An Obscure Buy Signal to Stir the Pot

Well as I see it, part of my job here at Sentimentrader is to find the stuff that you are either too busy - or not quite as far out in the weeds as I am - to uncover.

Take this one, for example.

As I will detail in a moment, an entirely obscure momentum buy signal flashed at the end of March 2021. For the record, this is the first signal it has generated in 25 years, which makes it easy to miss - not to mention easy to dismiss.

Still, historically this signal has tended to highlight bullish moves of up to 4 years. Which is a little uncomfortable at the moment given the:

- non-stop nature of the rally in the last year - and the gains seen since the 2009 low

- historically high P/E ratio (Shiller PE currently north of 37)

- vast array of overly speculative activity we have seen in the last 6-12 months (much of which has been highlighted in great abundance by Jason)

But mine is not to question why - mine is to show you what I've found.

So here goes...

The S&P Long-Term CCI Buy Signal

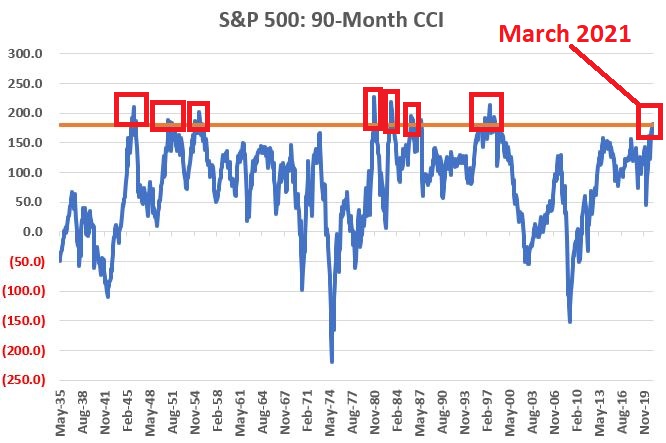

The CCI (mercifully shortened from Commodity Channel Index) is a fairly commonly used technical analysis tool. However, not many people use it as described below:

- If the 90-month CCI (Yes, 90 months!!!) CCI for the S&P 500 Index tops 180, a 48-month buy signal occurs

For testing purposes:

- when the 90-month CCI ends a month above 180, we will categorize the next 48 months as bullish

- we will ignore any new signals that occur within 24 months of a previous initial 48-month bullish period

The chart below shows each of the previous buy signals from this indicator. Prior to March of 2021 there have been only 7 previous signals in the past 76 years. A small sample size to be sure.

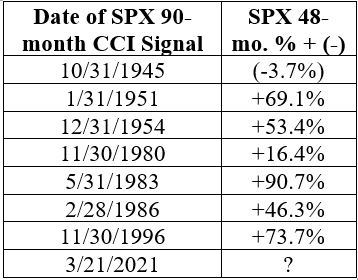

The table below displays the few signals that have occurred and the cumulative price return for the S&P 500 Index over the subsequent 48 months.

For the record the median 48-month return:

- for ALL 48-month rolling periods starting in 1940 is +38.1%

- the median 48-month return for the signals listed above is+53.4%

The chart below displays the cumulative price gain for the S&P 500 Index if held for 48 months after the dates listed in the table above.

Not perfect, not without volatility and dips, but also pretty solidly LLUR (Lower left to upper right) and somewhat compelling.

Why is this relevant? Because this indicator gave a new signal at the end of March 2021. The implication - in theory anyway - is that the next four years should be favorable for the stock market. Is anyone willing to make that bet?

I told you it was a little uncomfortable.