An objective look at the current state of PPI inflation

Key points

- According to much of the media, the inflation number this week "came in hot"

- Still, objective indicators suggest that inflation - at the moment - should not be a significant source of concern for stock market investors

- In this piece, we review/update several previous reports on inflation and assess the current state of affairs

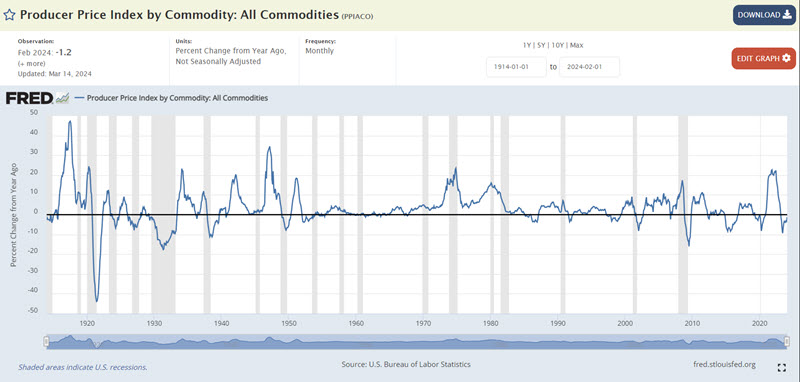

The state of the Producer Price Index

The chart below displays the historical 12-month % rate-of-change for the Producer Price Index since 1914.

In this piece (What to make of PPI inflation) dated 2023-01-19, I highlighted the performance of the S&P 500 Index based on the 12-month change in the Producer Price Index (PPI).

In this piece (PPI inflation and the stock market - Part I), dated 2023-02-21, I introduced a simple three-indicator stock market model using various measures of PPI performance.

Finally, in this piece (PPI inflation and the stock market - Part II), dated 2023-02-22, I highlighted the history of Dow Jones Industrials performance based on the status of the three indicator model highlighted in the previous piece and updated below.

Given the hand-wringing based on this week's inflation report, it seems like a good time to review the model highlighted in these previous pieces.

Review of PPI Indicators #1 through #3

I have previously introduced three indicators based on the Producer Price Index. To quickly recap:

Indicator #1: Looks at the 12-month percentage change in PPI. Below +9% and above -12% is bullish, and outside of that range is bearish.

Indicator #2: This is calculated as the Producer Price Index 12-month percentage change minus the Consumer Price Index (CPI) 12-month percentage change. Below +7.00 is bullish; above that is bearish.

Indicator #3: Looks at the 1-month percentage change in the PPI. Between +4% and -2.2% is bullish. Outside of that range is bearish.

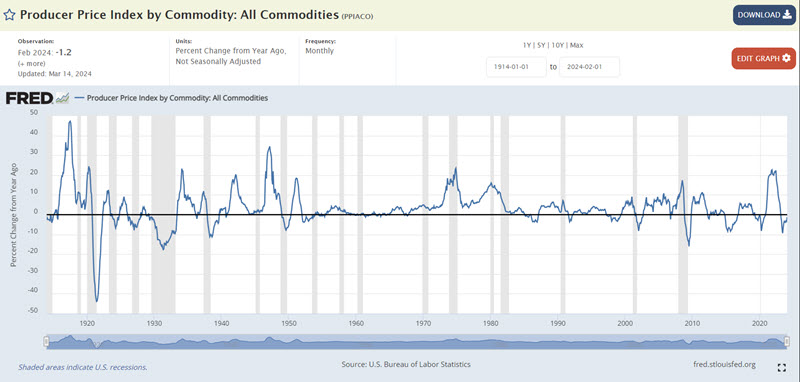

PPI Stock Market Model

This model considers the state of all three of the above PPI indicators at the end of each month to assess the status of this model as "bullish" or "bearish" for stocks in the following month.

If a given indicator is bullish at the end of a month, that adds one point to the model. As such, the model can read +3, +2, +1, or 0 at the end of any month.

For example, this model will "officially" consider the PPI values reported this week at the end of March 2023, and a model value will be calculated for April. Based on the latest readings, we can get a head start on this process (all three indicators are presently "bullish"). However, the official designation as "bullish" or "bearish" for the new month does not occur until the end of the month.

To clarify, if the model readings change from bearish to bullish (or vice versa) based on the latest data released mid-month, the model does not change from bearish to bullish until the close of the month's last trading day.

The chart below displays the month-end status of this model since 1914.

The current state of affairs remains favorable

Indicator #1: 12-month percentage change in PPI. The current 12-month rate-of-change in PPI is -1.2%. This indicator is favorable as this is below +9% and above -12%.

Indicator #2: The Producer Price Index 12-month percentage change minus the Consumer Price Index (CPI) 12-month percentage change presently clocks in at +4.34 points. Since this is below +7.00, this indicator is favorable.

Indicator #3: The 1-month percentage change in the PPI is +1.66%. This indicator is favorable because this value is between +4% and -2.2%.

This model has been reading +3 since the end of December 2022 and will read +3 again at the end of March 2024.

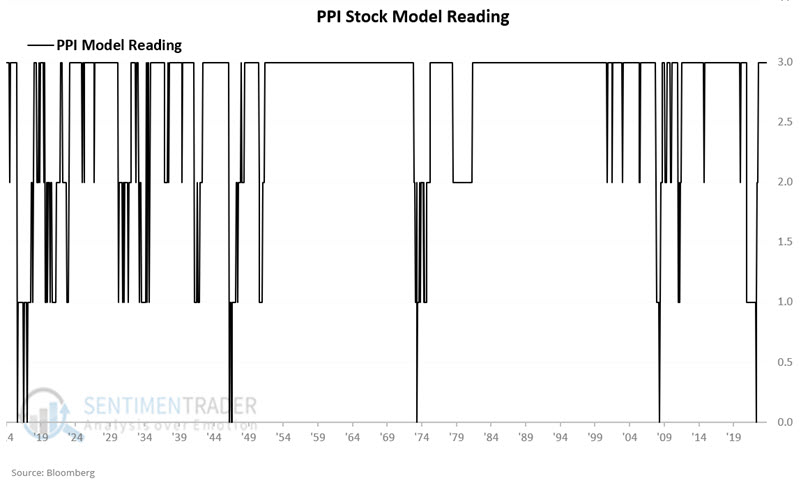

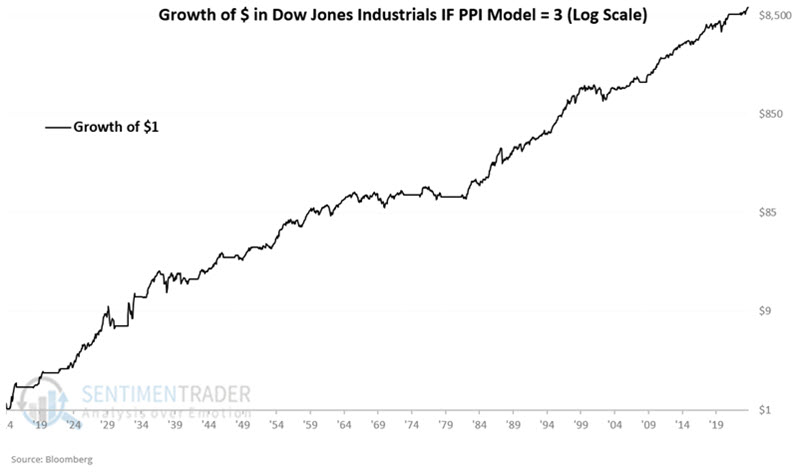

The logarithmic chart below displays the growth of $1 in the Dow Jones Industrials since 1914 if held only when the PPI Model = +3 (i.e., if all three PPI indicators were rated bullish at the end of the previous month). The cumulative hypothetical gain is + 103,925%.

Does this imply that stocks can't go down in the month ahead? Not at all. It only suggests that we should not worry about inflation as a reason for stocks to suffer significantly.

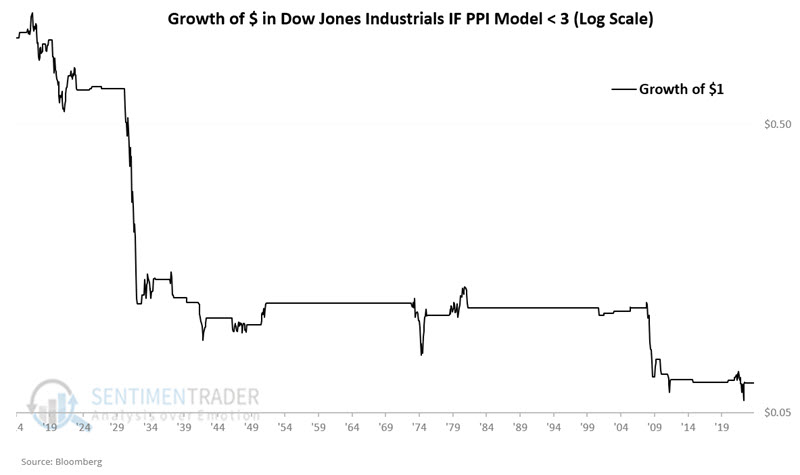

By way of contrast, the chart below displays the growth of $1 in the Dow Jones Industrials since 1914 if held only when the PPI Model is LESS THAN +3 (i.e., 0, +1, of +2). The cumulative loss is -93.7%.

The devastating decline during the early 1930s (a result of deflation rather than inflation) accounted for much of the overall decrease during unfavorable periods. So, let's look at post-1932 sell signals to assess their usefulness.

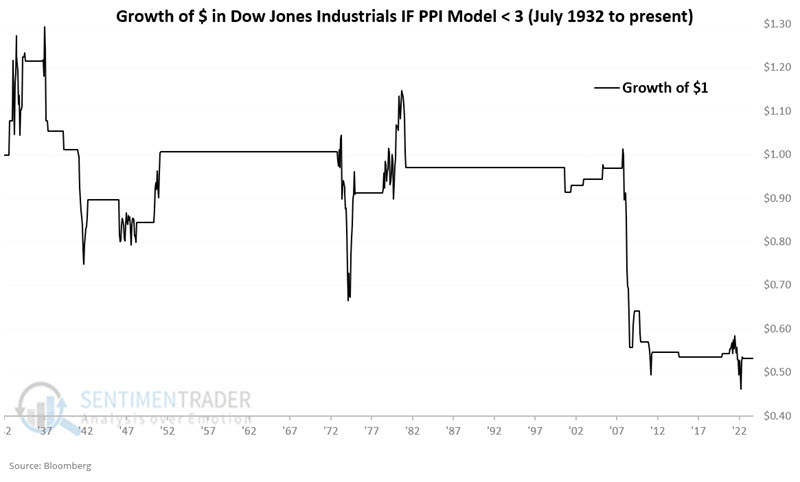

The chart below displays the growth of $1 in the Dow Jones Industrials since July 1932, when the PPI Model reads anything less than +3.

While there are points in the chart above where the stock market rallied, the bottom line is that extremes in PPI readings did an excellent job of warning investors before several severe stock market declines. The cumulative growth during unfavorable periods since 1932 is a loss of -47%.

Summary of performance

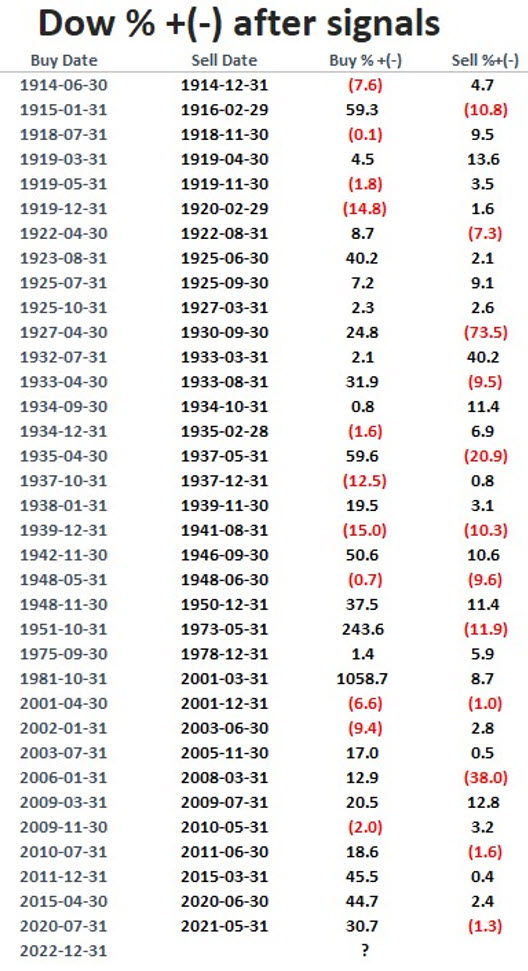

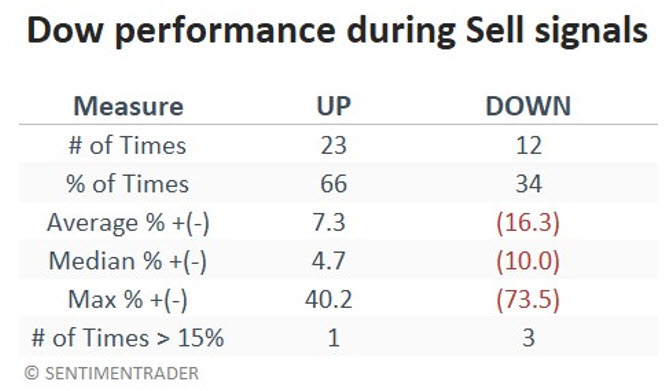

The table below shows the Dow's performance during favorable (+3 readings) periods and unfavorable (< +3 readings) periods. A "buy signal" occurs at the end of a month in which the model rises from below +3 to +3. A "sell signal" occurs at the end of a month in which the model drops below +3.

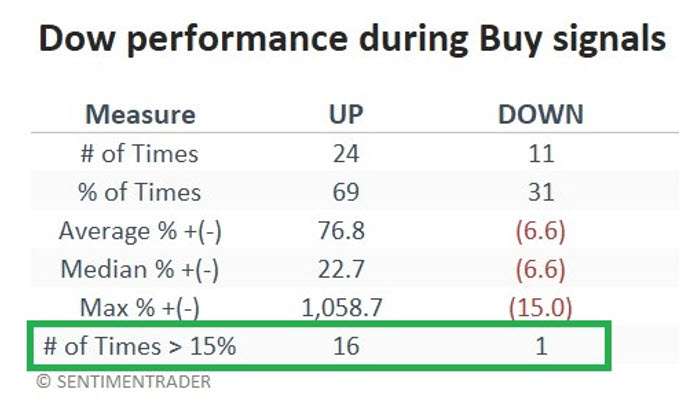

Since the buy signal on 2022-12-31, the Dow has gained +17.6% through the end of February 2024. The table below summarizes the Dow's performance during buy signals.

The table below summarizes the Dow's performance during sell signals.

What the research tells us…

Inflation can impact the stock market dramatically. However, for investors, the real key is to assess the current state of inflation "undramatically." Headlines and narratives regarding inflation are typically intended to generate an emotional response. The trick is to examine the data as objectively as possible. The reality is that many forms of inflation (rent and food, for example) remain challenging for many consumers. However, our objective here is not to assess the impact of inflation on the "man in the street" but rather to determine the likely effects of inflation on stock prices.

The current favorable status of the PPI Stock Market Model detailed here does not guarantee higher stock prices. But it does suggest that any fearmongering based on the latest inflation data is likely misguided. For at least one more month, the model detailed above will remain on the favorable side of the ledger for stocks.