As metals soar, safe-haven correlations are breaking down

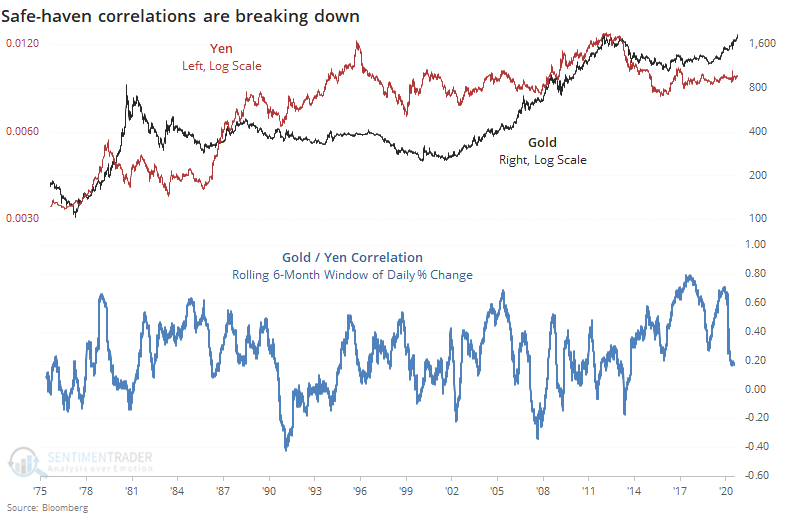

The correlation between two of the more reliable safe havens has been wobbling.

Normally, during times of duress, the price of gold and the exchange rate of the Japanese yen mostly move together. Lately, however, that has been breaking down, leading to the lowest 6-month correlation in five years.

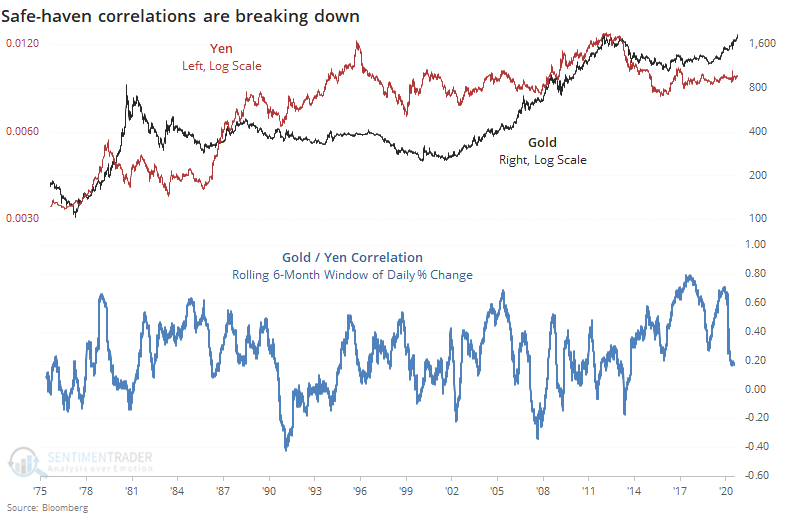

This is often considered a sign that inflation is about to do "something". Depending on who you ask, this either means that inflation is about to spiral out of control...or not. People tend to get an almost religious zealotry about things like this.

Historically, it hasn't necessarily meant much in terms of the growth in the U.S. rate of inflation.

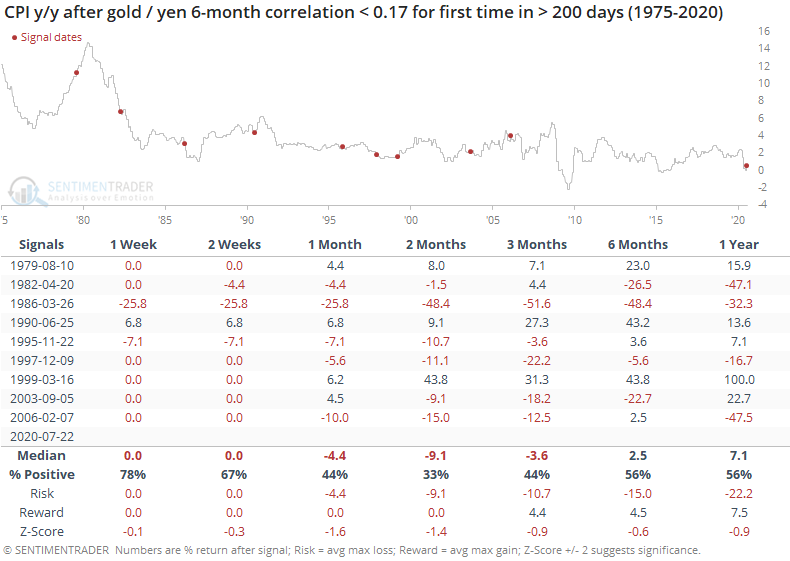

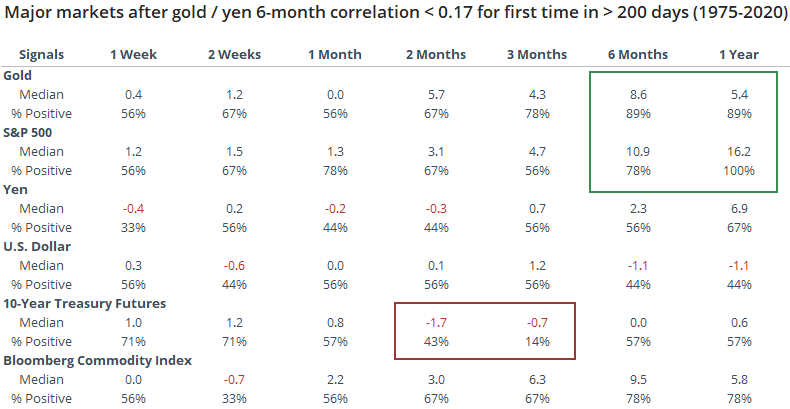

Looking at forward returns across major markets, they were good over the next 6-12 months in stocks and gold, while others were mostly mixed. The big standout was 10-year Treasury note futures. Over the next 2-3 months, they consistently declined as interest rates rose, even if the rate of inflation didn't consistently increase.

When this "something" was driving gold and not the yen, gold had a consistent tendency to rise from three months and beyond. The factors we outlined a month ago are still pretty much in place but a couple have reached points that are more troubling for the near-term.

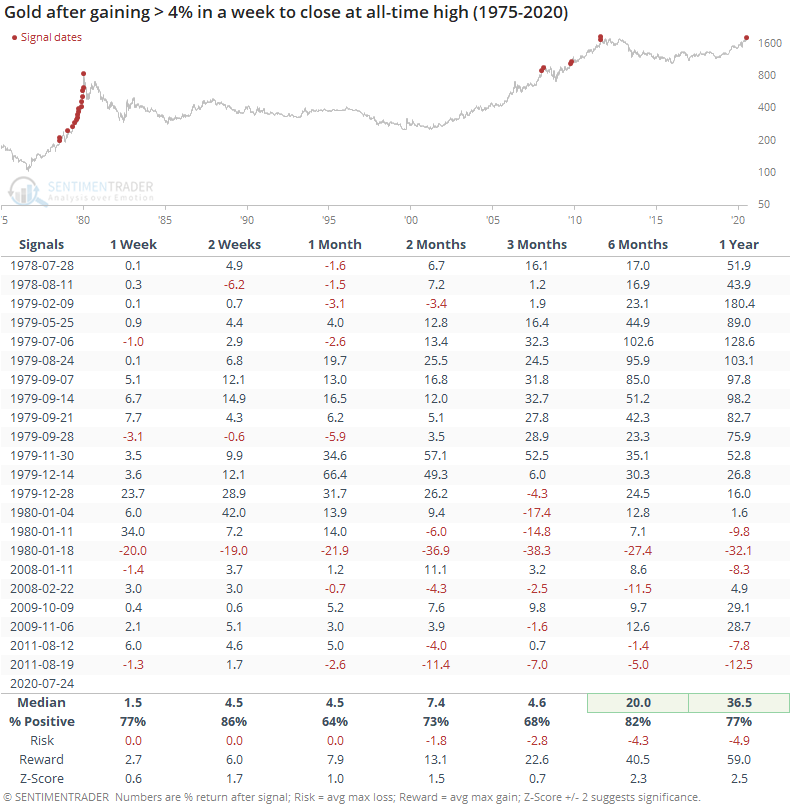

Regarding its momentum, it only continues to build. The metal is on the cusp of rising more than 4% during a week it will close at an all-time high (using weekly closing prices of the XAU index from Bloomberg).

Most of this kind of rise occurred during the tremendous run-up in 1979-80. It triggered a handful of times during the run in the 2000s, and those had much more of a tendency to give back short-term gains. Of the signals that triggered since 2008, all of them showed further gains over the next couple of weeks, but also all but one of them fell back in the months ahead.

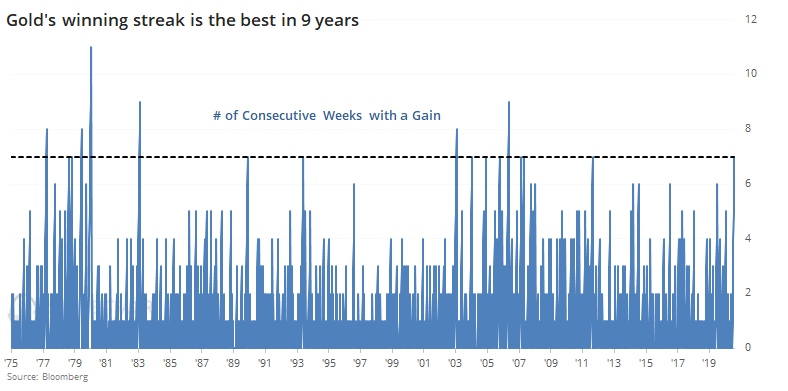

Also troubling is that this is gold's 7th straight week of gains, the most in 9 years.

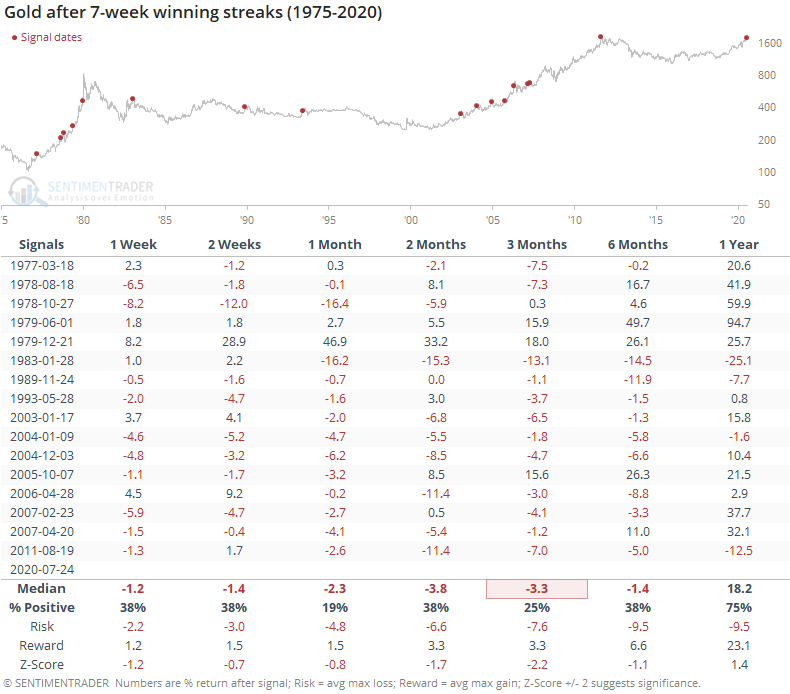

By the time it enjoyed this much momentum, it rarely led to further gains in the weeks and months ahead.

Outside of the late 1970's run-up, every single signal showed a loss over the next month. Only one of them showed a gain even three months later.

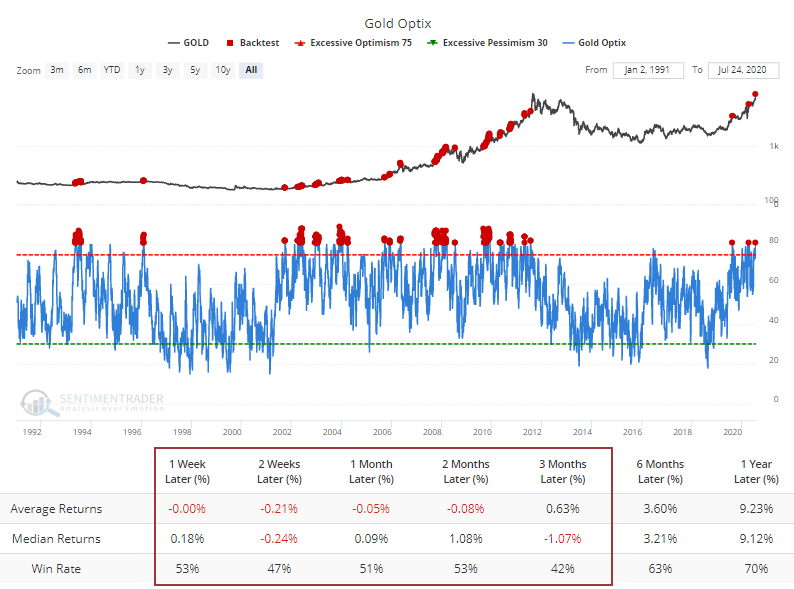

Also worth noting is that sentiment has become stretched again. The Optimism Index on gold just popped above 80, which the Backtest Engine shows has led to weak short- to medium-term returns. This is a change from the last note when it wasn't quite high enough to precede average negative returns or a win rate below 50%.

The run in both silver and gold has been impressive, and perhaps there are structural forces that will continue to push them higher, no matter historical precedent or stretched sentiment. That's always a bet on "this time is different", which we're loathe to do because it rarely is. Especially on a short- to medium-term time frame, the risk on gold (and silver) has risen to a high level.