Another bear market price pattern signals caution

Key points:

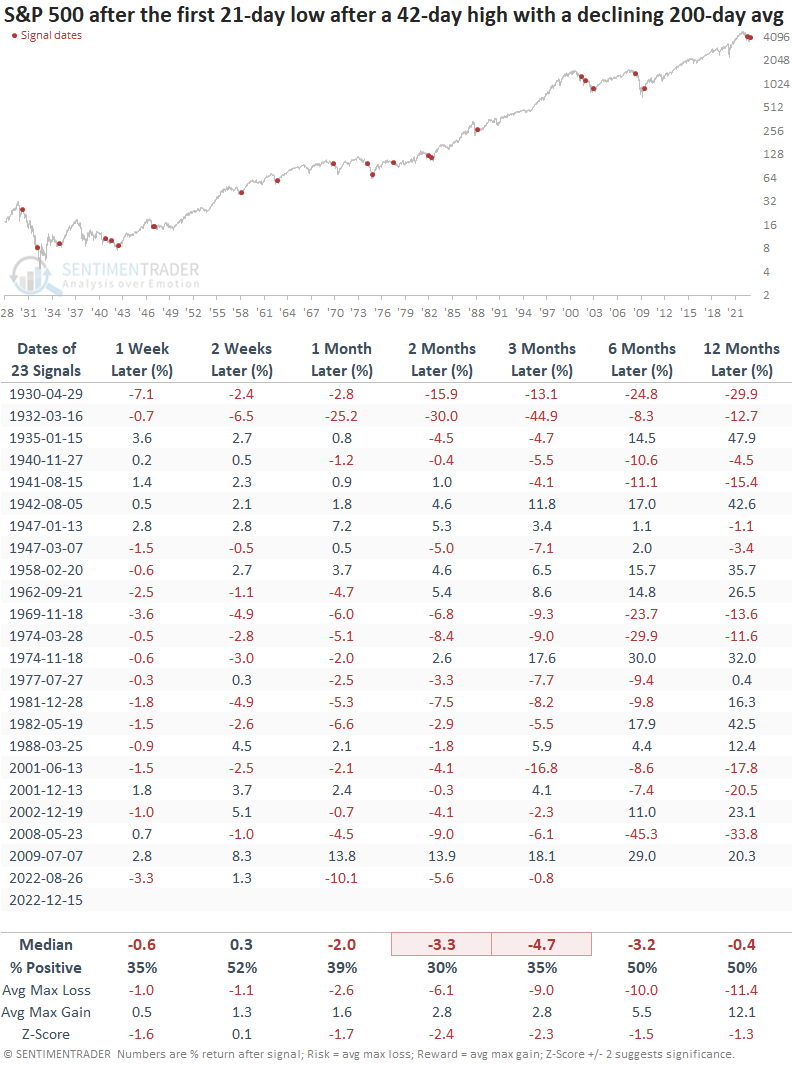

- The S&P 500 swung from a 42-day high (close) to a 21-day low (close)

- The reversal occurred in 11 sessions and within the context of a long-term downtrend

- After similar patterns, the S&P 500 showed negative returns across almost all time frames

A bearish price pattern in an established downtrend

The world's most-watched benchmark reversed from a 42-day high (close) to a 21-day low (close) in only 11 sessions, triggering a bearish price pattern for the second time in four months. The last signal was unkind to equities, with the S&P 500 declining 10% over the next month.

Let's assess the S&P 500 outlook when the index reverses from a 42-day high (close) to a 21-day low (close) in 15 or fewer sessions. At the same time, the index must be below its 200-day moving average, and the average has declined for at least 80 consecutive days.

Similar bear market patterns preceded negative returns

A swift reversal from a 42-day high (close) to a 21-day low (close) in a downtrend does not bode well for the bull case. Historical precedents suggest we should keep an open mind to a resumption of the downtrend. Since 1969, the signal shows a loss at some point over the next two months in 13 out of 14 cases.

A historical comparison

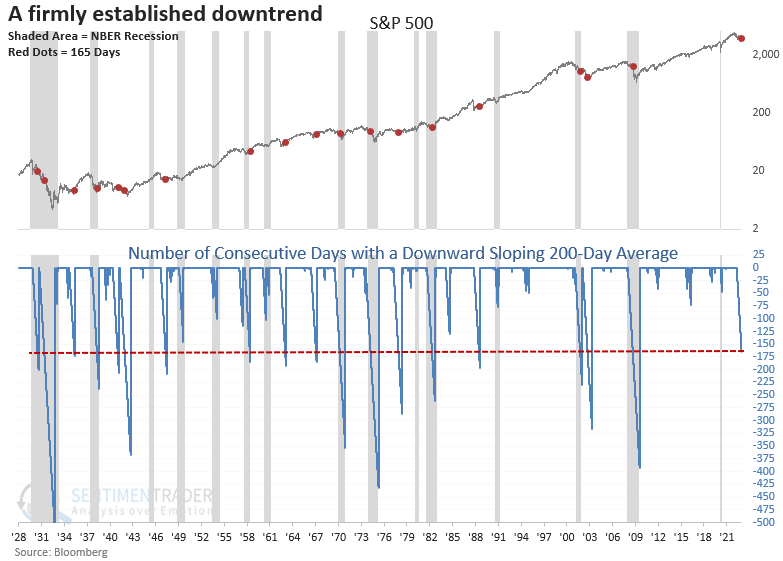

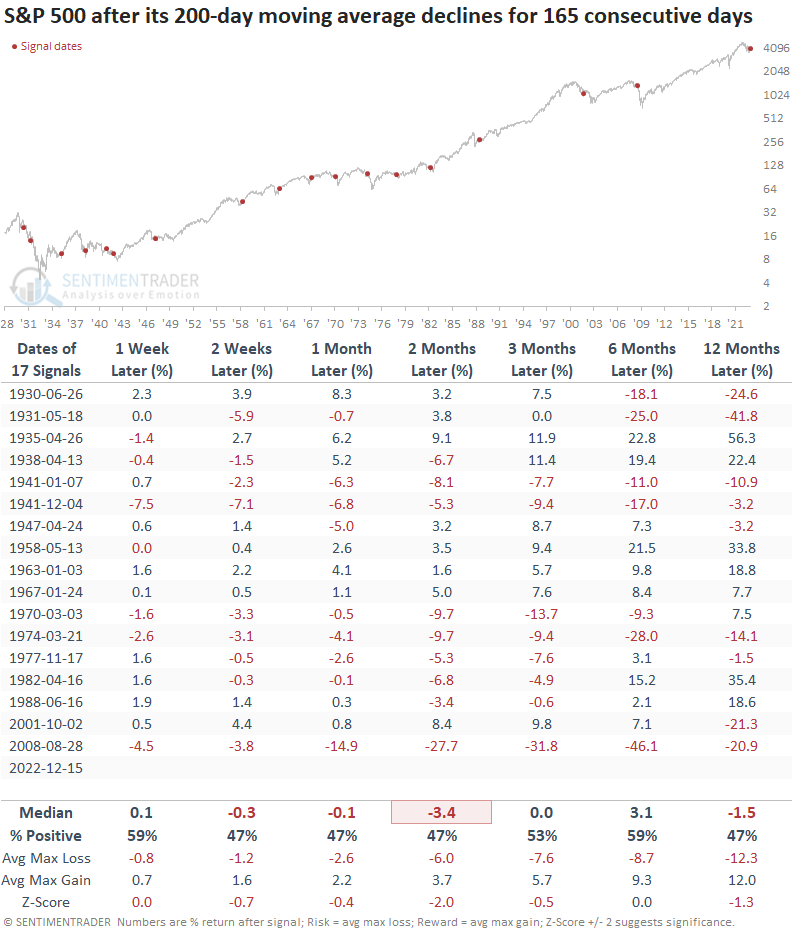

The 200-day moving average for the S&P 500 has now declined for 165 consecutive days, the 19th longest streak in history. Persistent long-term downtrends of this nature have occurred within the context of a recession in 8 out of 15 cases since 1928.

When the 200-day moving average declines for 165 consecutive days, stocks continue to struggle. Since 1970, the signal shows a loss at some point in the next two months in 6 out of 7 instances.

What the research tells us...

The emergence of an additional bearish price pattern after an impressive rally from the October low should remind us to keep an open mind to all market outcomes. One must consider a significant retracement or new low in equity indexes in the next few months as a real possibility. After swift reversals from a 42-day high (close) to a 21-day low (close) in an established downtrend, the S&P 500 closed lower two months later in 70% of the historical cases. The persistent decline in the 200-day moving average remains a headwind for stocks.