As Nasdaq indexes rallied, oddities have risen

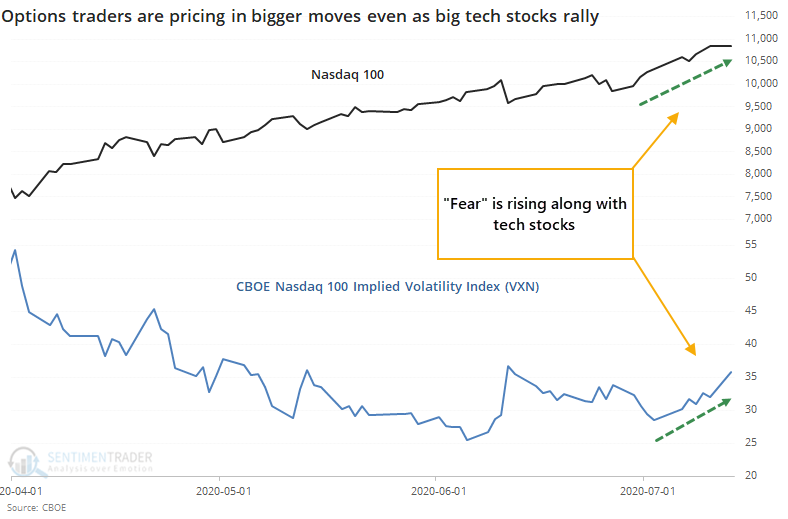

At the end of 2016, we looked at what had become yet another odd market development. Stocks were rising, and so was the VIX "fear gauge." That is based on options traders' anticipation of future volatility, and in the stock market, volatility = lower prices with a high degree of consistency.

We entered a historic momentum market soon after that, which rolled over the slight negative implications of the S&P's positive correlation to the VIX. Maybe we're on the cusp of the same thing now, as Jesse Felder notes that it's happening in tech stocks.

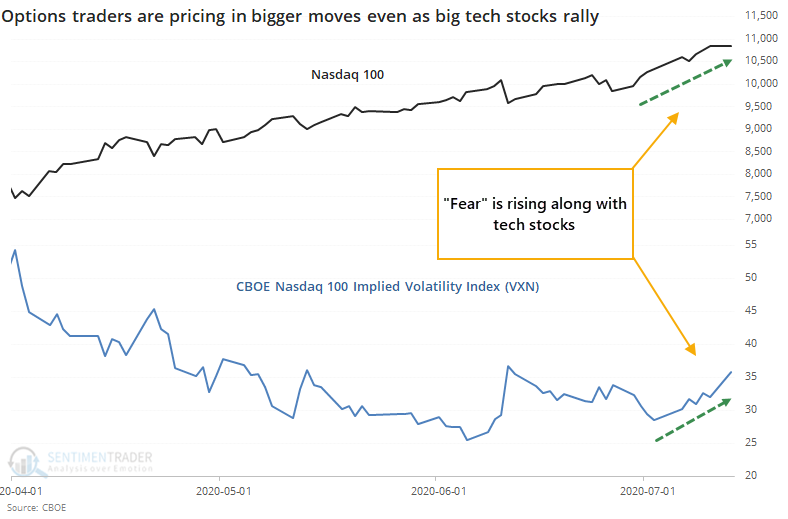

The Nasdaq 100 (NDX) is hitting new highs, but options traders are pricing in more volatility as we enter earnings season, with the NDX's version of the "fear gauge" (the VXN) rising in recent days. Entering Monday afternoon, the NDX was up more than 1%, and the VXN was up by more than 8%. That had never happened before.

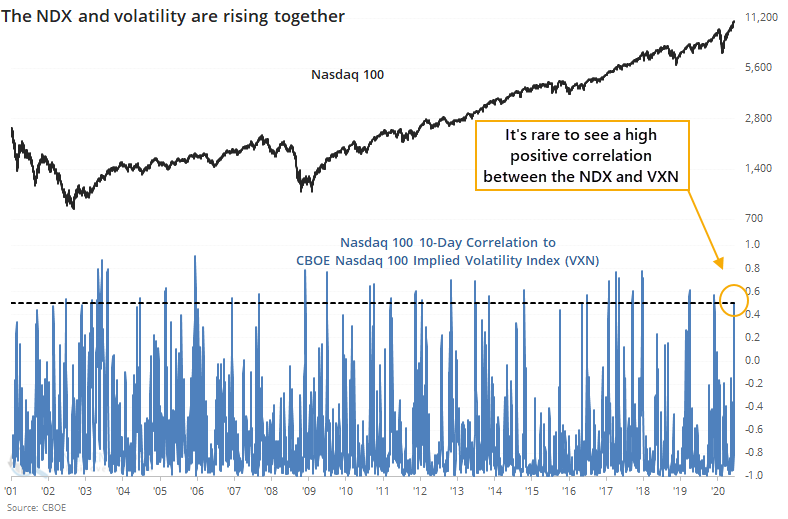

This behavior has pushed the correlation between them well into positive territory.

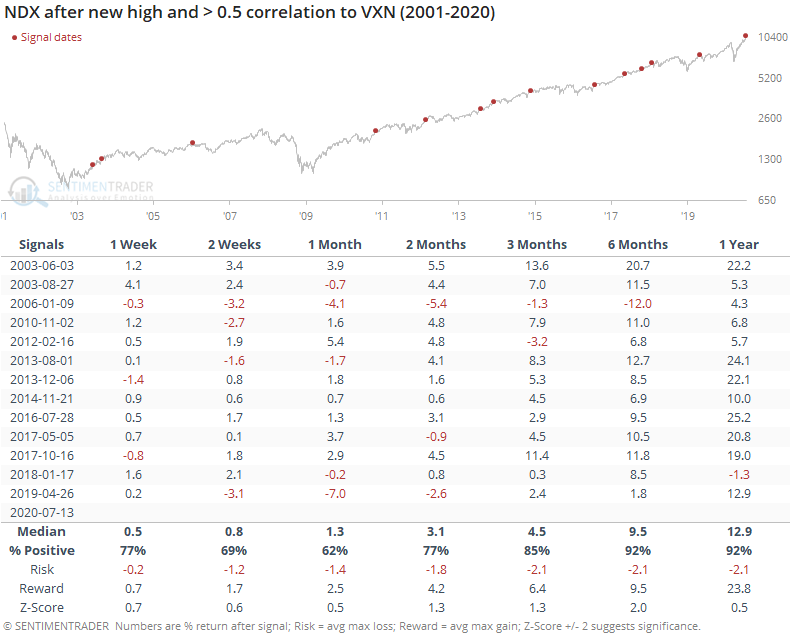

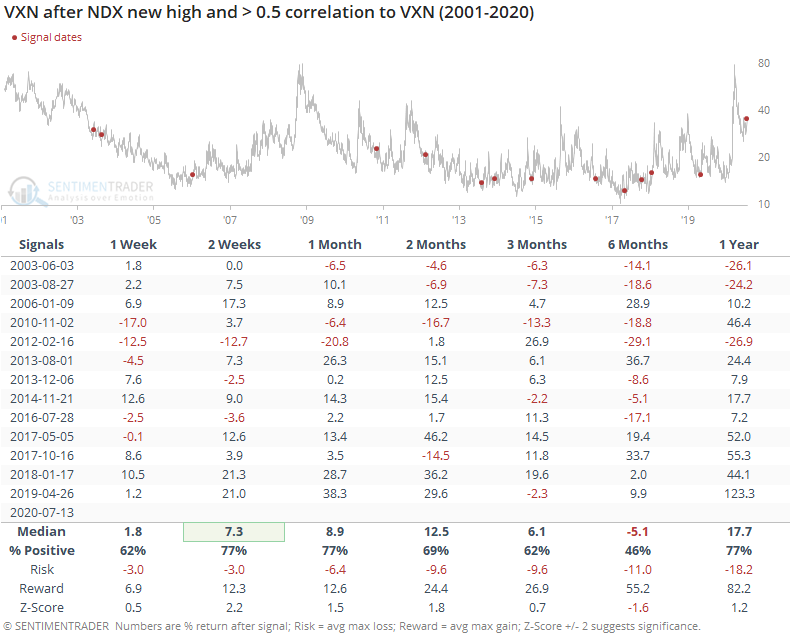

A high positive correlation between the NDX and VXN hasn't meant much for big tech stocks going forward, especially over the next 3-6 months, although the last two both preceded some shaky price action.

In the short-term, volatility continued to rise as the VXN typically jumped over the next 2-4 weeks.

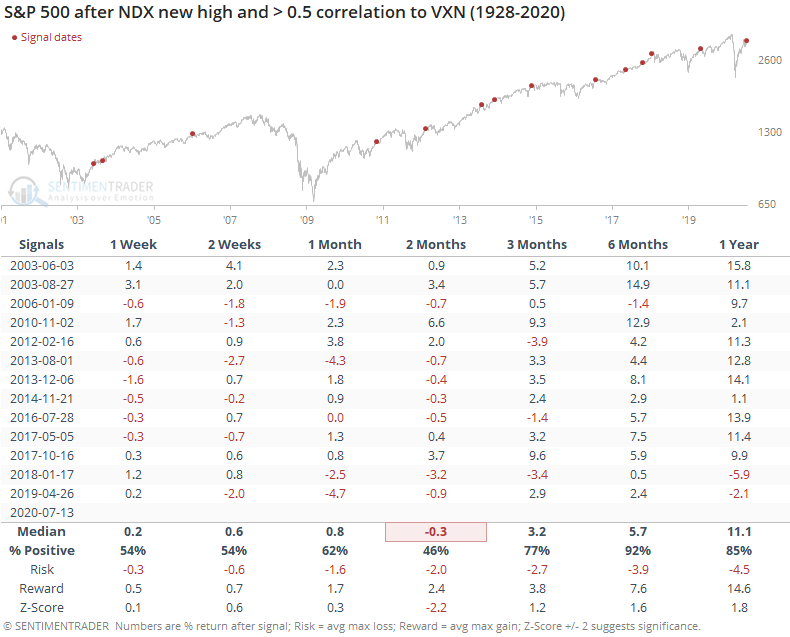

For the broader market, it was more negative. Over the next two months, the S&P 500 showed a well-below-average return, and a poor risk/reward ratio.

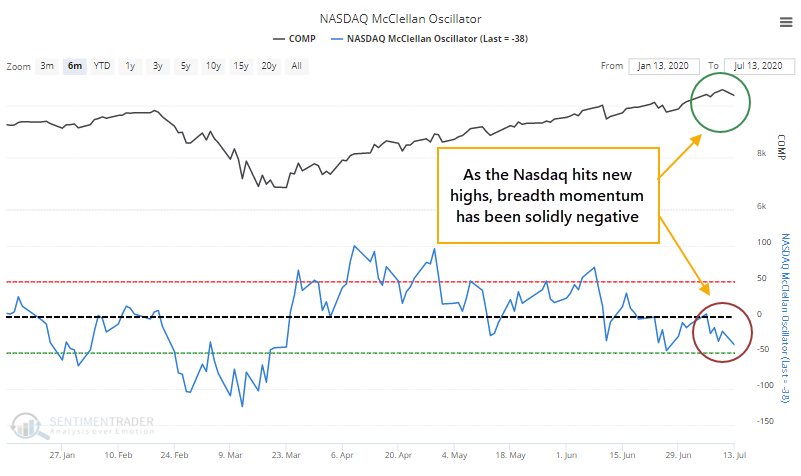

It's also odd that even while the Nasdaq Composite was setting record highs, momentum in breadth underlying that market has been poor. The McClellan Oscillator for the Nasdaq was below -25 even as the index was setting new highs.

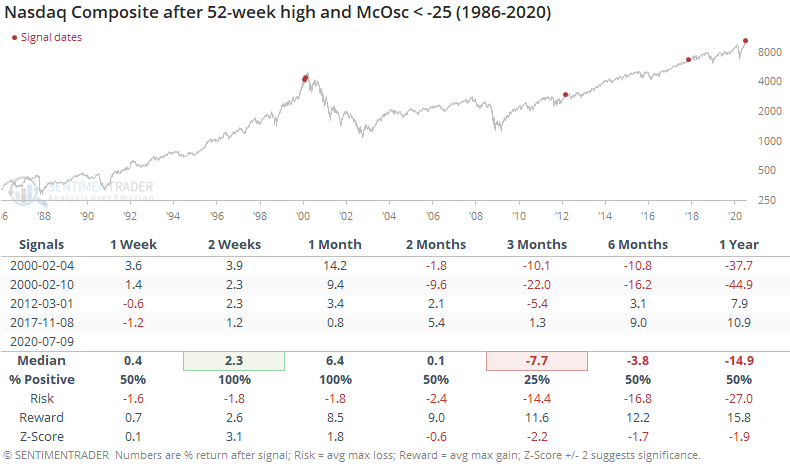

That's only happened four other times since 1986. It certainly was not a good reason to sell tech stocks immediately, as the Composite added to its gains over the next 2-4 weeks. But those rallies also all ran into some trouble in the month(s) after that.

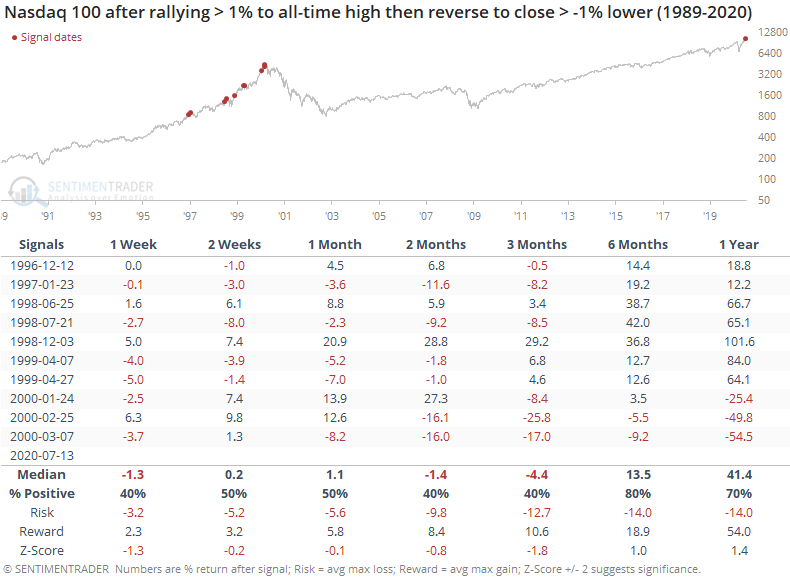

This is a little more troubling given Monday's rejection of a record high in the bigger tech stocks. As noted in yesterday's report, the Nasdaq 100 rallied more than 2% to an all-time high, only to reverse and close down by more than 1%. The only other day when that happened was March 7, 2000. Looking at smaller reversals, the tone over the next 2-3 months was still generally negative.

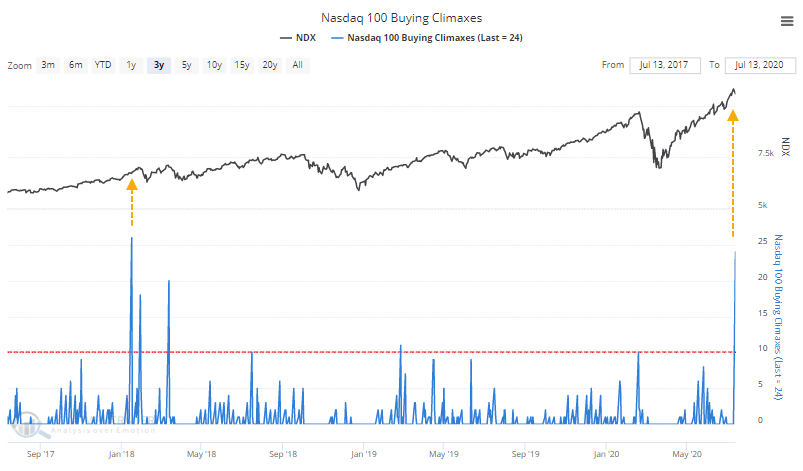

The reversal in the Nasdaq 100 coincided with the 2nd-largest number of buying climaxes in those stocks as well. Only early 2018 had more.

Overall, none of these oddities suggest an immediate worry. They're more of an environmental concern. The run in these stocks has been historic, and the momentum in many stocks underlying the move in the indexes is waning. Combined with reversals in some of them as we saw on Monday, it's a heads-up that we're unlikely to see them continue to run higher uninterrupted.