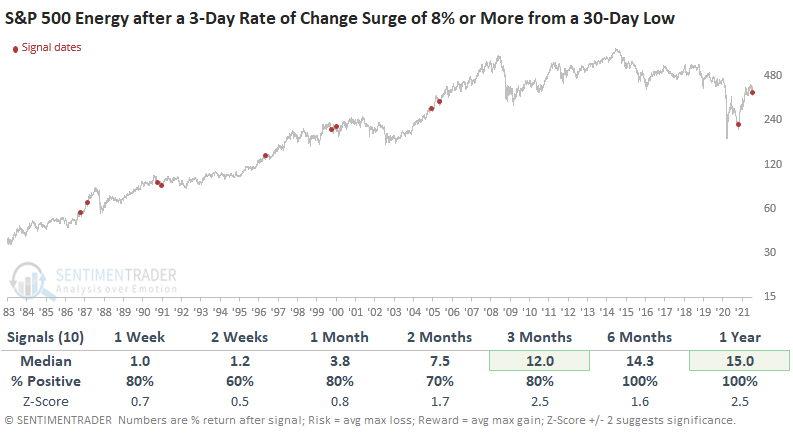

After This Signal, Energy Stocks Never Declined

After plunging to a monthly low last week, crude oil skyrocketed as buyers scooped up suddenly "cheap" contracts.

Oil futures surged over 8% in three days after registering a 30-day closing low on Monday. Dean noted that while the commodity's short-term trend outlook remains uncertain for the time being, the intermediate to long-term trend environment still looks very healthy.

When we looked at how crude oil performed after a 3-day surge from a 30-day low, the long-term results were constructive, especially in the 6-month window.

Analyzing similar surges within various contexts, like when oil was above its 200-day average or within a certain percentage of a 52-week high, results were mostly positive, again on a medium- to long-term time frame.

Even more impressive were stocks within the Energy sector. After oil surged from a low in a long-term uptrend, the Energy sector tended to rally strongly.

What else we're looking at

- Full returns in crude oil after surges in uptrends, including Energy stocks

- What tends to happen when there is a 5th week in July

| Stat box Since 1950, there have only been 30 years when July had a 5th Friday. The week following those tended to see a soft spot for stocks, with the S&P rising during the following week 11 times while declining 19 times. |

Etcetera

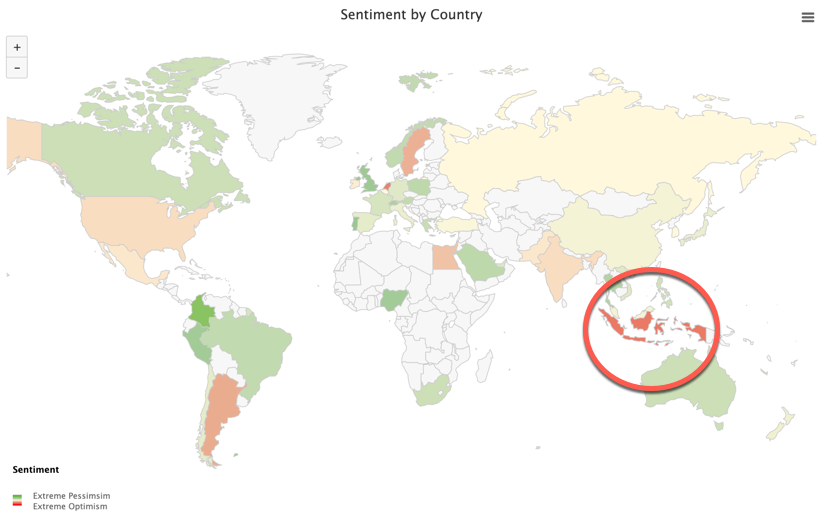

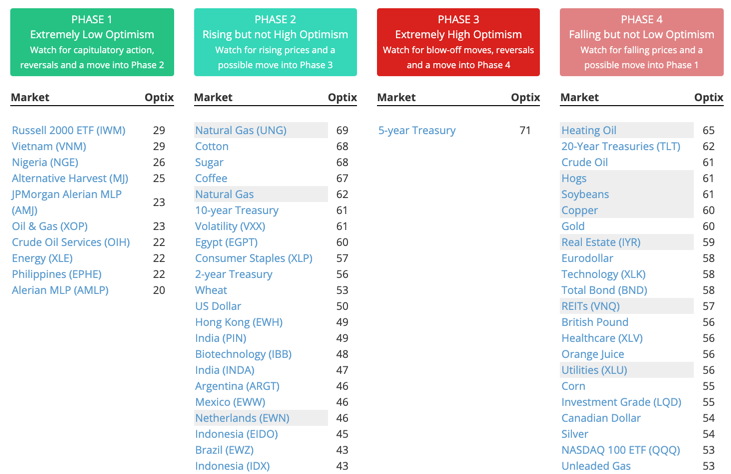

Indonesian optimism. The Indonesia Optix currently is the most optimistic in the world, just beating out the Netherlands.

Lone survivor. Currently, the 5-year Treasury bond is the only market trading in phase three, showing extremely high optimism.

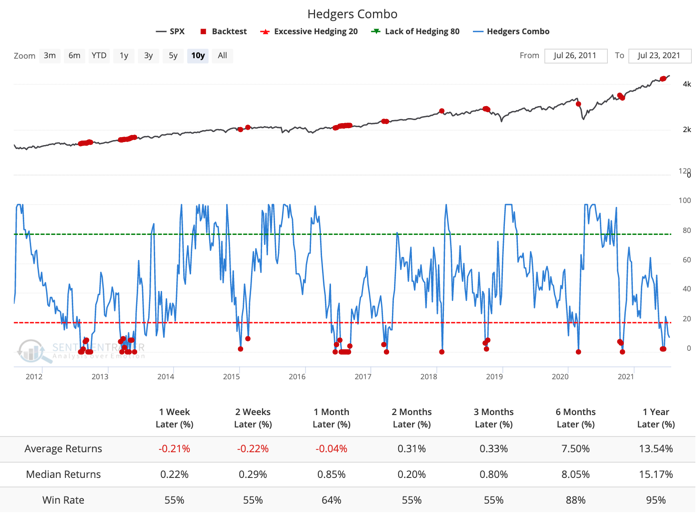

Smart money selling momentum. Commercial hedgers in major equity index futures haven't been too enthused about the recent rally in stocks. This kind of setup preceded each of the last 3 major declines in the S&P, but has not been a consistent long-term sell signal.

Smart money selling momentum. Commercial hedgers in major equity index futures haven't been too enthused about the recent rally in stocks. This kind of setup preceded each of the last 3 major declines in the S&P, but has not been a consistent long-term sell signal.