Amazon Upgrade As A Sign Of A Top

Price changes for popular stocks tend to get lost in the usual market noise, but one of them is sticking out today. Cantor Fitzgerald raised their price target on Amazon (AMZN) to $1,000.

That rang some bells for investors who lived through the late 1990s, when Wall Street analysts tripped over themselves to raise price targets, preferably to a big round number like $1,000, more to generate interest for their firm and themselves than to actually help investors make a decision.

So...sign of a top?

Let's go back as far as we can, which is only to 2012, and look at the history of price target changes in AMZN by Cantor Fitz. Maybe they're the "axe" in the stock and have been prescient in their calls.

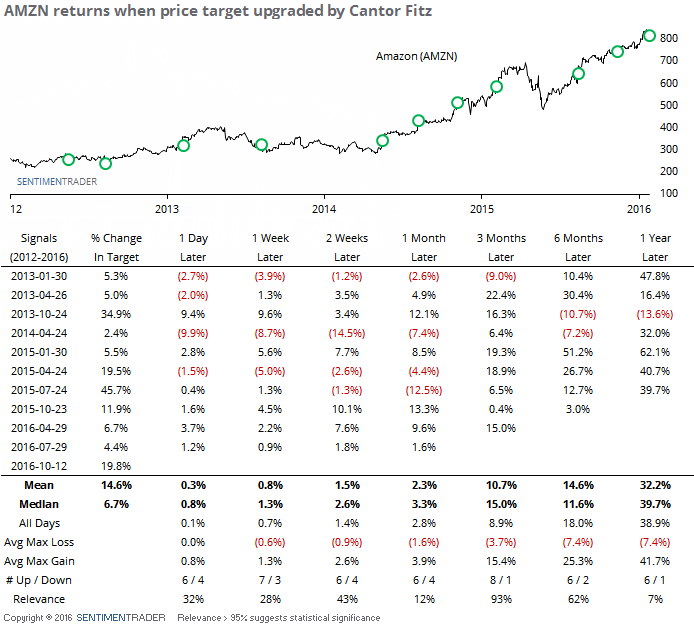

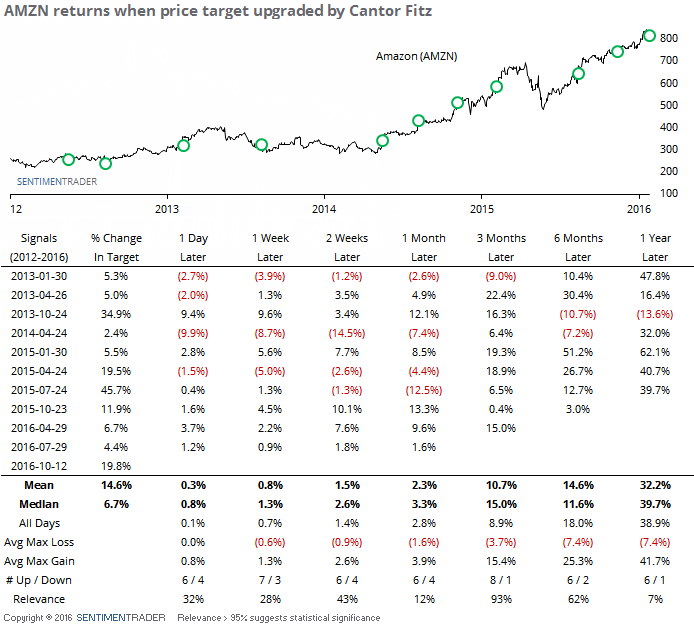

The table below shows how AMZN performed going forward after Cantor raised their price target (data courtesy of Bloomberg).

Mostly, the stock did pretty well, especially over the next 3 months. Shorter-term, it was more of an issue, with AMZN declining over the next 2-4 weeks 6 out of 10 times. Still, its average return was fine and the risk/reward was skewed to the upside.

This marks the 3rd-largest price hike. The two larger, in October 2013 and July 2015, led to a big rally and big decline, so a toss-up there.

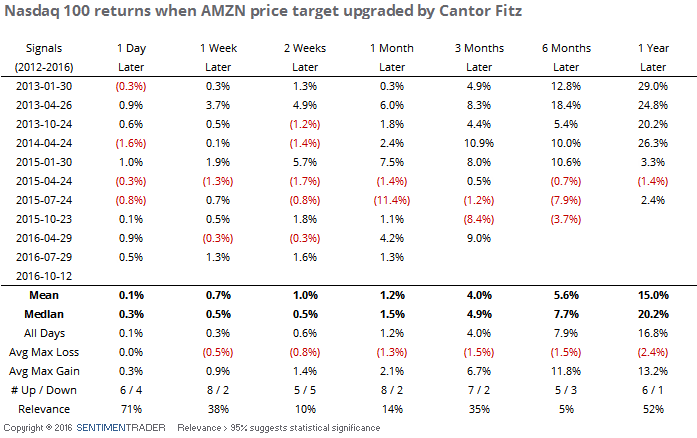

How about the broader market? Let's look at returns in the Nasdaq 100 after those same dates:

Here, there was more weakness over the next couple of weeks. The NDX was higher 5 out of the 10 times, but again its average return and risk/reward were about in line with random.

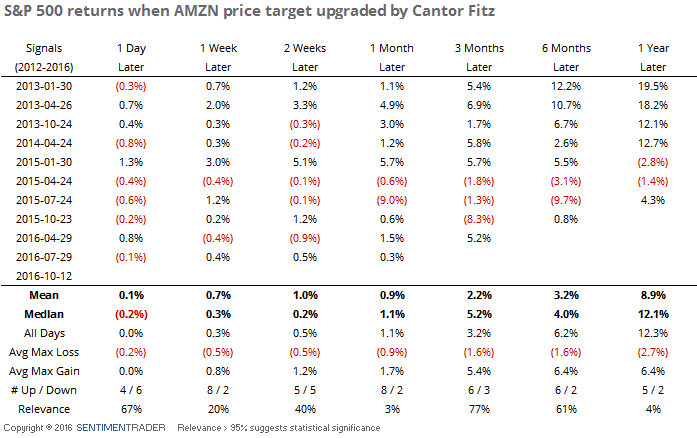

Now the S&P 500:

Again, the index was so-so over the next couple of weeks but nothing especially notable.

Looking at the consensus price target for AMZN, analysts in aggregate are expecting a further 10% rally in the stock. That's actually on the low side of estimates during the past decade. When AMZN surged so much that it actually surpassed the consensus target is when it usually ran into trouble as the stock became overheated.

Overall, there doesn't seem to be much here to suggest that Cantor's price target change is a sign of excess, with the only real weakness being confined to the next two weeks after their prior price hikes.