An obscure indicator flashes signals for gold stocks and U.S. dollar

Key points:

- The British Pound Risk Reversal is a little-known indicator that signals extremes in sentiment

- This indicator recently reached a rare extreme reading

- Extremes in this indicator have been followed by consistent performance for gold stocks and the U.S. dollar

British pound indicator flashes an alert regarding the gold stocks

The British Pound risk reversal has reached an extreme as traders bet on the massive gyrations in that currency.

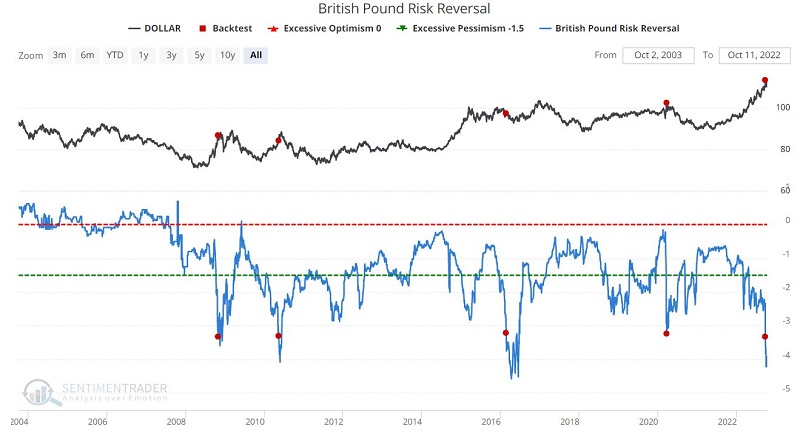

Risk reversal is an options-related term. The version we follow is a 6-month, 25-delta risk reversal. It shows how much more expensive put options are relative to call options. The more negative the risk reversal, the more traders are paying up for protection, a sign of pessimism or outright panic.

The chart below displays those rare occasions when the British Pound risk reversal crossed below -3.2 for the first time in six months. The most recent signal occurred on September 23.

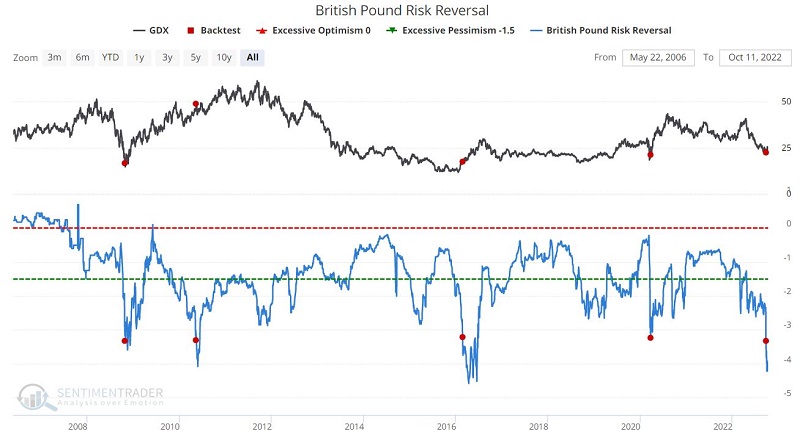

The table below displays performance results for VanEck Gold Miners ETF (ticker GDX) following previous signals. The good news is that the results are somewhat eye-popping. The bad news is that the sample size is tiny because extreme signals are rare by definition.

The table below displays results using VanEck Junior Gold Miners ETF (ticker GDXJ). The results are even more impressive.

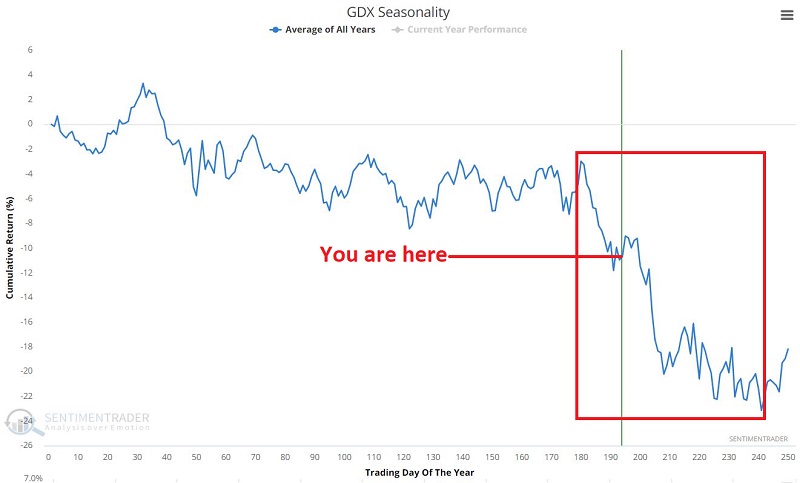

While the results shown above are compelling, one relatively obscure indicator giving infrequent signals is probably not enough to go on as a standalone model. In addition, seasonal headwinds remain strong for gold stocks. Some price confirmation and/or exiting the seasonally unfavorable period would make the case much more compelling.

Using the risk reversal as a U.S. Dollar signal

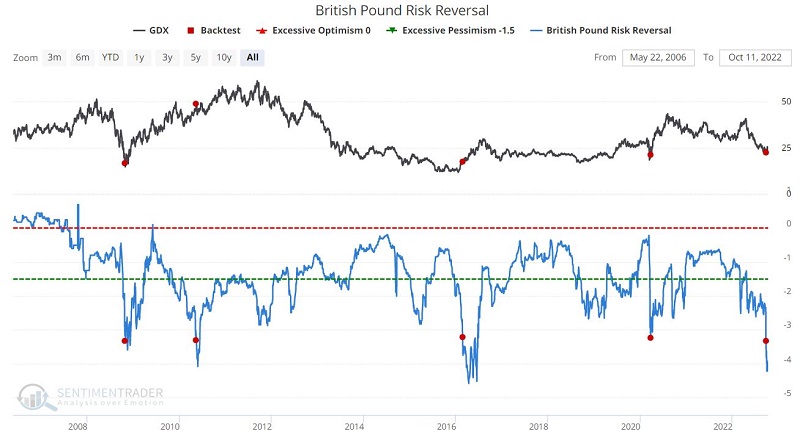

More directly related to the currency market, let's look at extremes in the pound risk reversal in terms of the U.S. dollar.

The chart below shows those same occasions when the British Pound risk reversal crossed below -3.2 for the first time in six months. However, instead of looking at gold stocks, we will look at the U.S. Dollar.

The table below displays performance results for the U.S. Dollar Index following previous signals. Once again, the caveat regarding the small sample size applies. Nevertheless, the results following previous signals have been overwhelmingly unfavorable for the dollar.

The dollar was just about the most consistently strong market in 2023. Trying to pick a top in a market on a roll is perilous. Additionally, note in the chart below that the dollar is moving into a seasonally favorable time of year.

Traders might be well served to wait until the dollar shows signs of a reversal before playing the short side. They should also be on high alert for that sign.

What the research tells us…

Markets often go to extremes. The U.S. Dollar has marched relentlessly higher since bottoming out in May 2021. Gold stocks have plummeted over -40% since April 2022. Neither of these conditions will last forever. The British Pound Risk Reversal indicator has gone to an extreme - a situation that has seen subsequent sharp reversals in gold stocks and the dollar.

The risk reversal signal alerts us that trend changes may be imminent. Nevertheless, picking tops or bottoms in strongly trending markets is dangerous. Now is the time for traders to pay close attention to price action in gold stocks and the U.S. Dollar. At the same time, no one can predict when the turnaround will come. But - the markets being what they are - the reversals will come. And when they do, the counter moves are likely to be substantial.