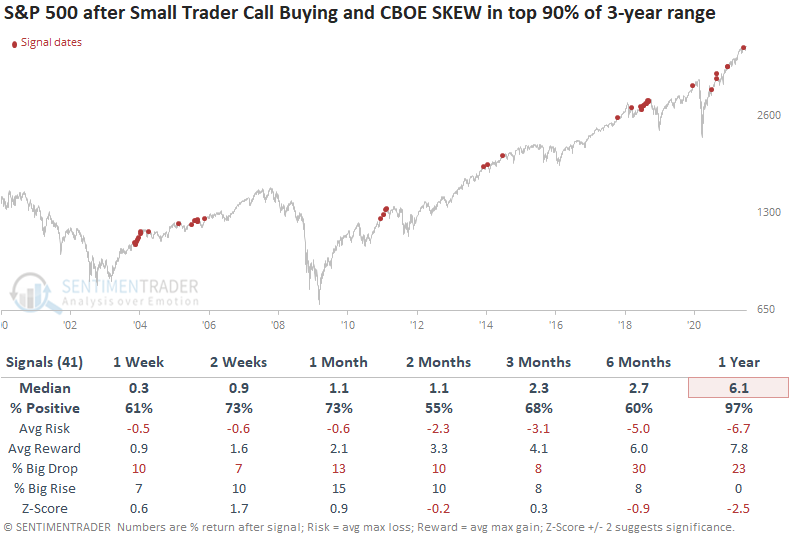

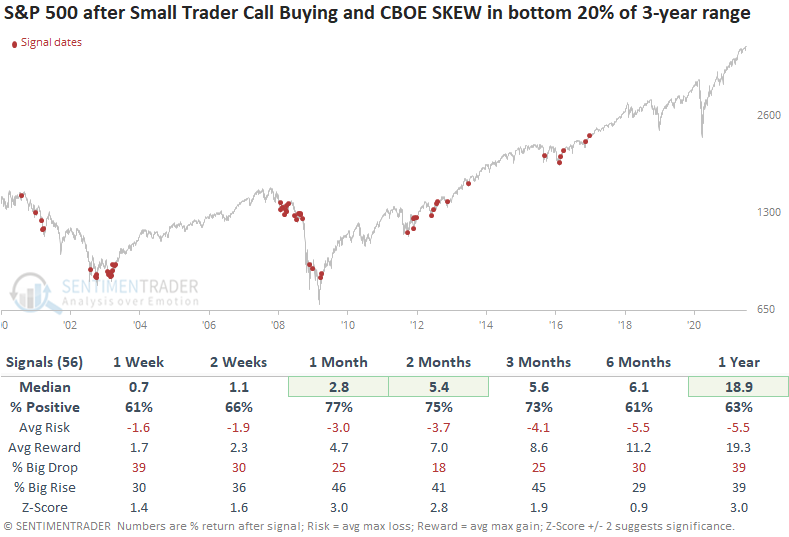

The table below shows every time in the past 22 years when small traders' call buying activity and the SKEW index were both in the upper 90% of their 3-year ranges at the same time.

This was not necessarily a sign that we should sell everything and prepare for a crash. Across all time frames, the S&P 500 rallied more often than it declined. What it was a sign for, however, was mediocre returns.

While the timing was inconsistent, if stocks did continue to grind higher, most of the time those gains were given back during a subsequent pullback. Over the next three months, there was about an equal probability of seeing at least a 5% decline as there was a 5% rally. Even up to a year later, risk and reward were about even, which is not a great performance given most of the study period was dominated by bull markets.

If we look at the opposite scenario, when both small trader call activity and the SKEW were near the bottoms of their ranges simultaneously, it was a better setup for stocks.

So, what's the point with all this - is it a reason to worry about the next month or so?

Uhh...maybe? An uncertain adverb with a question mark is about the highest conviction we could have given the concerns shown above and the inconsistent timing with future declines. It is definitely a concern that small traders of highly leveraged, expiring instruments are so confident in stocks, and it's probably a concern that SKEW is high as opposed to low. Taken together, that hasn't been a great setup for stocks.