An ominous price pattern or typical bull market behavior

Key points:

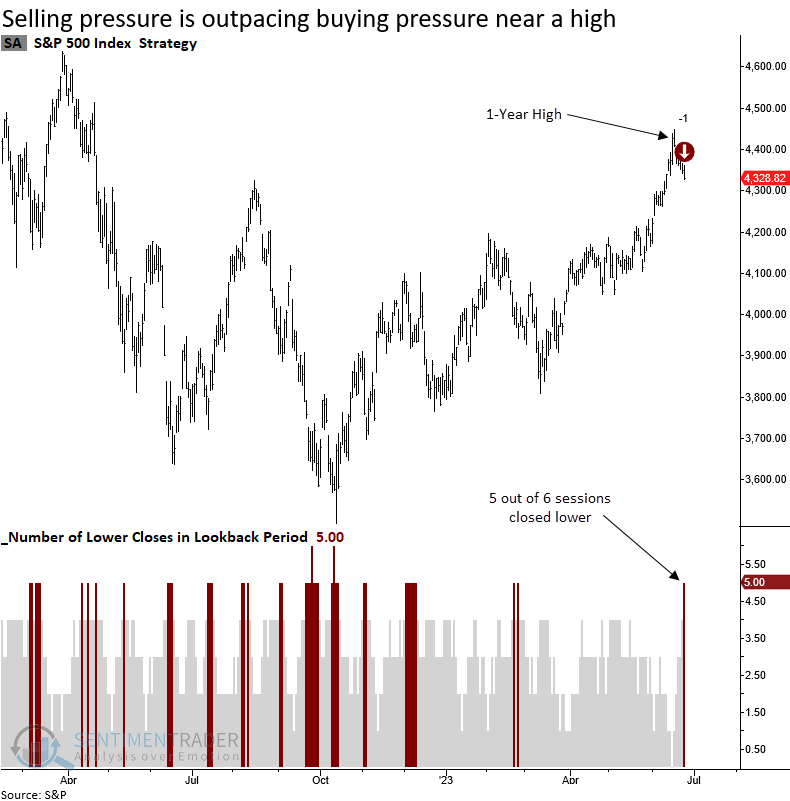

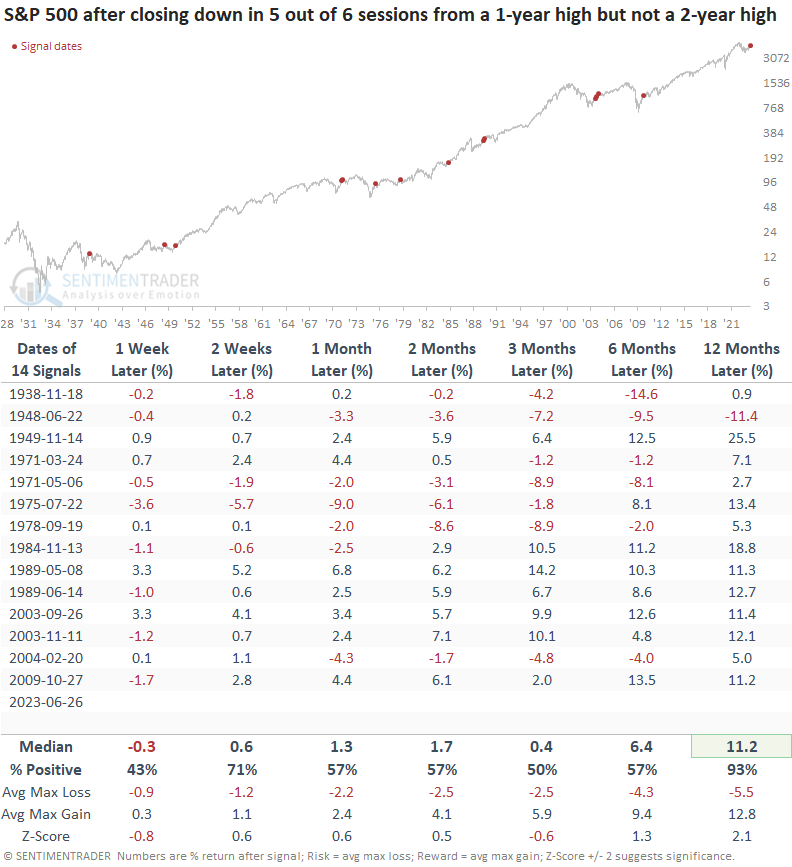

- The S&P 500 declined in 5 out of 6 sessions after closing at a 1-year high

- Similar price patterns led to positive returns in line with historical results over the next few months

- When the signal occurred below a 2-year, the S&P 500 was higher 93% of the time a year later

A normal pullback or the start of something more ominous

The S&P 500 has fallen in five out of the last six sessions after closing at a 1-year high on 2023-06-15. The natural assumption would be to infer that the selling pressure so soon after a high is an ominous sign for the market.

Let's assess whether we should follow the narrative or trust the data.

Similar price patterns led to an upward bias in the S&P 500

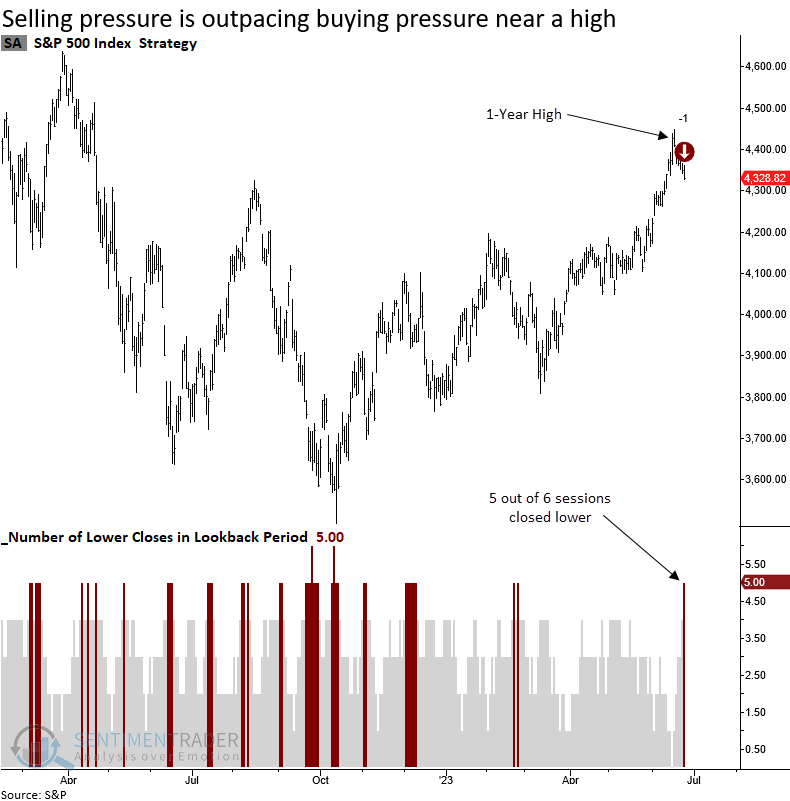

When the S&P 500 declines in 5 out of 6 sessions after closing at a 1-year, the large-cap index tends to perform in line with historical results for the next few months. From three to twelve months later, returns are slightly better than average.

There were only 13 occasions out of 111 precedents where a maximum loss of -5% or more occurred within the next month, suggesting this is not the start of a more meaningful correction.

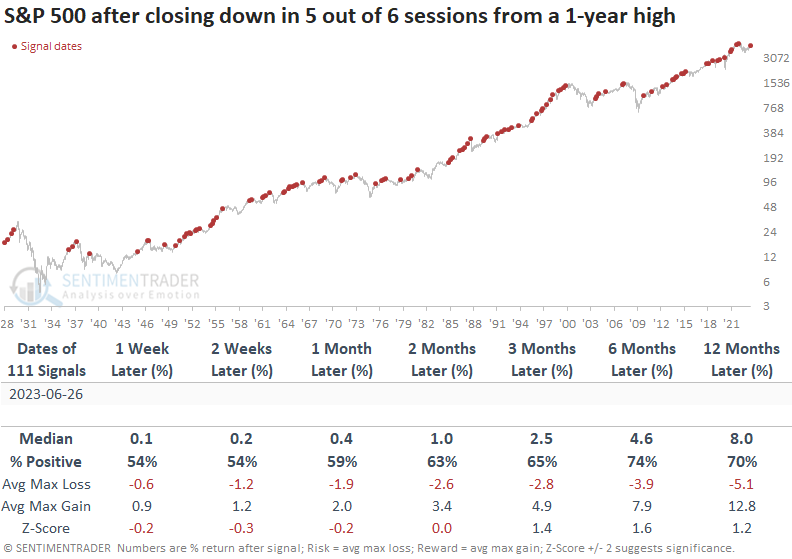

Applying the signals to an ultra-short-term outlook table shows a tendency for the market to bounce in the subsequent five sessions.

Additional context

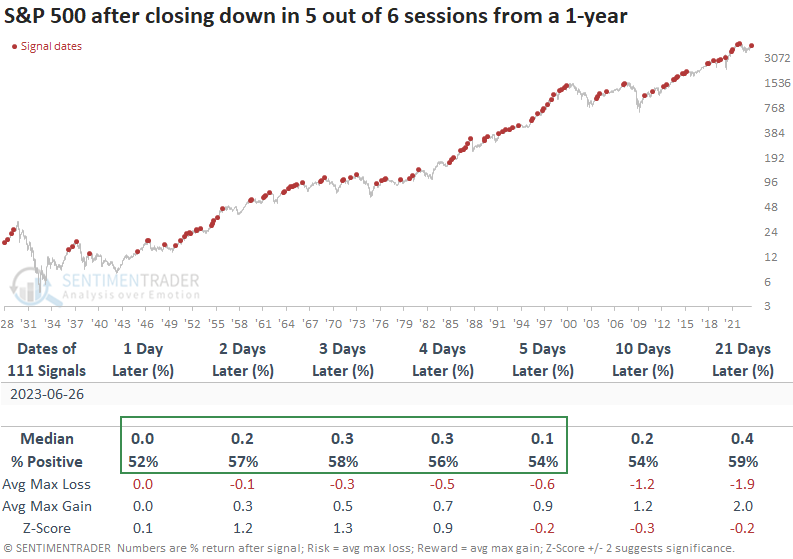

Suppose we include a new condition to the original study, specifically focusing on identifying signals when the S&P 500 remains below a 2-year high as it is currently. In that case, the S&P 500 struggled in the first week but tended to bounce back nicely the following week.

A year later, the index was higher in all but one case.

What the research tells us...

The S&P 500 has fallen in 5 out of the last six sessions from a 1-year high. Similar price patterns suggest this is likely profit-taking commonly observed during bull markets and not the start of something more ominous. When the signal occurred with the S&P 500 below a 2-year high, the large-cap index was higher every time but once a year later.