An Update on the World's Most Important Commodity

Some people ("Hi, my name is Jay") are adamant that the most important commodity in the world is coffee (followed closely, of course, by sugar). What, you were expecting crude oil and copper?

A bearish signal occurred recently in the coffee market. However, there appear to be several other factors in play. So, let's use this as an opportunity to illustrate the process of combining different factors to zero in on a potential trading opportunity.

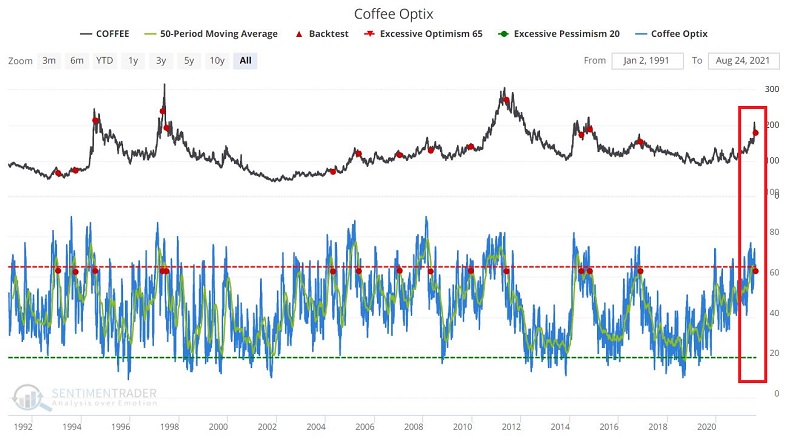

SENTIMENT

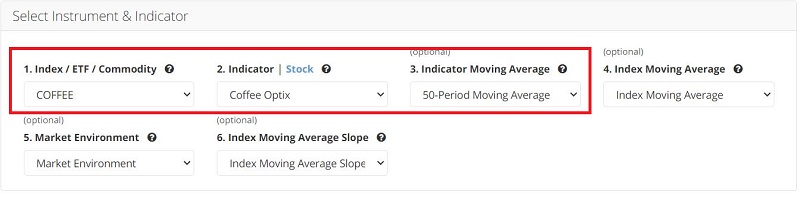

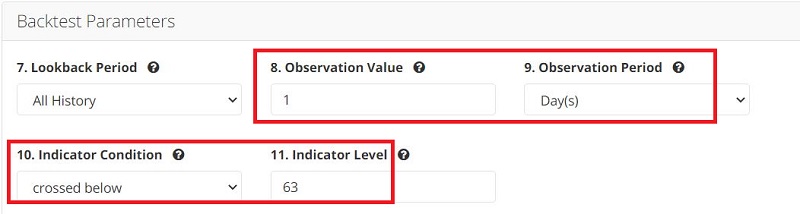

The 50-day average of Coffee Optix recently crossed below 63. The Backtest Engine inputs appear below.

The output screen appears below.

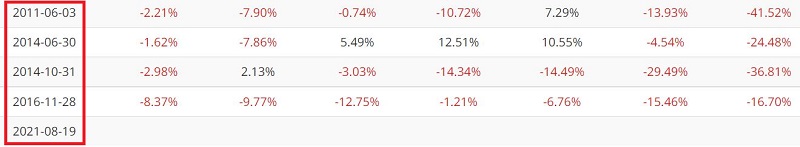

The most recent signal was on 8/19/2021. The reason I pay attention is highlighted in the screenshot below.

As you can see, after 1 month, the Win Rate is well below 50%, and the Median Returns are negative in each time frame. Does this mean that coffee is doomed to decline in the year ahead? Not at all. It does, however, suggest that the odds of an advance are below average.

Before we walk away with the notion that coffee is poised for immediate trouble, there are a few other factors that may be worthy of consideration.

SEASONALITY

The chart below displays the Annual Seasonal Trend for coffee. As you can see, we are about to enter a period of seasonal strength. This might suggest delaying entering into a bearish position (or continuing riding a current open position).

ELLIOTT WAVE

The chart below displays coffee futures (front month) with the Elliott Wave count overlaid as calculated - for better or worse - by the Elliott Wave algorithm built into ProfitSource software.

As you can see, as presently drawn, the count is calling for a decent rally into at least late September. It is important to note that this is merely a "projection," Sometimes, those things work, and sometimes they don't. I include it here because it dovetails pretty closely with the Annual Seasonal Trend chart above, suggesting a bit of patience before diving into the short side.

FILTERING WITH MOVING AVERAGES

IMPORTANT: What follows is NOT a "trading method" or a "recommendation." The purpose is to help you develop your own ability to "think like a trader."

So far, we have:

- A signal suggesting that coffee will exhibit weakness at some point in the next 12 months

- A few other indications suggest that further strength could continue

One of the most important concepts for a trader to comprehend is that you want to enter a trade when you think it is most likely to move in the anticipated direction.

The chart below displays coffee futures with a 50-day and 200-day moving average. One can argue coffee is presently in the midst of a strong price uptrend. This argues in favor of waiting for some reversal or confirmation before considering a short position.

The table below highlights the signal dates from the last 10 years from the original Optix test that we ran.

So, let's propose the following. A short position may be entered when:

- The 50-day Coffee Optix has recently dropped below 63, AND

- Coffee futures are - or subsequently fall - below the 50-day moving average

Let's look at the signals from the table above. The chart below displays the signal from November 2016.

The chart below displays the two signals from 2014.

The chart below displays the signal from 2011.

SUMMARY

Given the cross-currents presently affecting the coffee futures market:

- A bullish trader might hold on and attempt to ride the current trend

- A bearish trade might look for some reversal (ex., a close below the 50-day average before jumping into a short position)