Approaching New Highs on Negative Breadth

Since the peak of the speculative orgy in February, we've been watching for major internal deterioration in the indexes. There were short bursts of unusual behavior in the months following that peak, but stocks immediately recovered.

There were more pronounced divergences during June and July, such as with the percentage of stocks holding above their 50-day moving averages. And with subsequent push to new highs, sentiment was becoming less and less enthused. Knee-jerk contrarians may take that as a positive thing, but stocks need buyers to be ever more optimistic to sustain an advance.

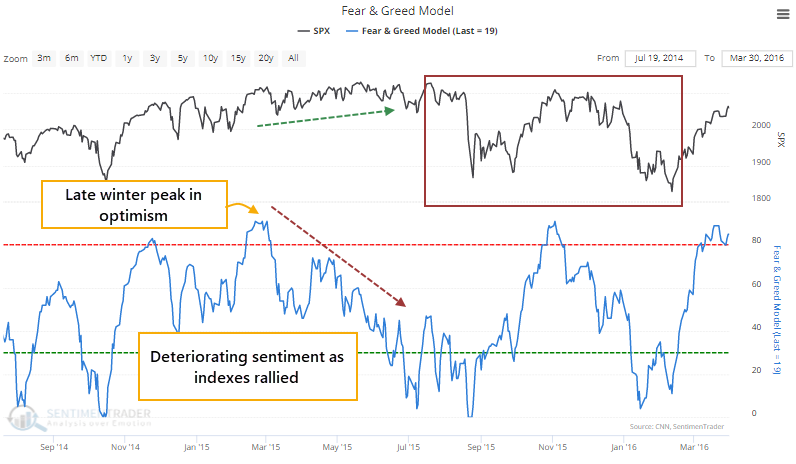

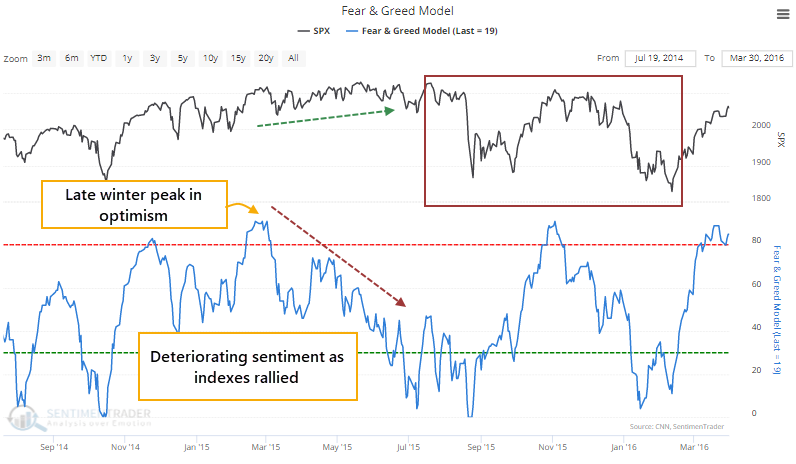

Looking at an aggregate model like Fear & Greed, this is an almost exact repeat of 2015. A February/March peak in sentiment followed by a choppy move higher in the S&P 500 as sentiment ebbed more and more into July and August.

Investor confidence isn't necessarily the most influenced by movements in the S&P or Dow Industrials. While they get the headlines, investors are more concerned with broader movements in stocks. So it's no surprise that internal breadth metrics were deteriorating during that drop in sentiment in 2015.

Just like now.

LONG-TERM BREADTH IS NEGATIVE

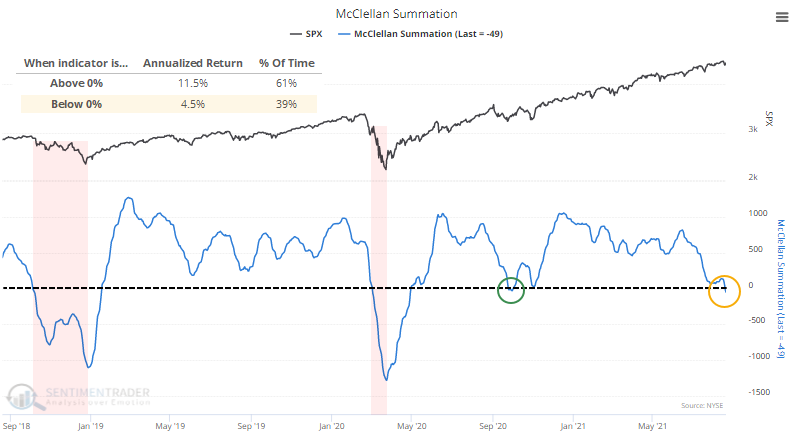

Two of our core measures for a long-term, broad look at how healthy stocks are is the NYSE McClellan Summation Index and the Net % of New Highs - New Lows. And right now, they're signaling caution.

Despite the S&P rallying on Friday to close within 1% of its prior high, and another push on Monday, the Summation Index is negative. The worst possible combination for this indicator is when it is below zero and declining. That's when the worst selloffs happen. There was a brief fakeout last September-October, but the current reading is already below that one.

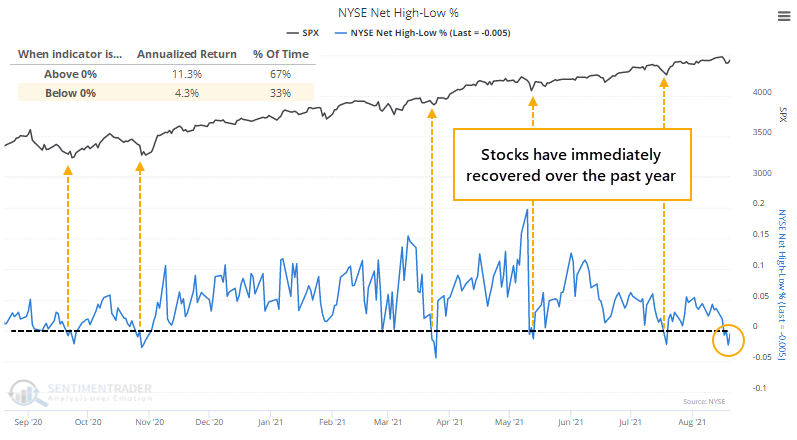

On the NYSE, there are also now more securities falling to 52-week lows than rising to 52-week highs. When this is below zero, the S&P's annualized return is only about a third of what it is when it's above zero.

Bulls could justifiably argue that every time this has happened in the past year, the S&P 500 almost immediately turned around and resumed its advance. Fair point. So, we should watch to see if this time will be any different, which would suggest that the environment has changed.

RARE TO SEE SUSTAINED UPSIDE

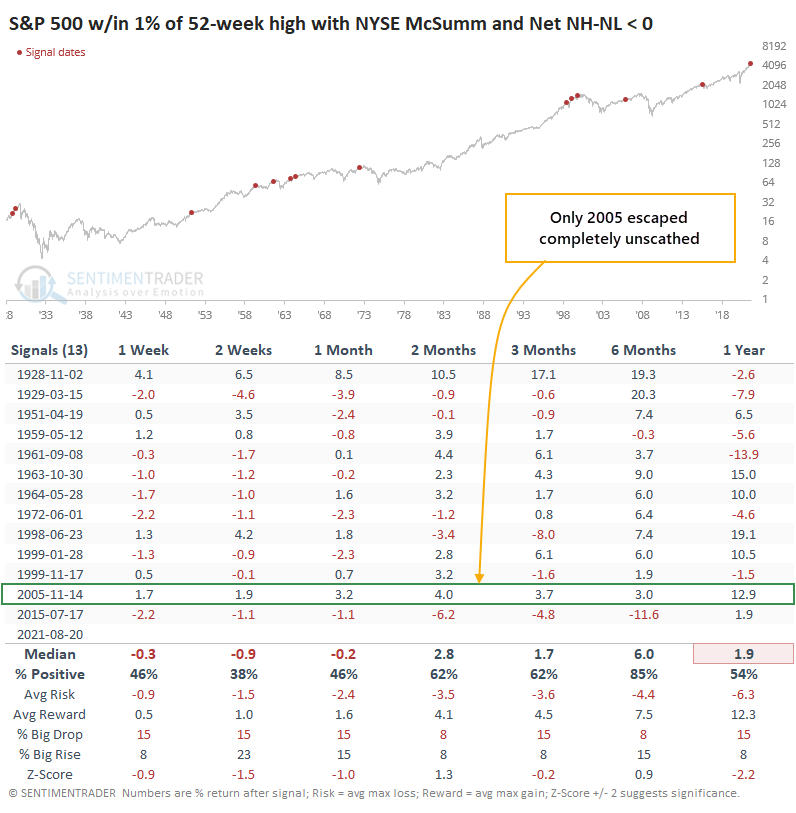

The table below shows every time since the late 1920s when the S&P was within spitting distance of a 52-week high and both the Summation Index and Net NH - NL were negative.

The only instance when stocks escaped unscathed was 2005. All the others saw weakness in the S&P at some point in the weeks or months ahead. Sometimes it took a long while (1928), but most saw losses or limited gains across most time frames.

There is a bit of boy-who-cried-wolf with this type of analysis because it hasn't worked at all in 2021. This time, the potential difference is that it's really the first time such broad and long-term metrics were so poor despite the major indexes holding near their highs. This has been a dangerous combo in the past.