An extreme of extremes

Last week, options traders returned to their speculative ways. Traders large and small plunged into call options, buying them at a pace twice as great as put options.

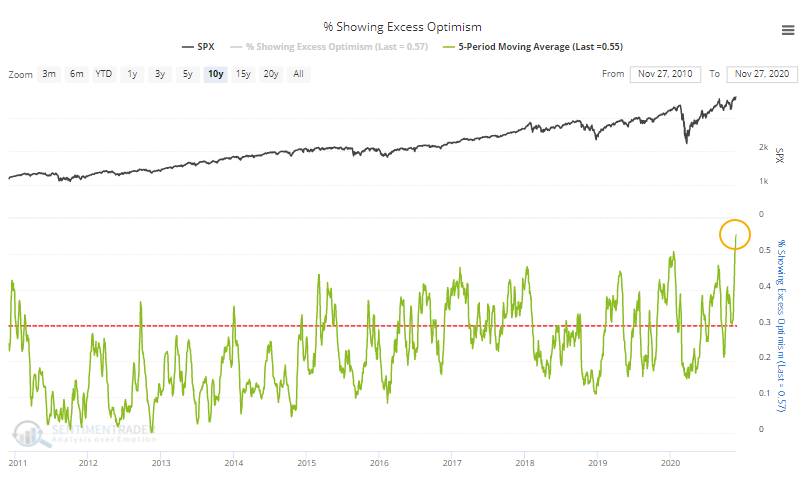

Options activity is but one of the many extremes that our indicators are showing. So many, in fact, that an average of more than 55% of the core indicators have been in extreme territory over the past week.

Spread out over a week, this is the most extremes we've seen among our indicators in 15 years. Other times we've seen more than 50% become extreme, stocks have had a tough time holding their upside momentum.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- A rundown of options activity last week, including some extremes not seen in 20 years

- What happens when Fear & Greed tilts heavily to the "greed" side

- The S&P 500 gained more than 10% in November

- The Russell 2000's single-month gain and what that bodes for the broader market

- The VIX is dipping below 21 for the 1st time in months

- Optimism on gold dropped to its lowest level in a year

- What happens when the copper / gold ratio cycles from a 2-year low to a 1-year high

| Stat Box The VIX "fear gauge" closed below 21 last week for the first time in more than 100 days. It has ended similar streaks only 6 times in the past 30 years, and all 6 of those ended up leading to gains in stocks over the ensuing 6 months. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

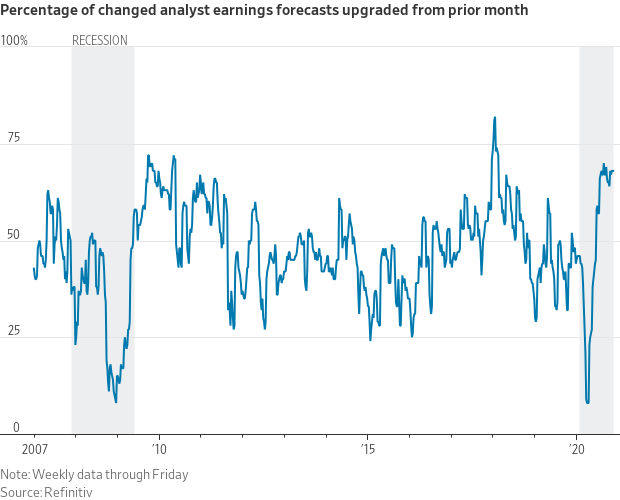

1. More than 70% of Wall Street forecast changes have been to the upside. Analysts do NOT like being left behind in a bull market. [WSJ]

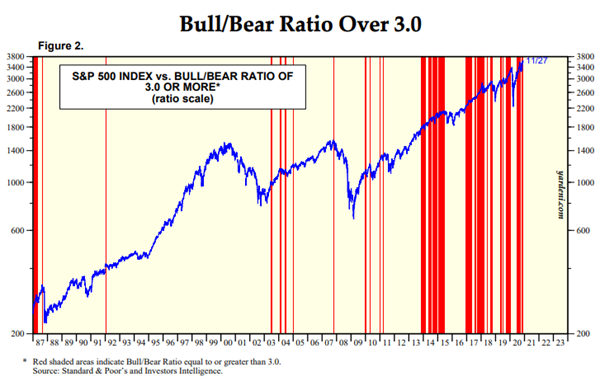

2. Newsletters are nearing maximum optimism, too. The ratio of bulls to bears is back over 3.0, a level that has often led to a plateauting of gains for stocks. [Yardeni]

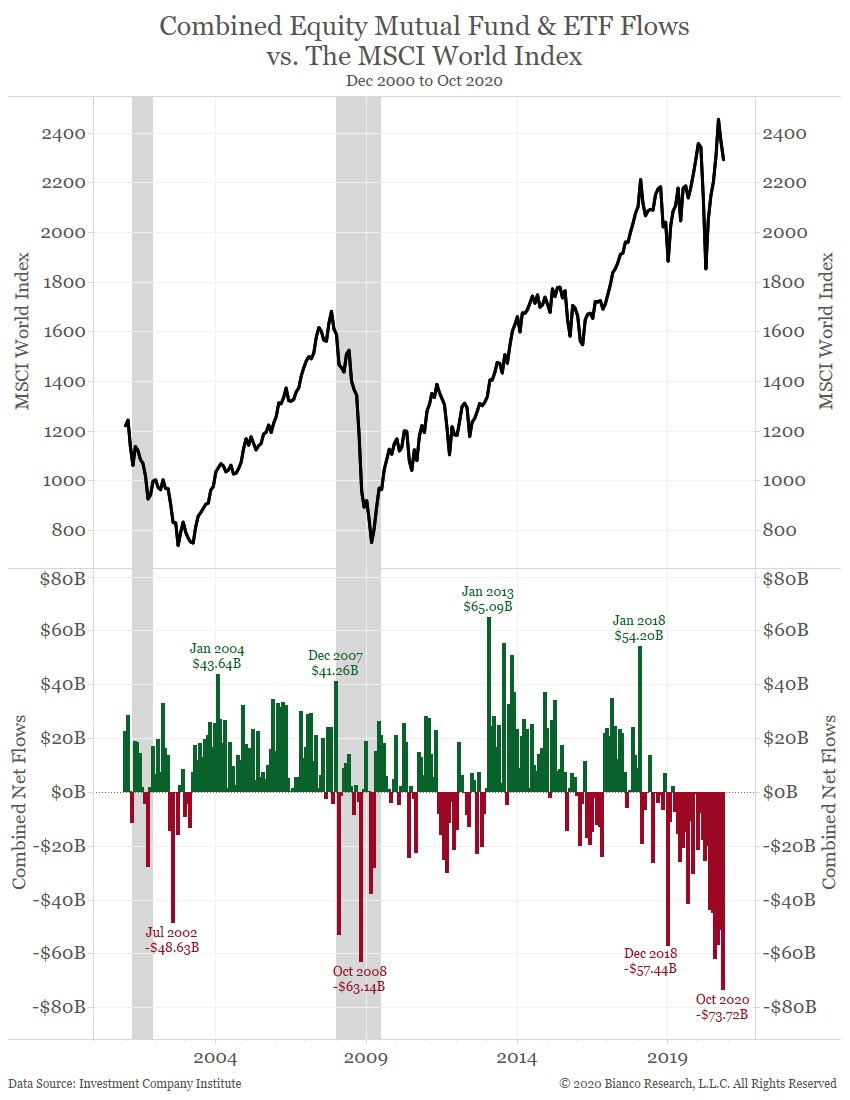

3. And yet...and yet. Equity funds continue to bleed assets. It doesn't seem to make sense, but there are ways to buy stocks other than through a fund structure. [Bianco Research]