Another Jobs Report Gap

The Nonfarm Payroll report came in better than expected, and even better than that, the consensus knee-jerk analysis is that it was good enough to show growth, but not so good as to raise the probability of more severe rate increases.

Whether that's actually the reason or not, stock futures are rising and showing decent gains over yesterday's close.

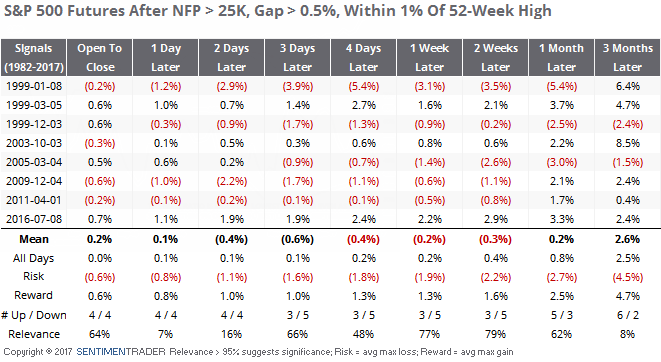

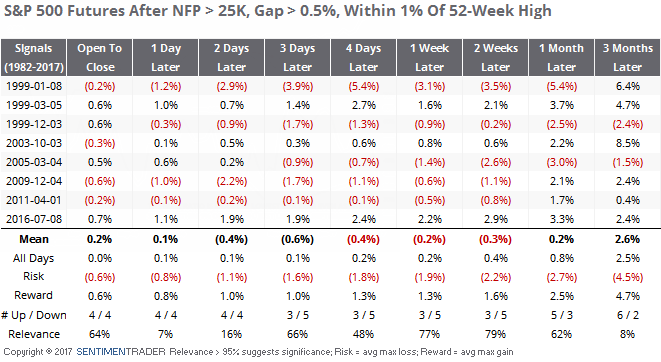

Assuming this holds, let's take a look at other times that we had a situation where:

- The jobs report beats expectations by > 25,000

- The S&P 500 futures gap open by > +0.5%

- The open is within 1% of the previous 52-week high close

With those conditions, we get the following dates, along with how the futures performed going open (from the open).

Expectations were negative up to two weeks later, with a negative average return, percentage of time positive, and risk/reward ratio.

Even if we ignore the jobs report and look at this kind gap on any Friday, expectations were still negative, with the worst performance one week later. The futures added to its opening gain 25 out of 56 times, averaged a return of -0.4%, with risk of -1.8% versus reward of +1.2%.