As Good a Time as Any for Commodities to Cool Off (and What it Means if They Don't)

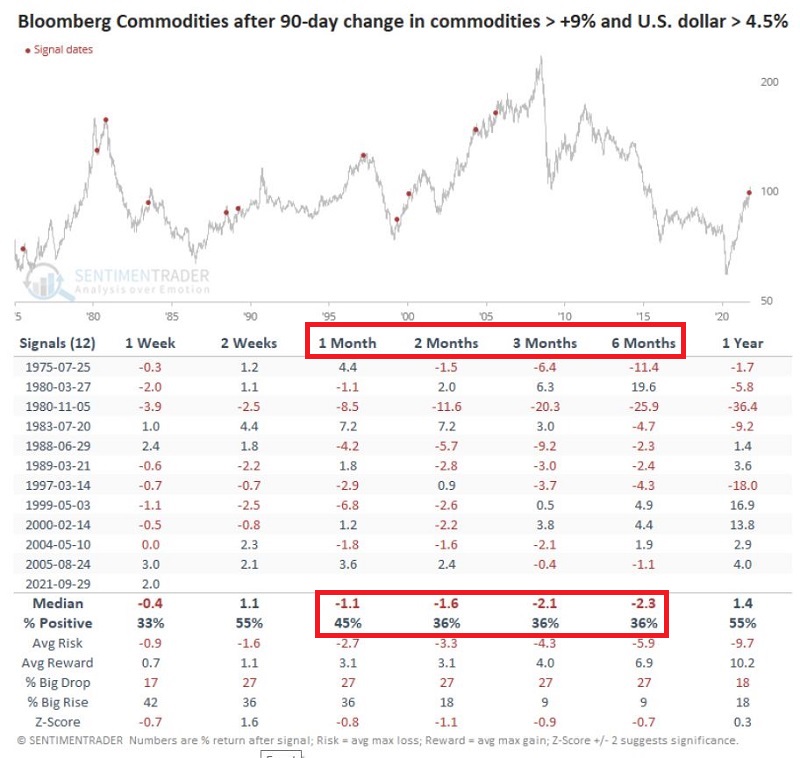

Commodities as an asset class have enjoyed a tremendous run in the past year or so. They have also reached a point where a pause in the torrid rate of advance is quite possible. A quick look at the chart below from Jason's recent article tells the story pretty clearly.

So, the obvious question is, "Will this rally continue unabated, or is a cooling-off period in the offing?" As we will detail in a moment, there is reason to believe that commodities will cool off in the not-too-distant future. But first, let's talk a little bit of real-world trading.

So, the obvious question is, "Will this rally continue unabated, or is a cooling-off period in the offing?" As we will detail in a moment, there is reason to believe that commodities will cool off in the not-too-distant future. But first, let's talk a little bit of real-world trading.

HOW MARKETS TOP

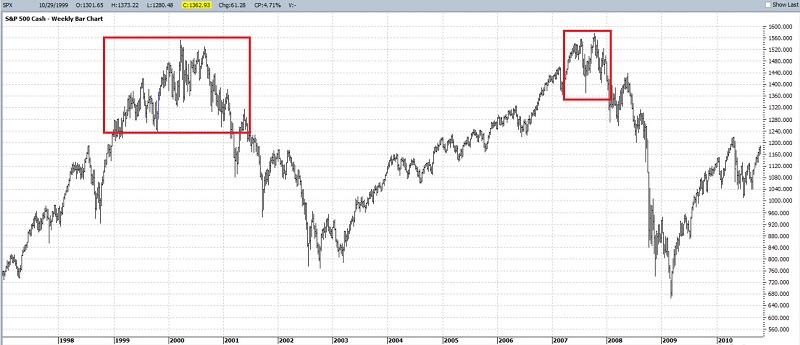

Historically, one difference between the broad stock market and commodities markets, in general, is how they typically put in a top. Historically, the stock market tends to move sideways (often referred to as "churning") for a period of months as internal market breadth deteriorates before embarking on a major market decline.

In the chart below, you can see that the S&P 500 Index went through a choppy, sideways period of churning before both the 2000-2002 and 2008-2009 bear markets began to decline in earnest.

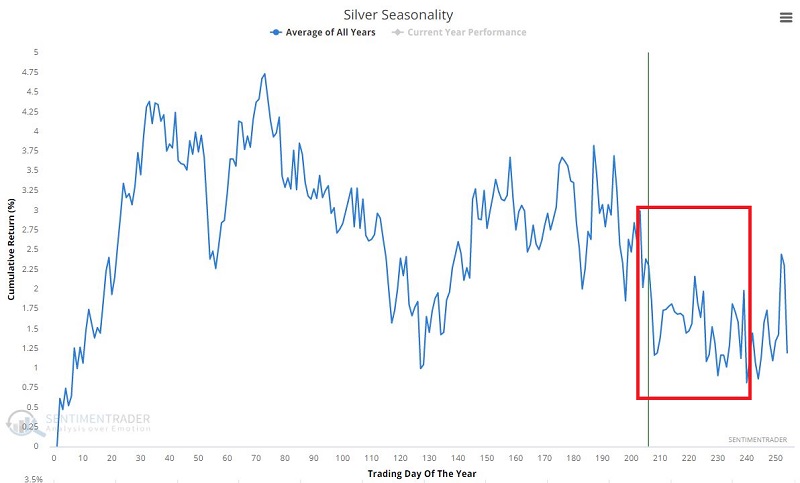

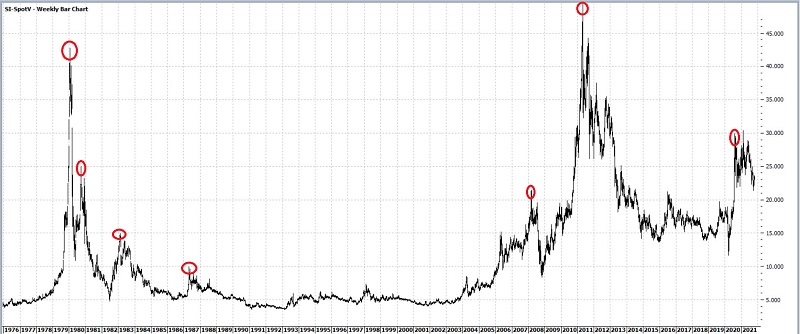

On the other hand, commodities have a history of moving straight to a top and then reversing lower almost on a dime. A classic case in point can be seen in the silver market in the chart below. On several occasions, this market has soared "rocket ship" style for many months - leaving more than a few bankrupt bears in its wake - before turning quickly and heading sharply lower without looking back.

On the other hand, commodities have a history of moving straight to a top and then reversing lower almost on a dime. A classic case in point can be seen in the silver market in the chart below. On several occasions, this market has soared "rocket ship" style for many months - leaving more than a few bankrupt bears in its wake - before turning quickly and heading sharply lower without looking back.

Trying to pick a top in commodities is a dangerous game to play.

Trying to pick a top in commodities is a dangerous game to play.

- A commodity can run in price to an absurdly high level before running out of steam

- That said, a trader looking to play the short side in commodities needs to be prepared to act quickly

COMMODITIES IN THE NEAR-TERM

The severely overextended nature of commodities prices in general, combined with a host of unfavorable seasonal trends set to exert whatever effect they may have soon, suggests that commodity traders should be alert to a potential cooling-off period.

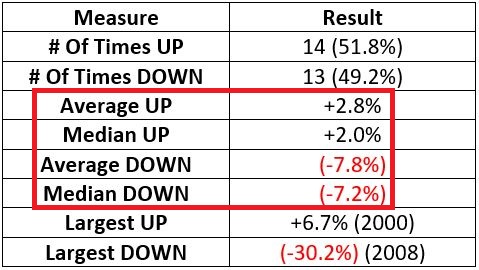

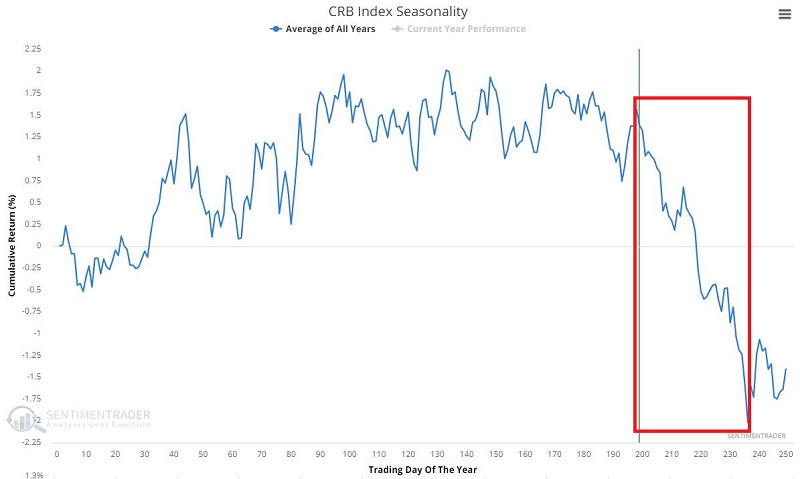

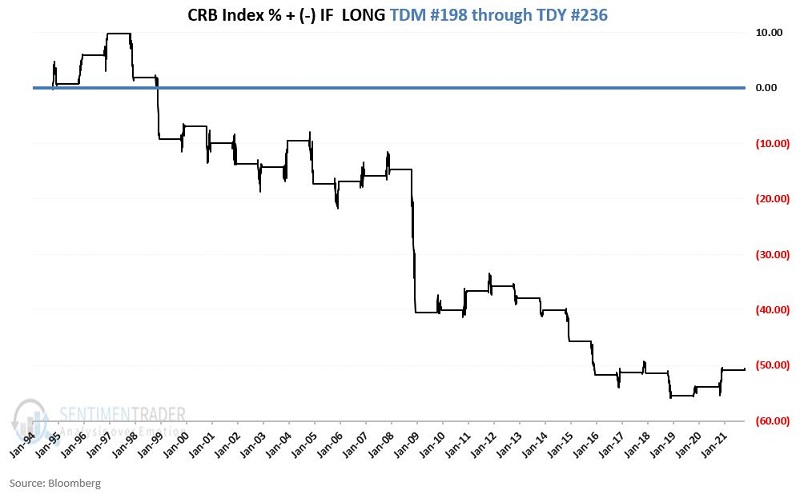

First, let's look at commodities as an asset class in aggregate. The CRB Index tracks a basket of commodities. The chart below displays the Annual Seasonal Trend for the CRB Index. As you can see, it has just entered a seasonally "unfavorable" period.

- Whether or not the CRB rises during this period is essentially a coin flip

- However, the average decline is dramatically larger than the average advance

Does this mean that commodities are sure to pull back in the months ahead? Not at all. Seasonality is only one factor that affects commodity prices. As you can see above, year-to-year results can be quite random.

What the charts and tables above tell us:

- IS NOT that commodities are sure to pull back in the weeks ahead

- IS that if commodities are going to pull back, now would be as likely a time as any

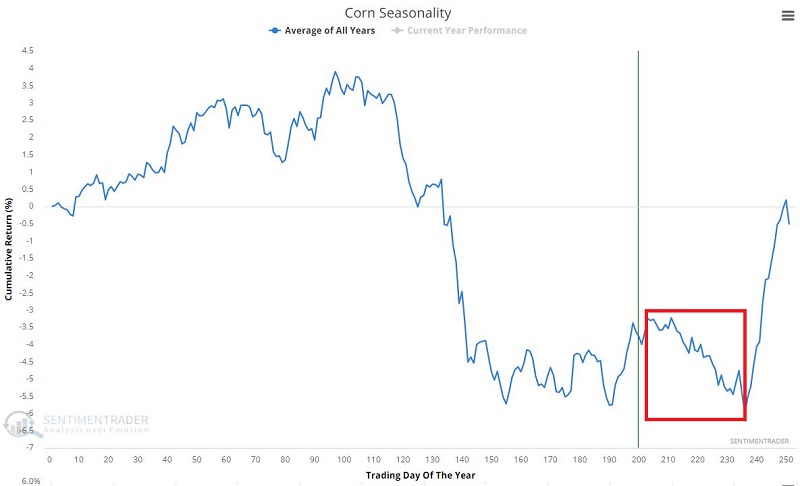

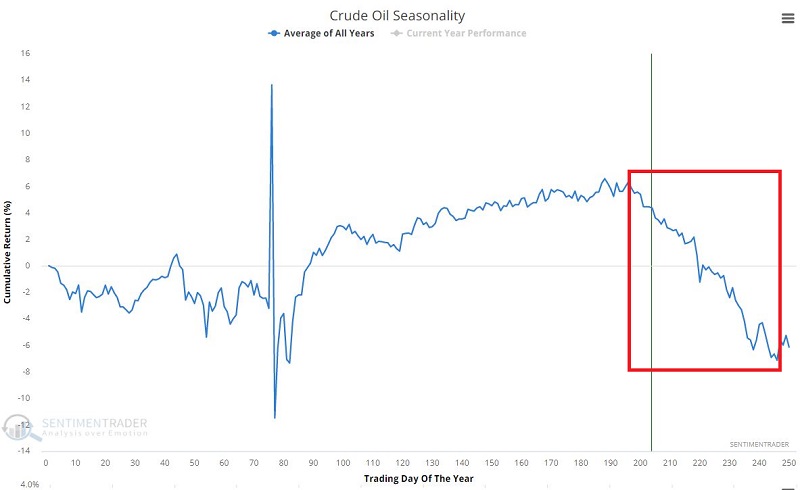

SEASONALITY ACROSS THE COMMODITY SPECTRUM

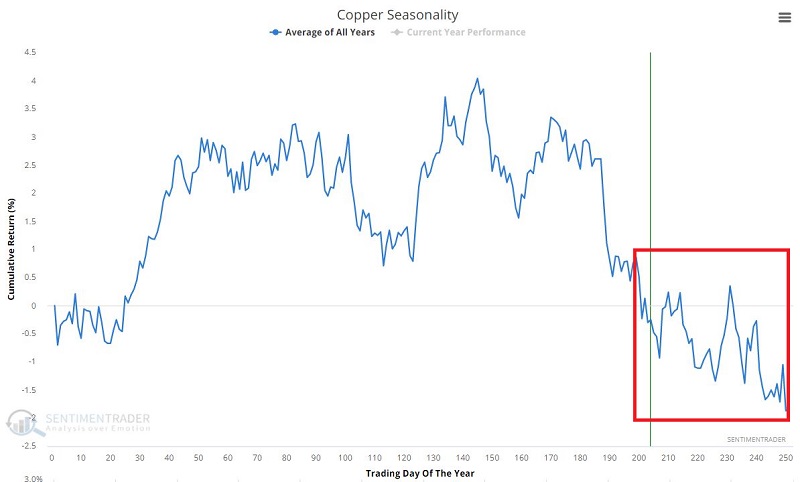

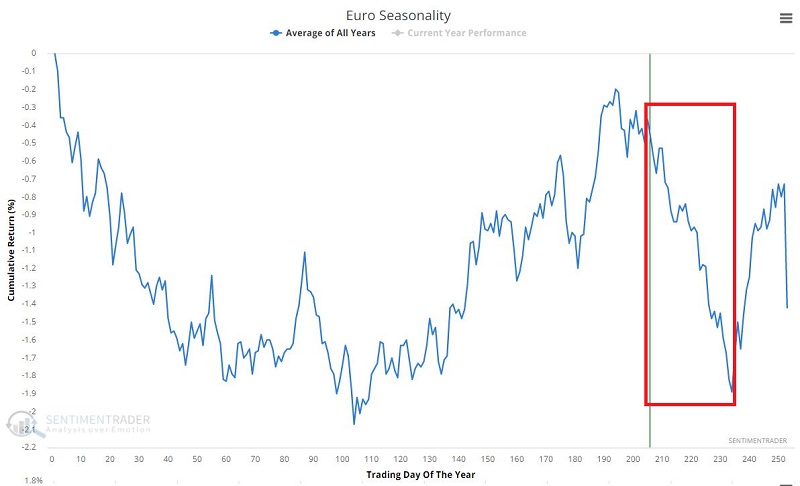

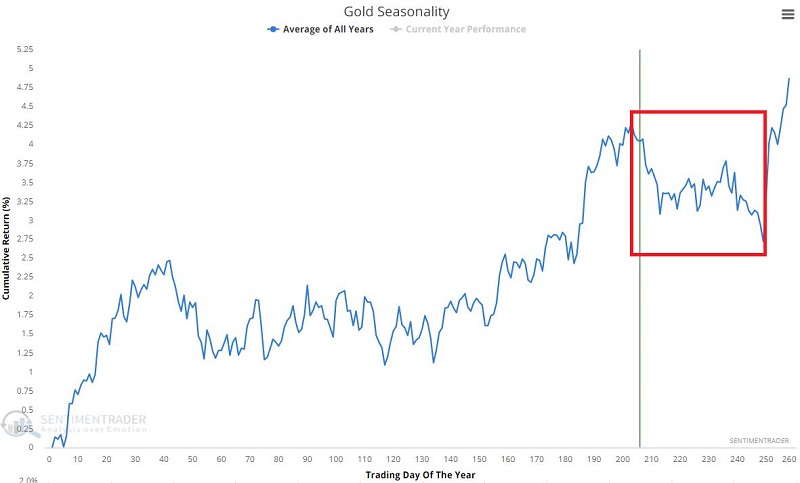

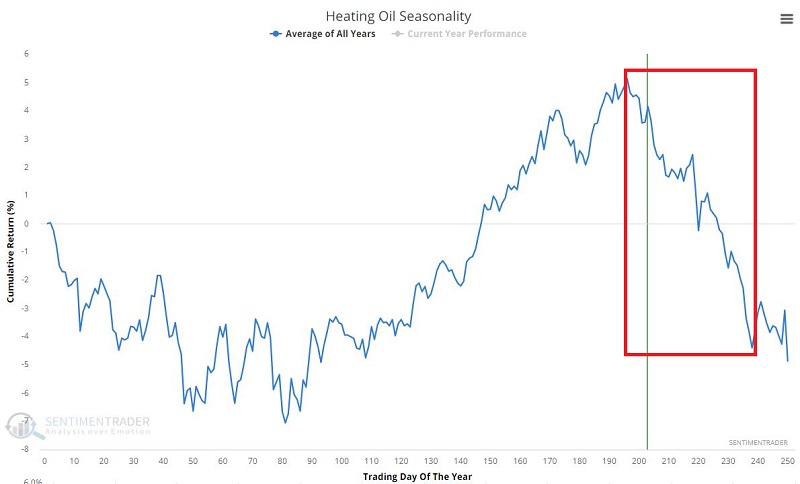

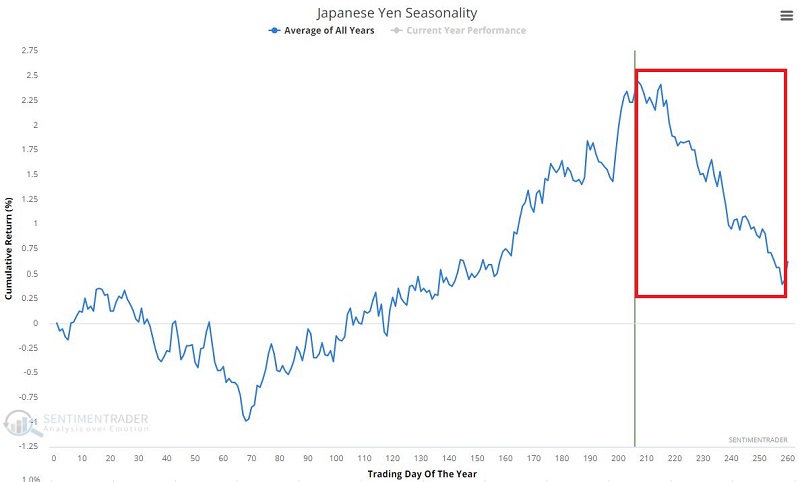

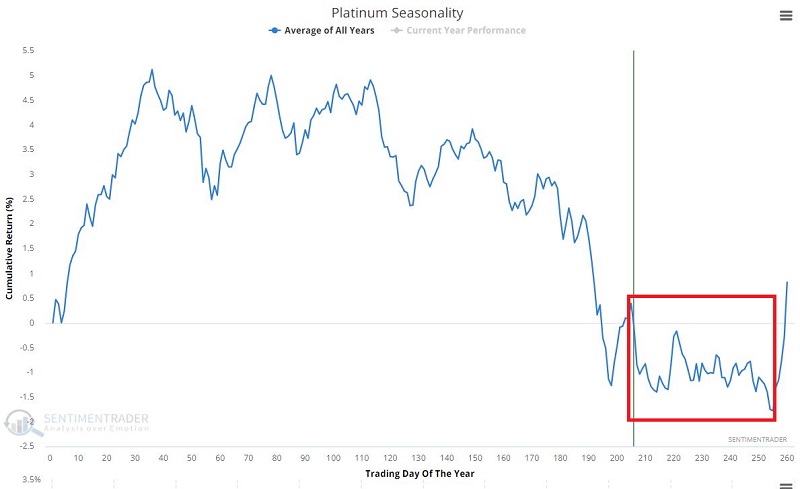

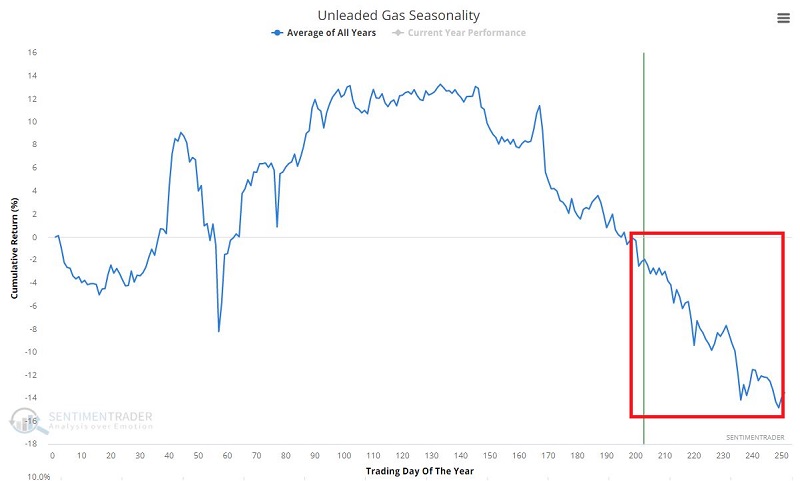

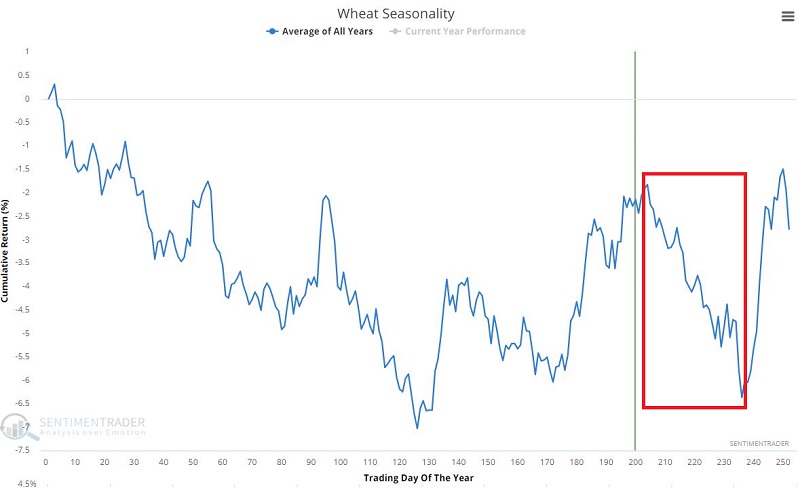

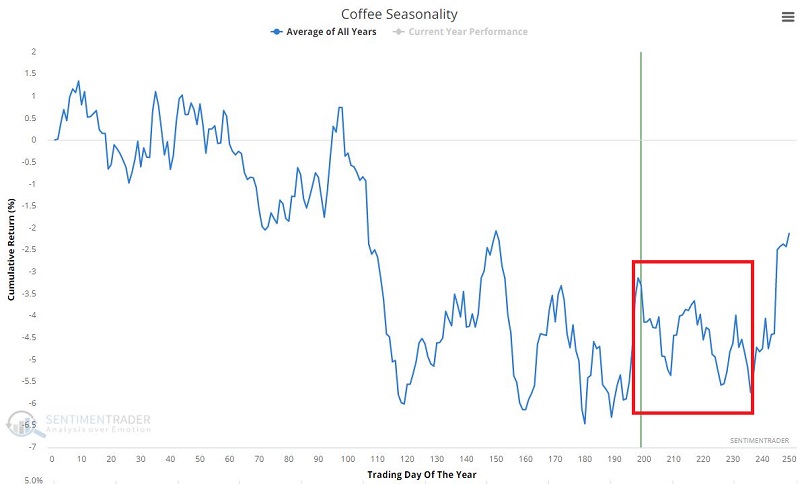

The CRB Index is intended to represent commodities as an asset class. But to further illustrate why this may be a time to expect commodities to cool off, let's look at the Annual Seasonal Trend for a variety of individual commodities. The key thing to note is the sheer number of individual markets in - or that will soon be entering - a seasonally "unfavorable" period.

SUMMARY

The information above argues that commodities may be about to cool off for a little while. However, it is also important to ponder what it means if they DO NOT. It may mean that inflation is NOT "transitory" as we are told by the powers that be and that inflation is exerting - and likely will continue to exert - a much stronger influence on prices than previously believed.

Investors and traders are encouraged to keep a close eye on commodities in the months ahead, not only for trading opportunities but for important clues regarding the likely future direction of inflation.