Another surge as Dow nears 20% threshold

Maybe this is a jinx given how things turned out on Wednesday, but the continued surge so far today has pushed the Up Volume Ratio above 90% yet again.

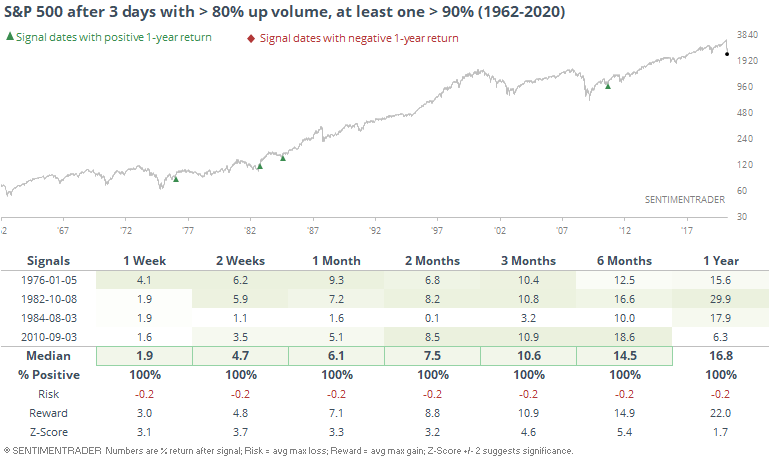

Even if we relax before the close, it's likely to least be an 80% up volume day. That would be the third in a row, with at least one of the days being better than 90%.

As we saw in a couple of previous notes, such skewed buying pressure has boded well when it occurs at least once when stocks are down from their highs. It boded extremely well when there were back-to-back days. And it has been perfect when there were 3 in a row.

Granted, anytime we hear about perfection in markets we should be skeptical, especially with a tiny sample size. Based on the history we have, however, this kind of buying pressure, couple with the readings we witnessed coming into the low, bode well for further gains.

One of the popular stats zinging around over the past couple of days has been the size of the daily gains. The most popular take is that the biggest gains only happen in bear markets. Okay, but that ignores any context.

We already saw that when stocks go from a major low to erasing at least a week's worth of losses, it has mostly boded well going forward. In bear markets, the one-day gains might be large, but it's typically not enough to make up for recent losses.

There is a lot of time left to go in today's session, but the Dow is making a charge to a 20% gain off its low in only 3 sessions.

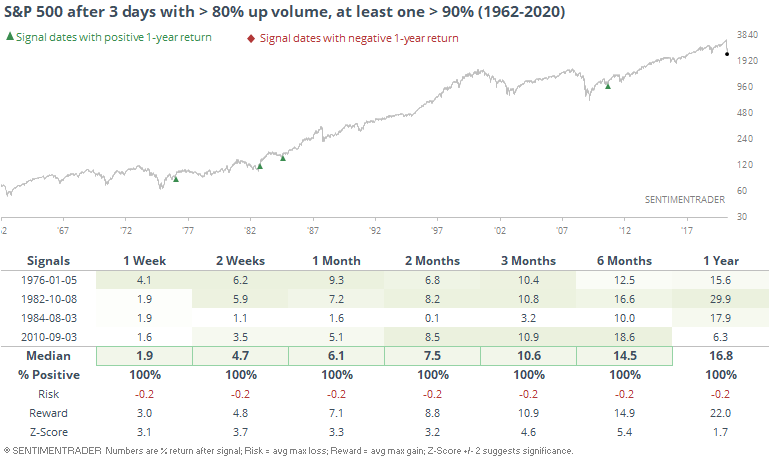

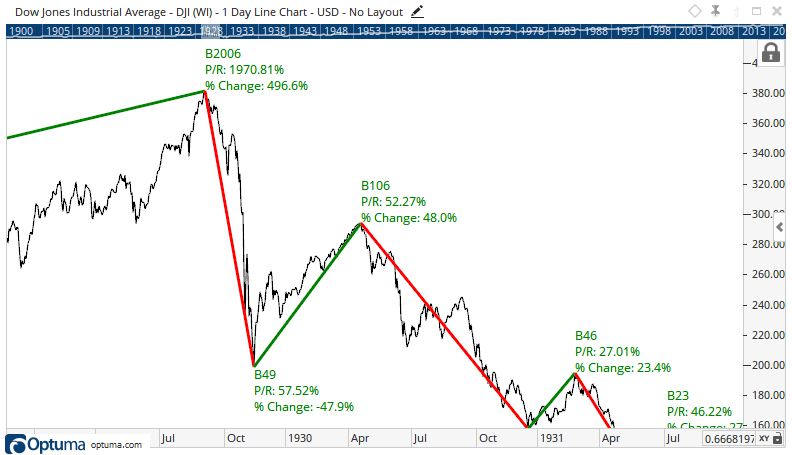

This might be notable. In 2008, there were no 20% bear market rallies - when the Dow did finally rally that much, it only happened on the start of the new bull market. This is kind of splitting hairs, though, since it rallied just under 20% at the end of 2008, which proved to be a very bad time to go long for a trade.

There were also no 20% rallies during the "fakeout" portion of the 1929 crash. By the time it rallied at least 20%, it went on to a total gain of nearly 50% before peaking in April 1930.

In the 1930s, the Dow saw many swings of 20% or more, but right now we're in the initial post-crash phase of a decline, and not the dragged-out bear market which can follow the initial purge and surge.