...And so does Dumb Money Confidence

Key Points

- Dumb Money Confidence has reached a minimum bullish threshold

- This indicator could reach even lower extremes if the market continues to decline

- Regardless, history suggests the potential for a market rebound in the near-term

Dumb Money Confidence

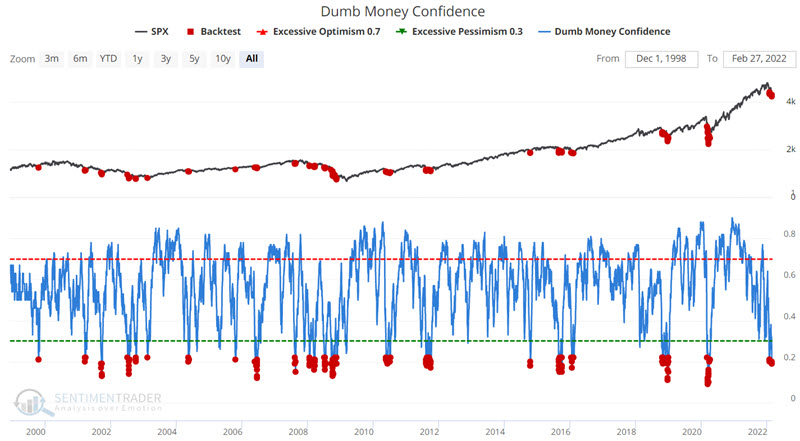

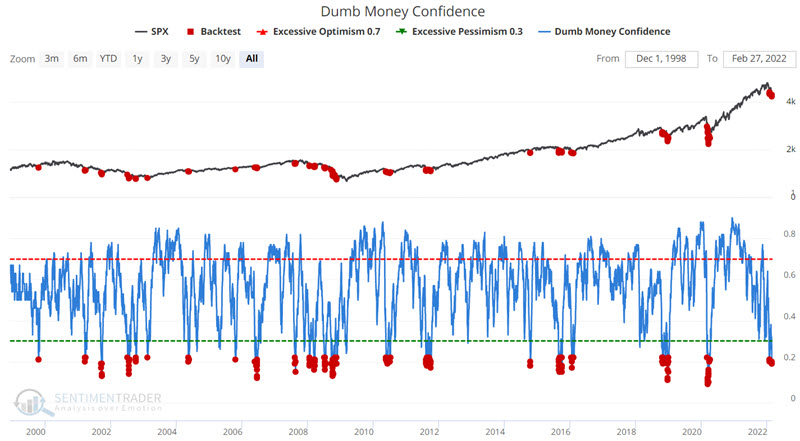

In this article, I noted that the Smart Money / Dumb Money Confidence Spread recently reached what I consider to be a minimum bullish level. As it turns out, so too has Dumb Money Confidence as a stand-alone indicator. The chart below displays all days when the Dumb Money Confidence Spread was below 0.23. You can run this test in the Backtest Engine.

Dumb Money Confidence was below 0.23 on 2/22, 2/23, and 2/24. Does this matter? Let's consider previous market performance.

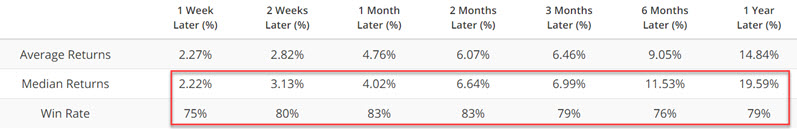

The table below displays a summary of the results.

There is good news and bad news to be gleaned from the above results.

- The good news is the consistently high Win Rate across all periods and the steadily increasing Average % Return across each time frame

- The bad news is that 75% to 83% Win Rates are NOT to be confused with 100% probability

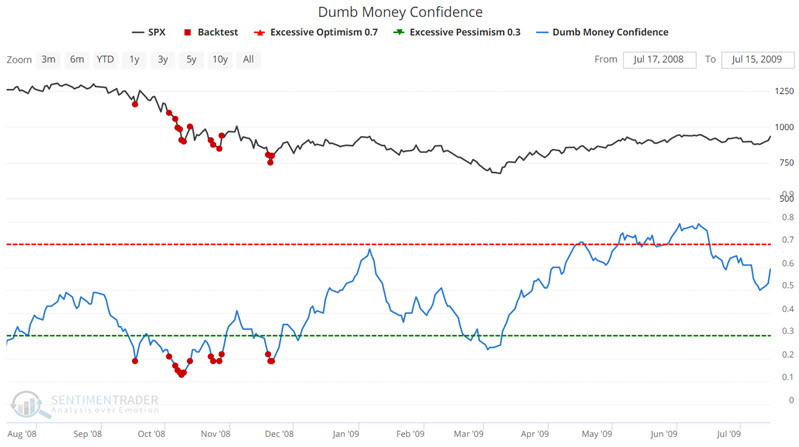

The chart below displays the signals that occurred in 2008. Despite the ostensibly bullish signals from the Dumb Money Confidence indicator, the market continued to decline significantly for several months, as other factors weighed more heavily on the market.

What the research tells us…

Is it possible that factors such as high inflation, rising interest rates, and war in Europe may weigh more heavily on the market in the months ahead? Absolutely. The latest signal from Dumb Money Confidence should not be interpreted as an "all clear" signal but rather as a wake-up call to overly fearful investors that the market could do what it does best and surprise investors in the months ahead.