Another surge in advancing volume strengthens the bull case

Key points:

- Volume in advancing shares as a percentage of total volume exceeded 90% on Friday

- A 90% up volume day has now occurred four times in two months

- After similar clusters, the S&P 500 was higher 91% of the time a year later

Surging volume in advancing securities strengthens the bull case

A multi-week sell-off resulting in a 9% decline for the S&P 500 finally eased last week.

The internal participation from constituent members was impressive on Friday, especially on the New York Stock Exchange. On that exchange, volume flowing into advancing securities as a percentage of total volume exceeded 90%. For these purposes, we ignore unchanged issues.

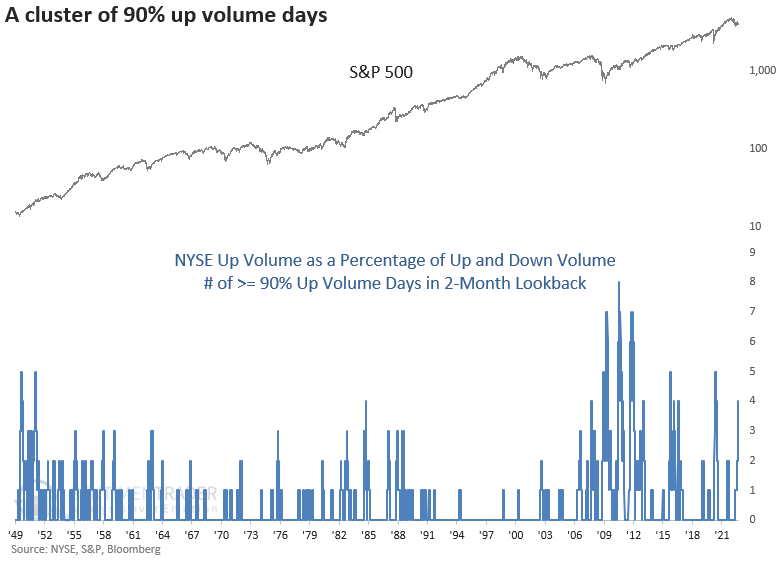

The lopsided volume has now occurred for the fourth time in two months. Historically, a cluster of 90% up volume days is bullish for the broad market as it represents overwhelming demand for stocks.

In the following studies, the count of 90% days has to fall to zero before a new alert could trigger again in order to filter out repeat signals.

Similar conditions preceded excellent long-term results

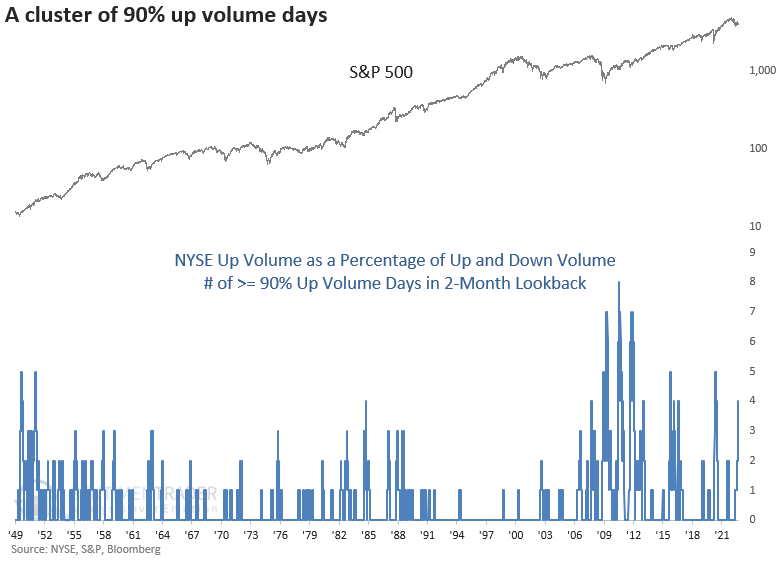

Other clusters of four NYSE up volume days of 90% in two months led to a bullish long-term outcome for the S&P 500.

Weak returns over the next week are a good reminder that sometimes markets take a breather after a burst of buying demand. The only signal that didn't lead to positive six- and twelve-month returns was during the financial crisis.

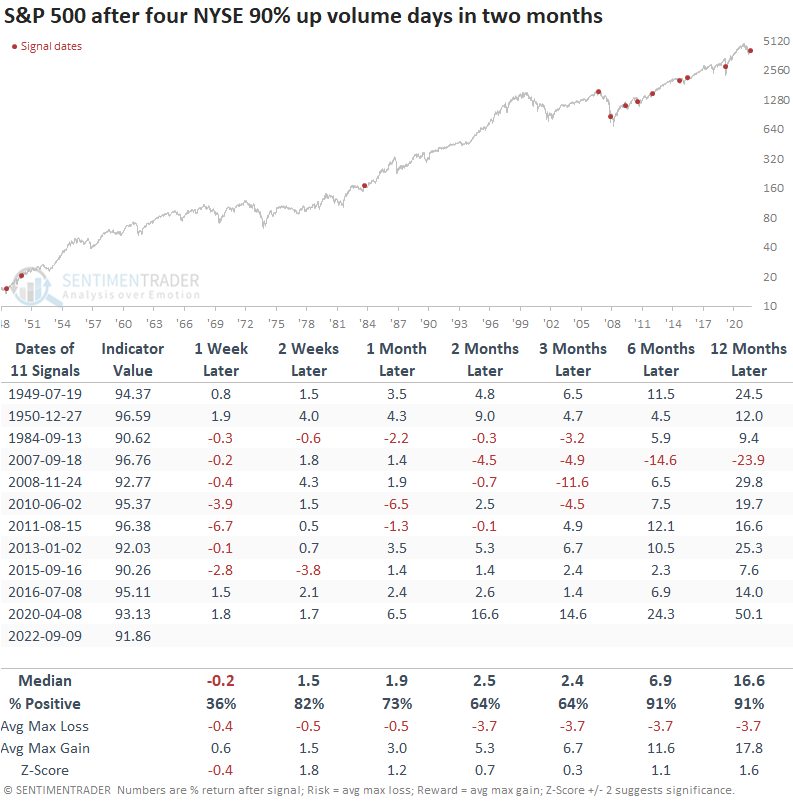

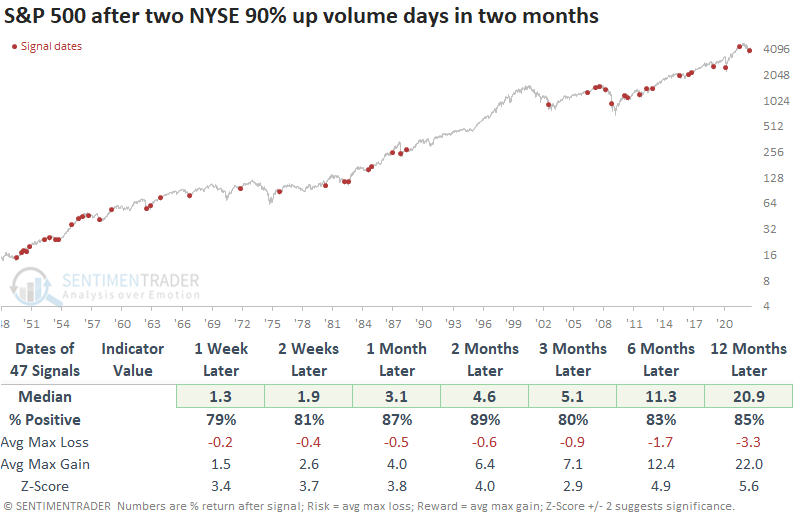

If we lower the threshold to three NYSE 90% up volume days in two months (instead of four), the sample size expands, and the results look even better. Drawdowns were minimal except for the couple that triggered during the global financial crisis.

Even a threshold of two NYSE 90% up volume days in two months looks impressive, with significance across all time frames.

I screened out repeat signals in all three threshold level examples by requiring the count to fall to zero before a new alert could trigger again.

What the research tells us...

Demand for stocks returned last week with the fourth NYSE 90% up volume day in two months. Historically, a cluster of 90% up volume days has been bullish for stocks, especially 6 and 12 months later. Over more than 70 years of history, the only negative long-term return occurred during the largest financial crisis since the Great Depression.