Another day, another new all-time high

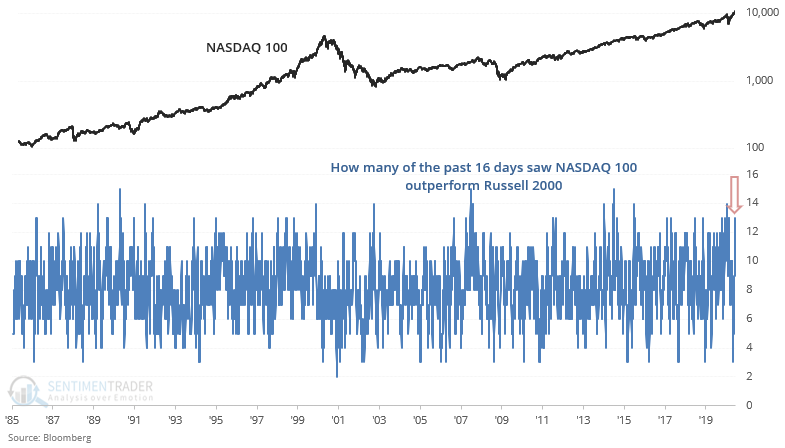

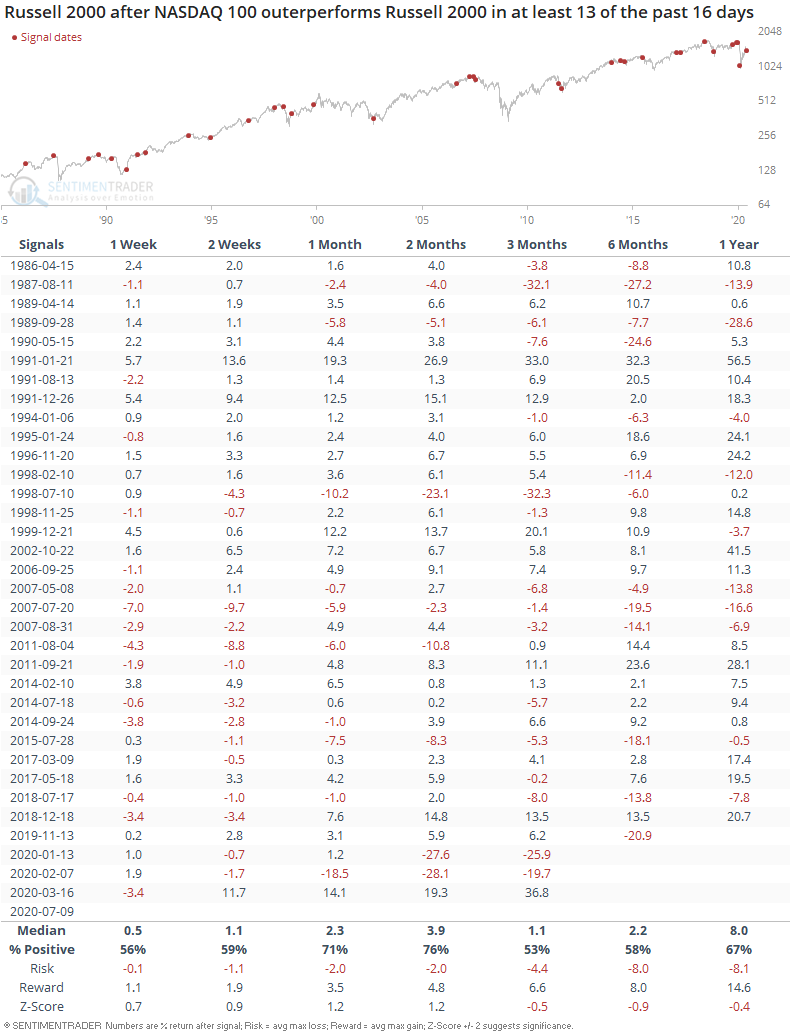

If it seems like tech stocks are making new all-time highs every day, that's because they have. As Helene Meisler pointed out, tech stocks significantly outperformed small caps recently. Both the NASDAQ Composite and NASDAQ 100 are continuously making new all-time highs while the Russell 2000 has trended sideways for a month. As a result, the NASDAQ 100 outperformed the Russell 2000 on 13 of the past 16 days:

This was somewhat of a concern for the NASDAQ 100 for the short term, particularly over the past 10 years:

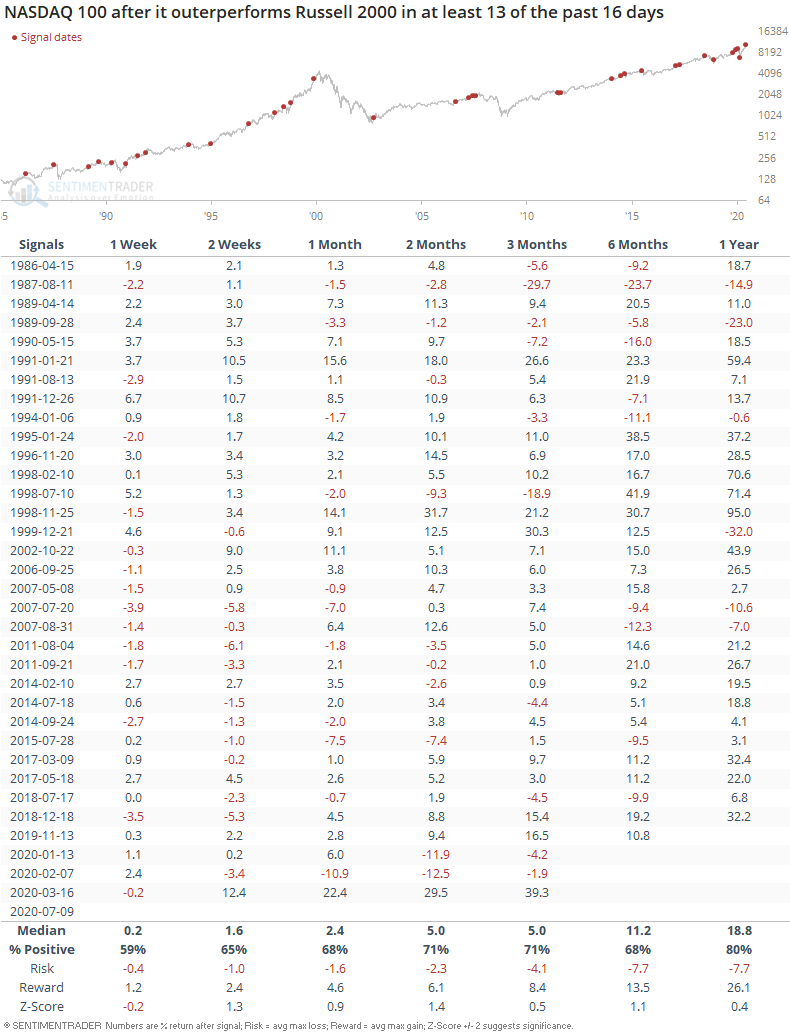

Eyeing the cases over the past 10 years more carefully, the Russell 2000 often pulled back over the next 2 weeks.

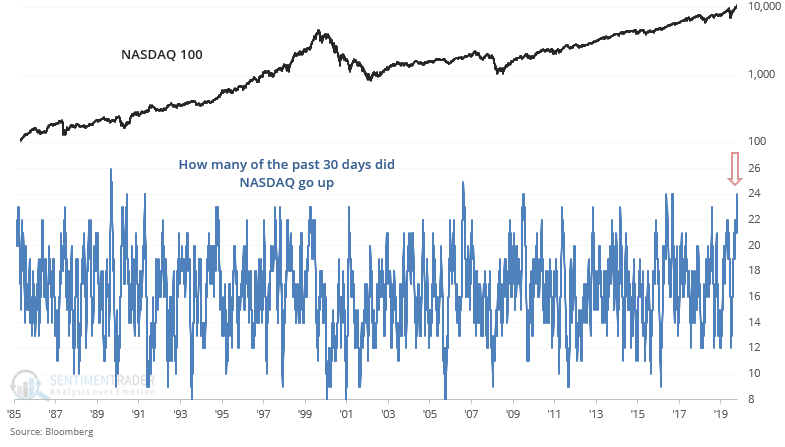

The NASDAQ 100 rallied during 24 of the past 30 days as tech stocks ramp higher nonstop.

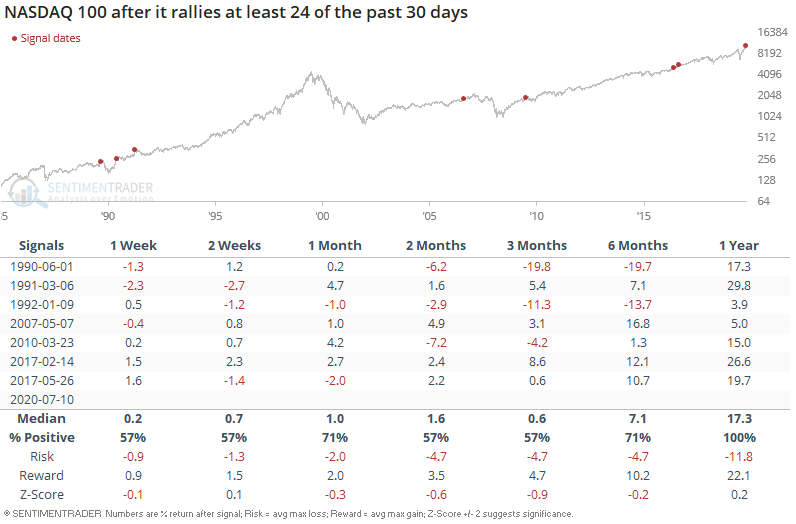

This wasn't a clear short term bearish sign for the NASDAQ:

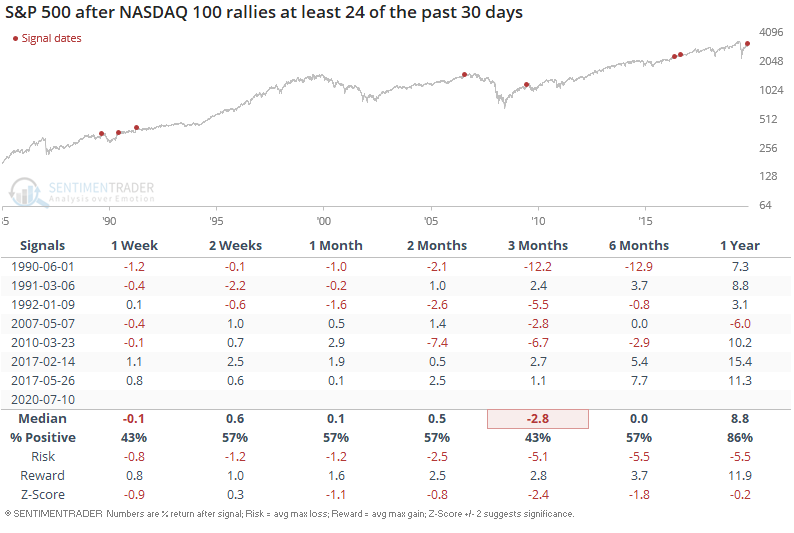

But it did lead to some pullbacks in the S&P 500 over the next 3 months:

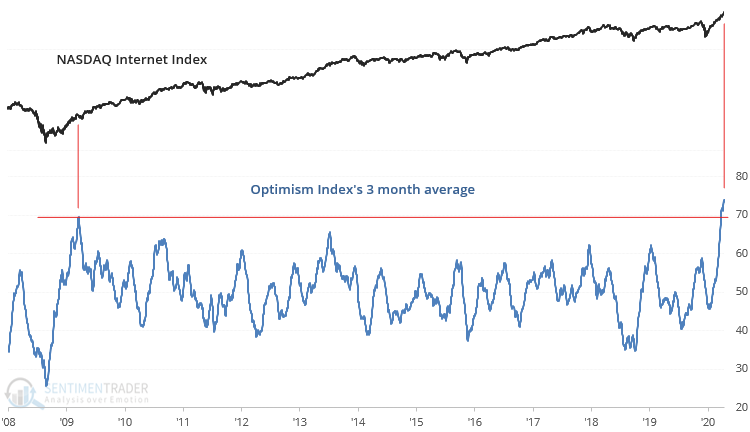

Investors and traders most exposed to internet, growth, and stay-at-home stocks outperformed other types of traders over the past few months. Such extreme price moves are reflected in sentiment, with the NASDAQ Internet Optimism Index's 3 month average at an all-time high. The previous high was in early June 2009. Although that was the start of a massive 11 year bull market, the NASDAQ Internet Index still dropped -11% over the next month:

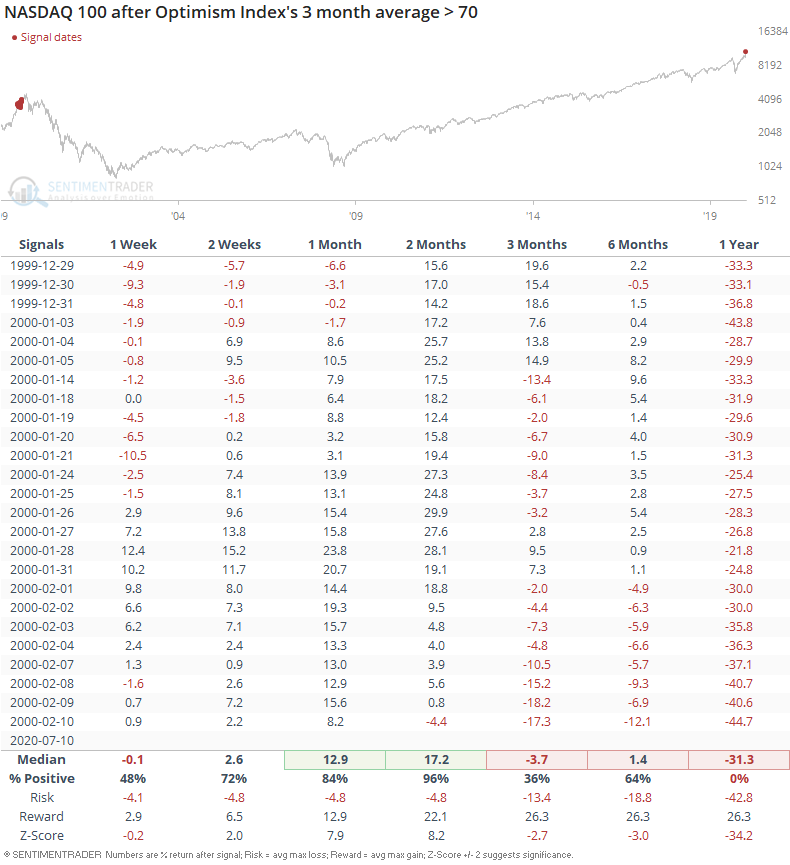

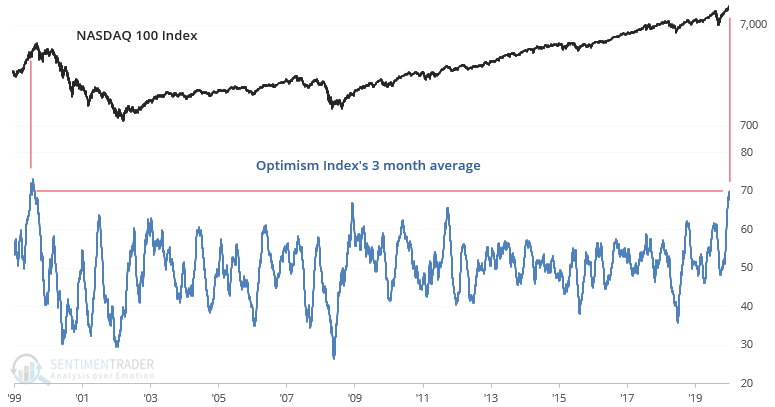

Looking at a broader index, the NASDAQ 100 optimism index's 3 month average is at the highest level since late-1999.

Such extreme optimism was only matched by 25 other days.