Analysts are chasing the trend... again

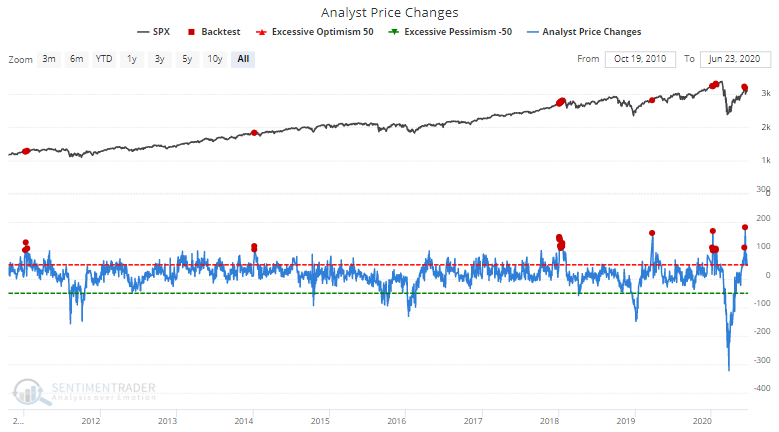

Analysts were aggressively upgrading their price targets for S&P 500 stocks almost 2 weeks ago as the U.S. stock market (and tech stocks in particular) surged. Keep in mind that back in March, analysts were downgrading their price targets at the fastest clip ever as they bet on the end of the world.

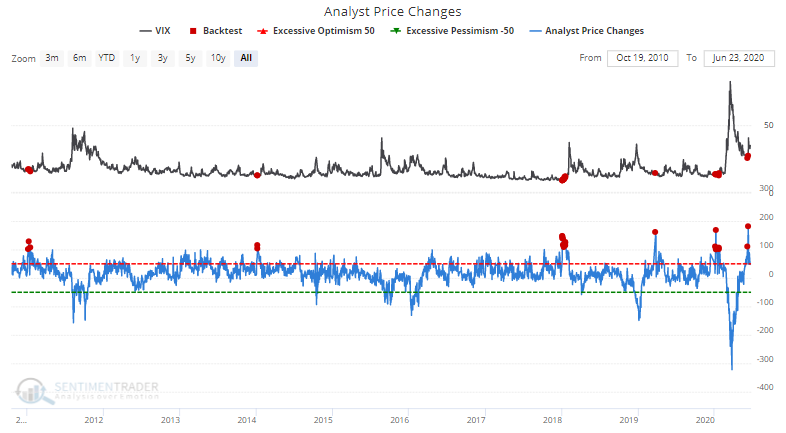

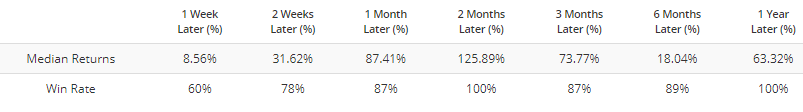

The following contrarian signal looks at the net number of S&P 500 stocks for which Wall Street analysts have upgraded their price target (# of upgrades - # of downgrades).

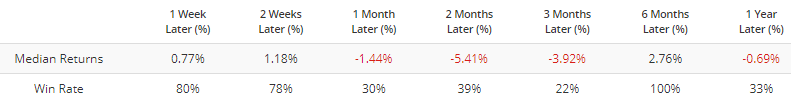

When analysts were ratcheting up their forecasts this aggressively (> 100), the S&P 500's returns over the next 2-3 months were quite weak:

This occurred somewhat early before the August 2015 market crash, before the September 2014 correction, before the early-2018 correction, before the May 2019 pullback, and of course before the most recent stock market crash. Since VIX and the S&P have an inverse correlation, this was always bullish for VIX over the next 2 months:

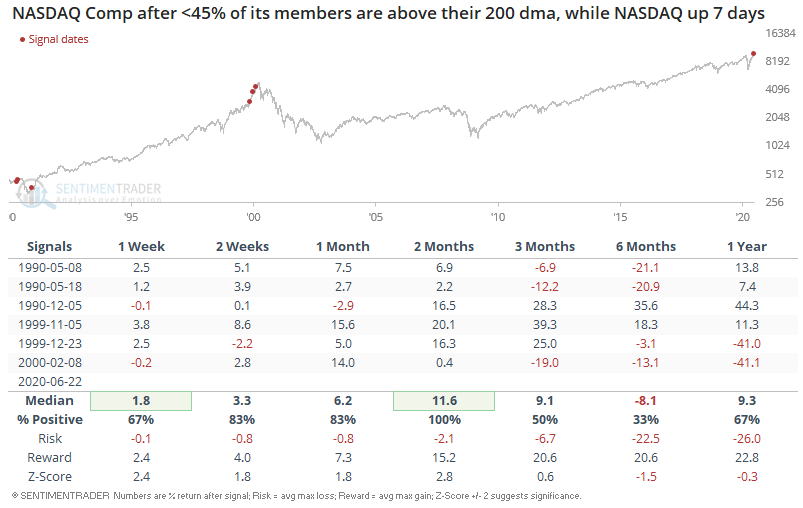

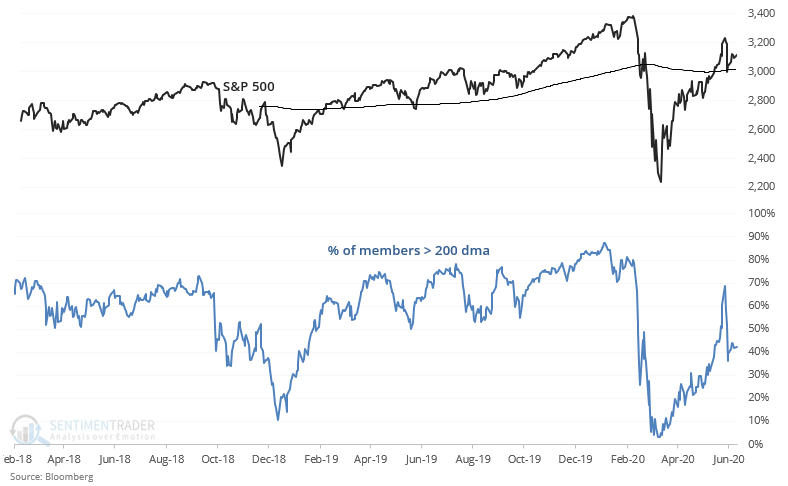

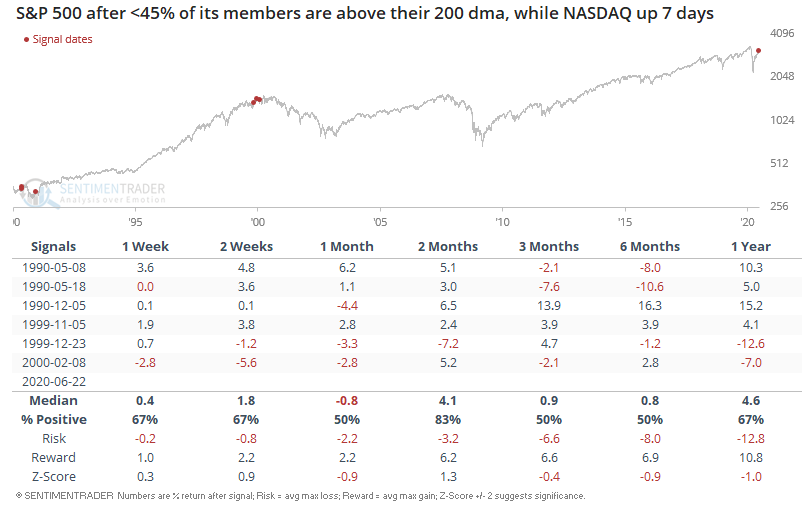

Perhaps analysts are getting ahead of themselves as they're seduced by the siren song of tech stocks. The NASDAQ Composite has rallied 7 days in a row, which is a rare occurrence when fewer than 45% of S&P 500 members are above their 200 dma (i.e. relatively weak breadth):

A strong rally in tech stocks coupled with relatively weak S&P breadth has been a somewhat concerning sign for the S&P. This occurred before the 1990 stock market crash and the 2000 bull market top:

And while this did lead to further short term gains for tech stocks, this was a dangerous warning sign for tech stocks over the next 6 months: