Another panicky morning

With markets set to see another large gap down, we've been asked several times if it's enough to consider it a panic, given the level of selling pressure stocks have already suffered.

With the boilerplate disclaimer that we've never really seen any other period in recent history like this, to some extent it doesn't matter. Investors are investors, and act most like investors always have. There are rare times that a historic fundamental event can overrule any technical, fundamental, or behavioral pattern, and maybe this is one of them. I don't know.

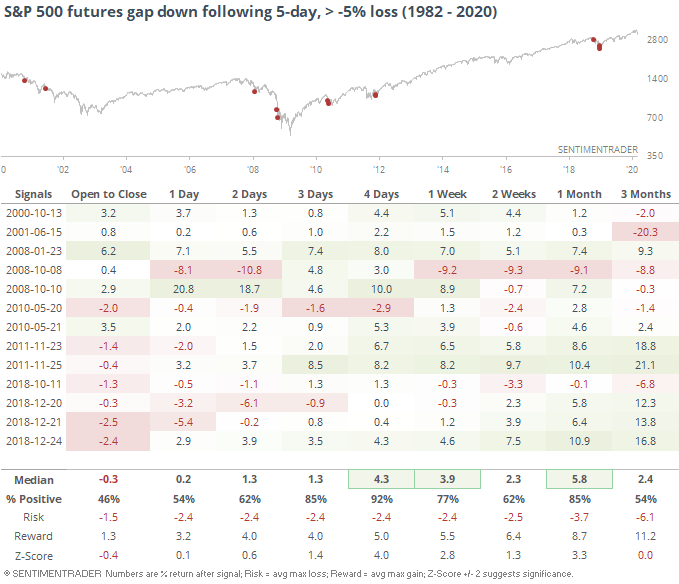

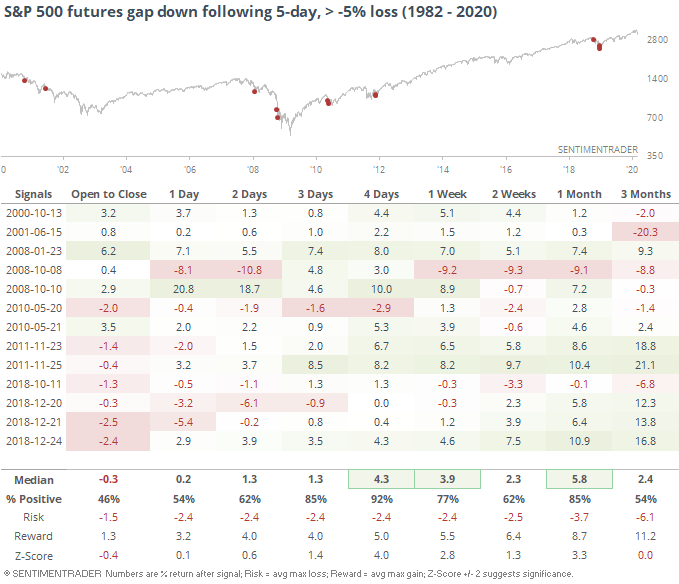

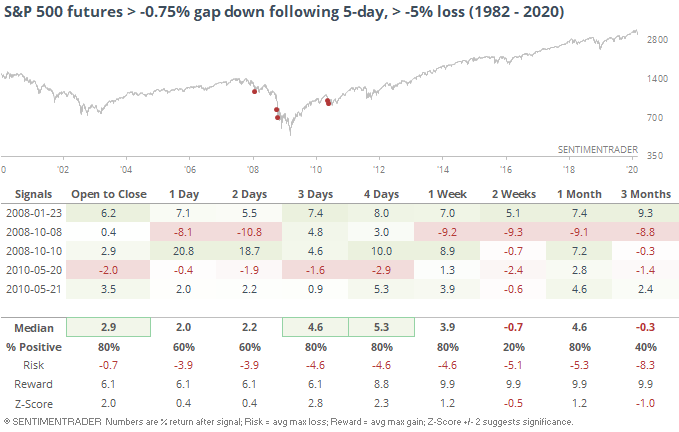

To answer the question specifically about panic gaps, below we can see every time since the inception of S&P 500 futures in 1982 that they fell at least 5 days in a row, with at least a -5% loss, then gapped down the next morning (i.e. this morning).

The open to close wasn't very encouraging, but even so, the futures were higher over the next 4 days every time but once, and that one became positive the next day.

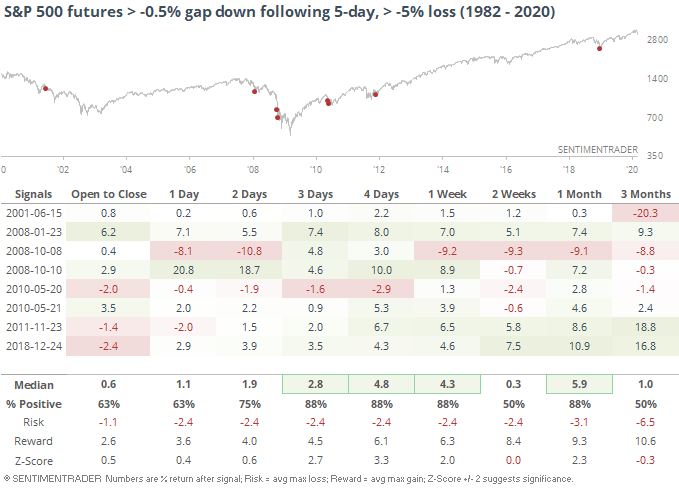

We're looking at a pretty extreme gap today, though, and that really cuts down on the similarities to the others. Below, we can see returns after the gap open was at least -0.5% on the sixth day.

Still some risk in the very short-term, but returns over the next few days were a bit higher.

We're staring at an even large gap, but of course the precedents become even scarcer the more extreme the conditions.

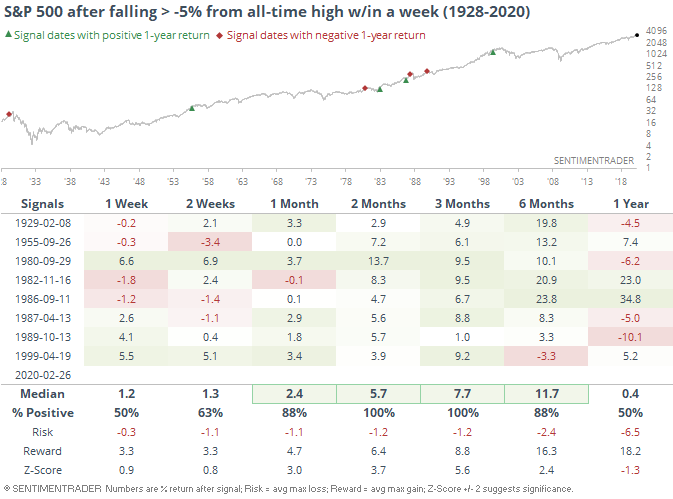

The scary thing for investors seems to be the potential that this kind of a swift, severe drop from an all-time high raises the probability we're transitioning into a bear market. Perhaps. Some of the signs we looked at over the past few months suggest it's possible.

Even so, drops like this usually don't coincide with the exact end - every time, the S&P bounced back over the next 2-3 months before rolling over (if it did).