Another Record Month as Momentum Rolls On

With a flood of money combining with preternaturally calm conditions in the broader market, equity investors can't help themselves. Once again, buying interest was enough to push the S&P 500 to a record monthly close in May.

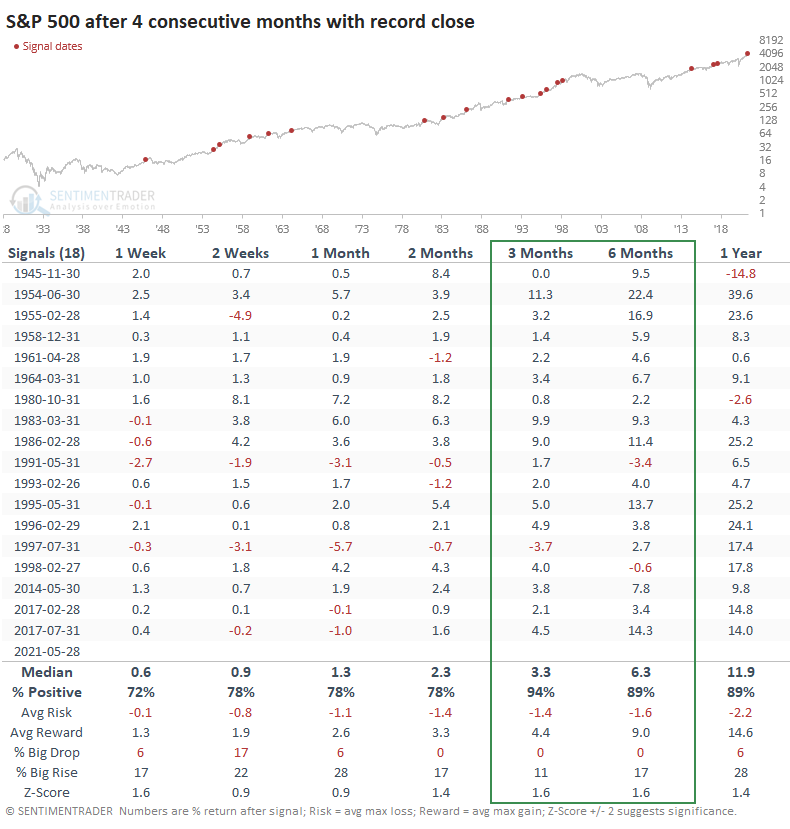

For the most widely-benchmarked index in the world, this was its 4th consecutive month with an all-time high.

We've seen time and time again since last April that momentum does not die easily. Despite an untold number of challenges, not least of which being euphoric sentiment at times, buyers are still interested. Sellers are not, at least not for more than a few days at a time.

When the index has rolled like this, it's rarely lost. The S&P's future returns were good - above random - but the biggest standout was its consistency. Over the next 3-6 months, losses were hard to find, and they were small anyway.

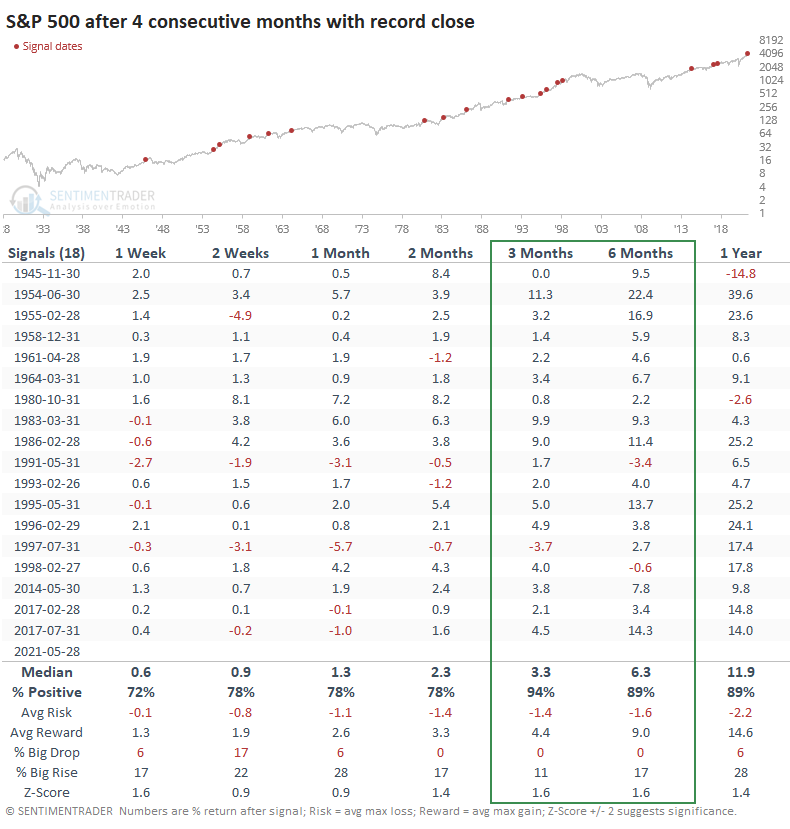

Looking at the Risk/Reward table, we can see that risk outweighed reward over the next six months only twice, and those two were reversed during the subsequent six months. Impressive.

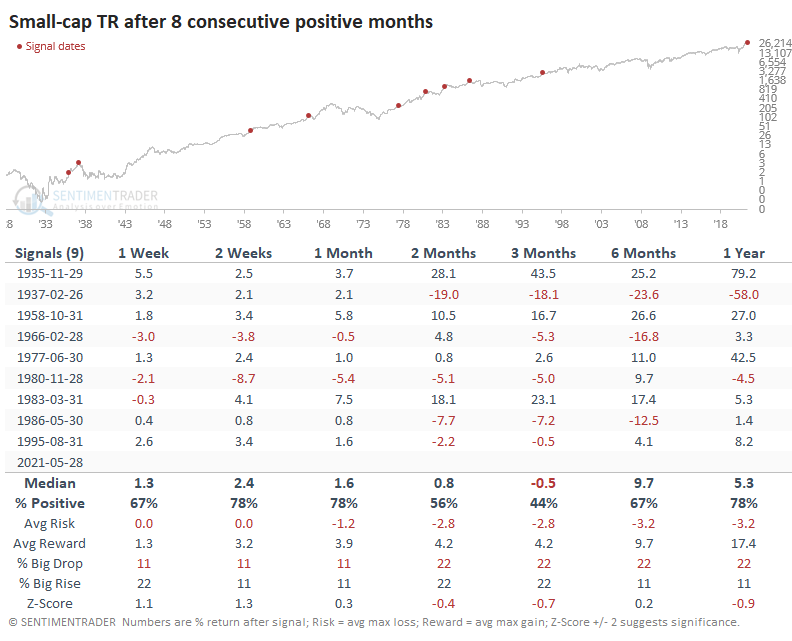

SMALL-CAPS ON THE BEST RUN IN 27 YEARS

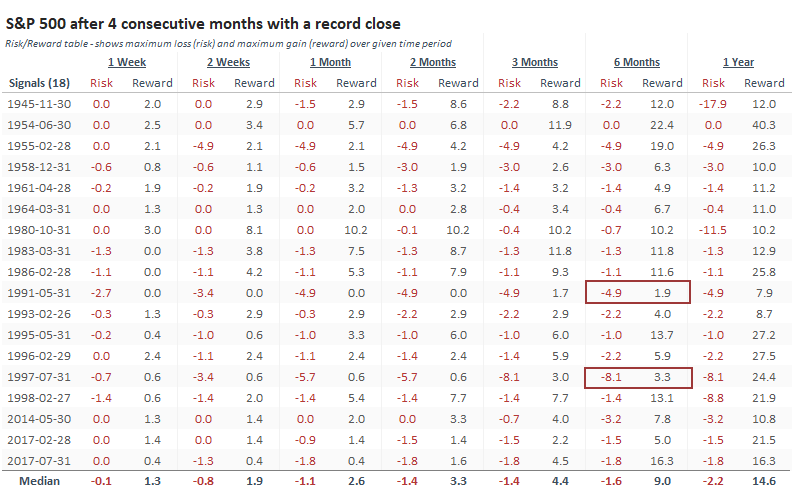

While they've settled back recently, part of the momentum has been due to a tremendous run in Small-Cap stocks, which just ended their 8th straight month with a positive total return, tied for the 5th-longest streak since 1926.

After other 8-month winning streaks, Small-Caps have tended to keep going, but there were some rough patches. A few times, they lost more than 10% over the next six months, though there was only one (very) large loss a year later.

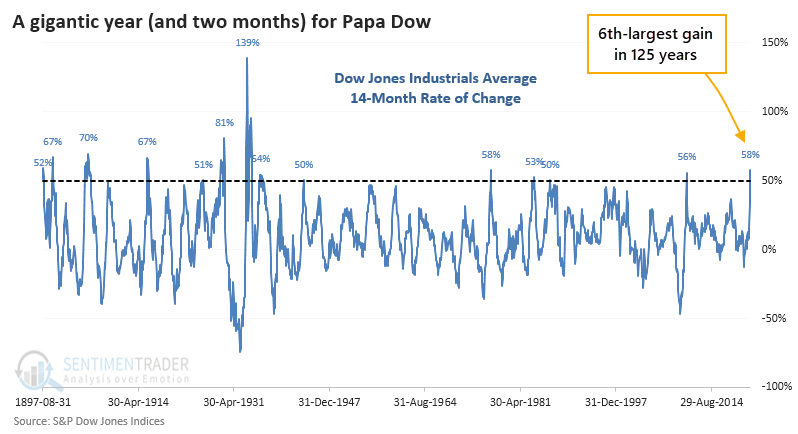

PAPA DOW RECORDS HISTORIC STRETCH

Looking at the other end of the spectrum, the Dow Jones Industrial Average just celebrated its 125th anniversary by recording its 6th-largest gain over a 14-month stretch.

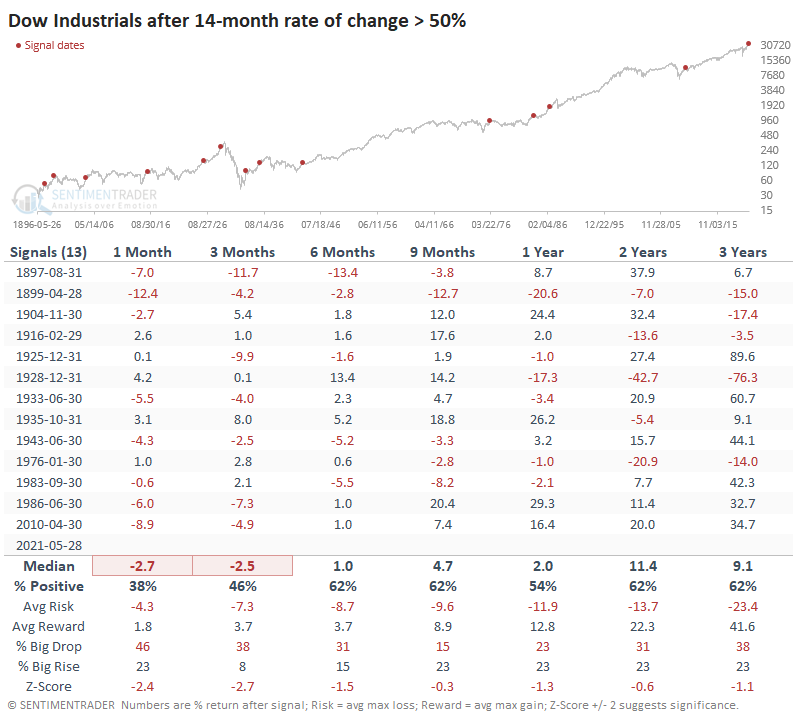

The only reason we're looking at a 14-month rate of change is that it coincides with the low last March, so we're cherry-picking the time frame. During its illustrious history, Papa Dow has managed a 14-month 50% gain 13 other times. The table below shows its future returns over a longer time frame.

Over the next few months, the Dow often wasn't able to hold its momentum at such a high level, with a handful of corrections along the way. Out of the 13 instances, there were 3 that ended up leading to bear markets at some point during the next year, but all of those were before 1929.

The overall theme from these displays of historic momentum weakly suggests that investors should curb their enthusiasm in the shorter-term. I say "weakly" because the future returns in the S&P study were quite good. There is a more compelling suggestion over a medium- to long-term time frame, and it's a positive one.

We've noted for months that there is a historic tension in the types of data we follow. Many of the breadth- and momentum-based ones show behavior often seen near the beginnings of new bull markets. Most of the sentiment- and valuation-based ones show behavior almost always seen near their ends. It's hard, maybe impossible, to reconcile that, and there are no good historical comparisons we can find.

Starting in late January at least, there was a more compelling argument for months of choppy trading activity ahead, which arguably we've seen. It's getting a bit harder to make that same case now, as many sentiment measures have come down from euphoric levels.