All we are saying is give Dec(ember) a chance

Key Points

- December 2021 is off to a rough start - hopefully it is setting the stage for a rally later this month

- December has historically been one of the best-performing months for stocks

- December of Post-Election years have seen particularly favorable stock market action

Establishing the baseline

For testing, we will use the monthly closing price of the Dow Jones Industrial Average from 12/31/1900 through 11/30/2021.

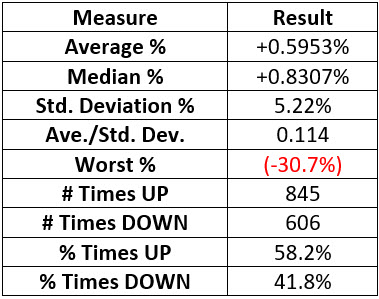

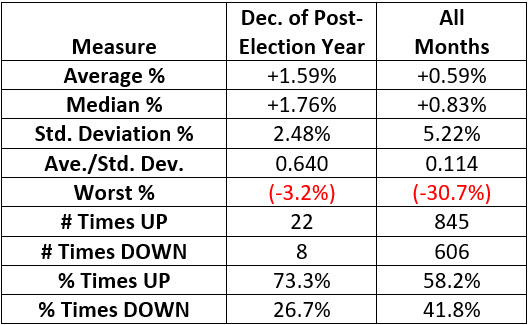

The table below displays a monthly performance summary for all 1,451 months included in the test period.

Dow performance during December of Post-Election Years

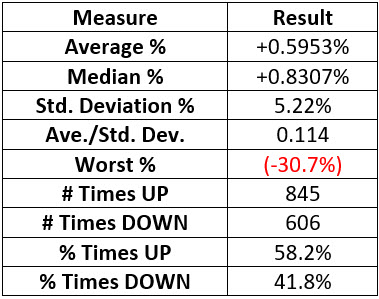

We look at December 1901, 1905, 1909, etc. The chart below displays the growth of $1 invested in the Dow only during December of each post-election year starting in 1901.

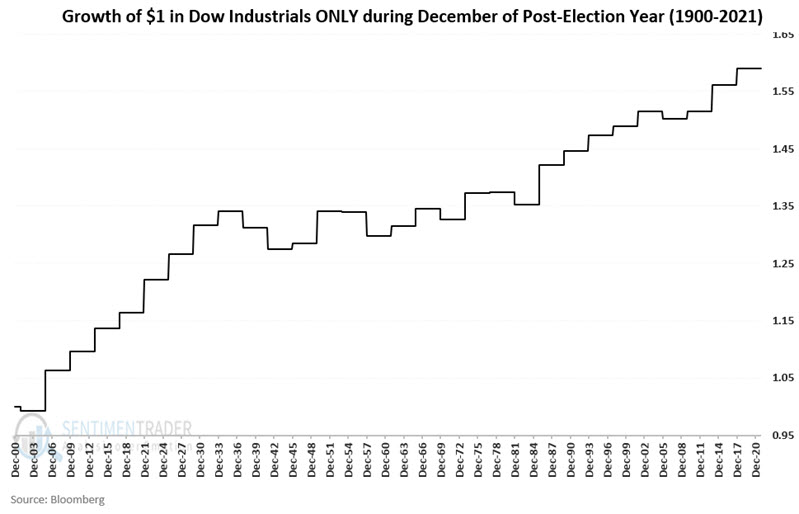

The chart below displays the performance of December of each post-election year since 1901.

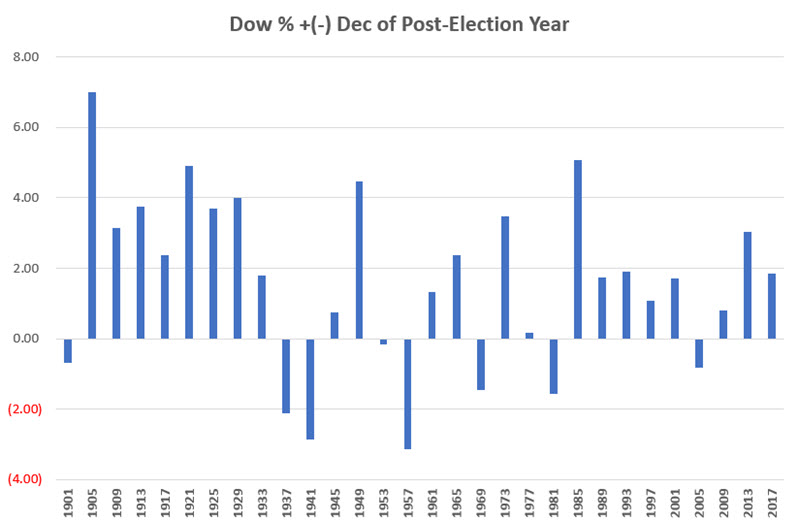

The table below displays a summary of monthly performance for all 30 post-election Decembers since 1901 compared to the baseline results for all months starting in 1901.

What the research tells us…

- December of the post-election year has a solid history

- As long as major market averages hold above their longer-term moving average, investors may do well to give the bullish case the benefit of the doubt as December 2021 unfolds